Are you searching for a way to make the most of your money? A high-yield savings account might be the solution you’re looking for. Many people are content with their regular savings accounts, but if you want to maximize your earnings, it’s time to consider the benefits of a high-yield savings account.

Choosing the right bank account can be quite a challenge, especially in a high-inflation and high-interest-rate environment. Many of us Gen Z individuals still rely on the ‘default’ POSB savings account that our parents set up for us when we were younger. However, sticking to the status quo may result in missed opportunities to earn extra interest and the gradual erosion of the value of our savings due to inflation.

With numerous options available for high-interest savings accounts, it begs the question: which one is the most suitable for us? Each individual has different preferences and criteria when it comes to selecting an account that suits them best.

During my own search for a better savings option, I stumbled upon the UOB One High Interest Savings Account. I was browsing through a financial website when I came across an article about high-interest savings accounts. The article mentioned the UOB One Account and its impressive interest rates. I was immediately intrigued and decided to do some more research.

After learning more about the UOB One Account, I knew that it was the perfect fit for me. I was looking for a savings account that would allow me to earn a high interest rate without having to jump through hoops. The UOB One Account’s simple requirements made it a no-brainer.

A couple of months ago, I made the switch from my DBS Multiplier account to the UOB One Account as my high-interest savings account. I’ve been using the UOB One Account for a few months now, and I’m incredibly happy with it. I’ve been able to earn a significantly higher interest rate on my savings than I was with my previous bank. This has helped me to grow my savings much faster than I ever thought possible.

In this article, I will share the reasons why I chose UOB One Account, which has the potential to earn me $400 in interest each month.

Key takeaways:

- Simplicity of UOB One Account – UOB One stands out for user-friendly requirements, offering up to 7.8% p.a. interest with minimal effort.

- Highest Returns – Surpassing the average 2.5% interest rate, UOB One offers an impressive 7.8% p.a.

- Synergy with UOB One Credit Card – Combine UOB One Account with UOB One Credit Card for high-interest savings and cashback rewards.

Table of Contents

What is the UOB One account?

The UOB One account is a high-yield savings account and it has been a preferred choice among savvy savers in 2023, known for its consistently high interest rate within the financial community. This popularity soared, especially after the maximum bonus interest rate on the UOB One account was increased significantly from 3.6% to an impressive 7.8% p.a.

Serving as the flagship savings account of UOB, the UOB One account is designed to offer maximum interest returns with minimal effort required on your part. Its user-friendly features and attractive interest rates make it a standout option for those looking to optimize their savings strategy.

Let us dive deeper to find out more about the UOB One account and why I made the switch to this account. I am also a big fan of this high interest savings account and had vouch for it to my friends, colleagues and family.

The UOB One Account Offers Simplicity

In today’s market, many financial products come with complex mechanisms and requirements that can overwhelm customers. However, the UOB One High Interest Savings Account stands out by offering simplicity and ease of use. With the UOB One Account, you can enjoy the benefits of a high-interest savings account without the typical complications associated with such products.

It only takes two simple steps – credit/debit card spending and salary credit/GIRO payments – to earn up to 7.8% p.a. interest. This account eliminates the need to compromise between simplicity and high interest rates.

By spending a minimum of $500 monthly on my UOB One credit card and crediting a minimum salary of $1,600, I can earn 3.85% interest on the first $30,000 of savings. For any working adult, achieving this is extremely straightforward each month. The best part is that as you regularly credit your salary, your savings increase, leading to higher bonus interests.

If you’re unable to credit your salary into the account, you can still qualify for the high interest by making three GIRO debit transactions per month. Simply set up GIRO transactions with your insurer, telcos, SP services, and more to meet the requirement. However, I don’t recommend to go for this method as it gives out a lower interest rate. Instead, you can use a quick hack to do a FAST transfer to your UOB One Account from another bank such as DBS, under the category of “SALARY”. You can refer to this guide for more information.

High Interest with UOB One Account

According to a recent study, the average interest rate offered by high-interest savings accounts in Singapore is 2.5%. The UOB One Account offers an interest rate of up to 7.8% p.a., which is significantly higher than the average.

When it comes to maximising savings and earning cashback on everyday expenses, the combination of the UOB One Account and UOB One Credit Card is a winning formula. By leveraging the features of both products, you can enjoy high interest savings and attractive cashback rewards on your card transactions.

Let’s say you have $100,000 in your UOB One Account. You would earn an annual interest of $5,002.50 and an annual cash rebate of $200, totaling $5,203 per annum or approximately $434 per month. This passive income of $434 each month can easily cover your monthly grocery spending! In fact, you can also pair it up with the UOB One Credit Card to save more money on your groceries.

To determine your monthly interest earnings with the UOB One Account, you can use the UOB One Account Calculator. This handy tool allows you to estimate the amount of interest you can earn in a given month based on your savings and the specific requirements you meet. Simply input your data into the calculator to find out how much interest you can earn with your UOB One Account.

Synergy between UOB One Account and UOB One Credit Card

What truly makes the combination of the UOB One Account and UOB One Credit Card powerful is the synergy between the two products. By fulfilling the requirements of both the account and the credit card, you can enjoy even more benefits and rewards.

For instance, having a UOB One Account may make you eligible for higher cashback rates on your UOB One Credit Card transactions. This means you can earn more cashback on your spending while enjoying the high interest savings. The seamless integration between these two products makes managing your finances convenient and allows you to optimise your savings and rewards.

With the UOB One Credit Card, you can earn cashback on various categories such as dining, groceries, and online shopping. The cashback program is designed to align with your lifestyle, ensuring that you earn rewards on your most frequent purchases. By using the UOB One Credit Card for your everyday expenses, you can accumulate cash back quickly. The cashback earned can be used to offset your credit card bills or redeemed for a wide range of exciting rewards, enhancing your savings and providing additional benefits while maintaining your financial discipline.

Personally, the card gives me up to 15% cashback on my everyday purchases. Using the UOB One Credit Card allows me to enjoy enhanced cashbacks in my daily life as I earn extra rewards on the merchants I frequent, without having to change my lifestyle. In a typical month, I easily meet the $500 minimum spend requirement at popular merchants such as Giant, 7-11, Shopee, and Grab. I’ve previously talked about this in my other post, you can read my recent review of the UOB One Card.

If you’re interested to find out how much cashback you can earn in a month with the UOB One Credit Card, simply enter your average spendings into the UOB One Credit Card rebate calculator.

UOB One Account vs. Competitors

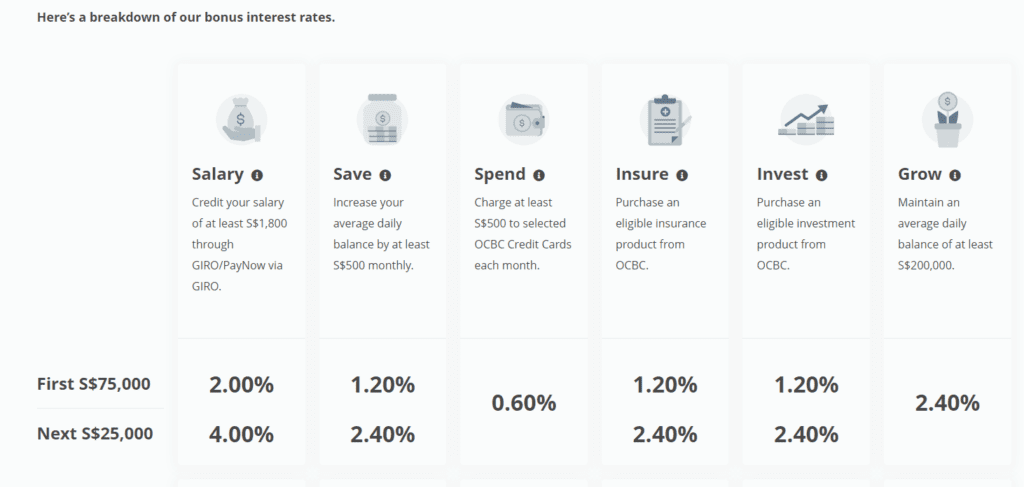

The UOB One Account has its competitors, such as the DBS Multiplier Account and the OCBC 360 Account. These accounts also offer high interest rates, but they come with more stringent requirements.

The DBS Multiplier Account requires customers to meet a number of criteria in order to earn the highest interest rate. These criteria include having a salary credit, making a certain number of card transactions, and investing in DBS products such as Home Loan Instalment, Insurance and Investments.

The OCBC 360 Account requires customers to meet a number of criteria in order to earn the highest interest rate. These criteria include having a salary credit, making a certain number of card transactions, and other OCBC products such as insurance and investments.

Unlike them, the UOB One Account offers simplicity and flexibility, making it an attractive choice for those looking for high-interest savings accounts.

What are the eligibility requirements for the UOB One Account?

Ready to snag your UOB One account? Hold on, there are important things that you need to take note first.

To qualify for the UOB One high-yield savings account, you must fulfill the following requirements.

- You will need to be 18 years and above to open a UOB One account.

- The minimum initial deposit for the UOB One account to S$1,000.

- You will also need to maintain a monthly average balance in your UOB One account of at least S$1,000, or a S$5 fall-below fee will be imposed. This fall-below fee is waived for the first 6 months for accounts opened online.

- A S$30 early account closure fee will levied if you close your UOB One account within 6 months from opening.

You can find the full terms and conditions here.

Maximizing Your UOB One Account

The UOB One Account is a powerful tool for growing your savings, and there are several strategies you can employ to make the most of it. Here are some tips on how to maximize your UOB One Account:

1. Meet the Minimum Requirements: To start earning high interest with the UOB One Account, ensure you meet the minimum requirements. This typically involves making a minimum monthly spend on your UOB One Credit Card and crediting your salary to the account. By consistently meeting these requirements, you’ll be on the right path to maximize your savings.

2. Increase Your Spending: If your spending habits allow, consider increasing your monthly spend on your UOB One Credit Card. The more you spend, the more interest you can earn. Look for opportunities to make everyday purchases with your card and pay it off in full each month to avoid interest charges.

3. Optimize Salary Credits: To earn the highest interest rates, ensure your salary is credited to your UOB One Account. You can also explore setting up GIRO transactions with your insurer, telcos, SP services, and more to fulfill the salary credit requirement if necessary.

4. Leverage the UOB One Credit Card: The synergy between the UOB One Account and the UOB One Credit Card is a key aspect of maximizing your benefits. With this credit card, you can earn cashback on various categories such as dining, groceries, and online shopping. By using the UOB One Credit Card for your everyday expenses, you can accumulate cash back quickly, which can further enhance your savings.

5. Use the UOB One Card Calculator: To get a clearer picture of how much you can save and earn with the UOB One Account and UOB One Credit Card, consider using the UOB One Card calculator. This tool helps you estimate your annual interest and cash rebates based on your spending habits.

6. Stay Informed: Keep an eye on any updates or promotions related to the UOB One Account. Banks may introduce limited-time offers or bonuses, so staying informed can help you take advantage of these opportunities.

7. Set Clear Financial Goals: Define your financial goals and how the UOB One Account fits into your overall savings plan. Whether you’re saving for a major purchase, an emergency fund, or long-term goals, having a clear plan can motivate you to maximize your savings.

Remember that the UOB One Account rewards consistency, so by staying committed to meeting its requirements and exploring the benefits of the UOB One Credit Card, you can effectively maximize your earnings and enjoy the full potential of this high-interest savings account.

Is UOB One Account The Best High Interest Savings Account?

The UOB One Account’s main competitors are the DBS Multiplier Account and the OCBC 360 Account. These accounts also offer high interest rates, but they have more stringent requirements than the UOB One Account. The DBS Multiplier Account requires customers to meet a number of criteria in order to earn the highest interest rate. These criteria include having a salary credit, making a certain number of card transactions, and investing in DBS products. The OCBC 360 Account requires customers to meet a number of criteria in order to earn the highest interest rate. These criteria include having a salary credit, making a certain number of card transactions, and paying bills using OCBC services.

Many high-interest savings accounts require numerous steps to achieve their high bonus interest, but the UOB One Account makes it simple and easy for most consumers to qualify

The bonus interest and cashback systems are also graded, allowing even those with modest savings or spending habits to benefit. Meanwhile, those with stronger savings and spending habits can accumulate even more extra interest and cashback.

The combination of the UOB One Account and UOB One Credit Card offers you the best of both worlds: high interest on your savings and attractive cashback rewards on your card transactions. With the UOB One Account, you can grow your savings faster and earn competitive interest rates. Meanwhile, the UOB One Credit Card allows you to earn cashback on your everyday expenses, enhancing your savings and providing additional perks.

For me, switching to the UOB One Account was an obvious choice that perfectly suits my lifestyle. I am currently using it as my main high interest savings account. How about you?

FAQ (Frequently Asked Questions)

How does the UOB One Account earn high interest?

The UOB One Account offers high interest by providing tiered interest rates based on fulfilling specific requirements, such as minimum credit card spend and salary credit. By meeting these criteria, you can earn attractive interest rates on your savings.

Can I still earn high interest if I am unable to credit my salary into the UOB One Account?

Yes, you can still qualify for high interest even if you are unable to credit your salary. By making three GIRO debit transactions per month, such as payments to insurers, telcos, or SP services, you can still enjoy the benefits of the high interest offered by the UOB One Account.

Are there any fees or charges associated with the UOB One Account?

The UOB One Account may have certain fees and charges, such as account maintenance fees or transaction fees. It is advisable to review the terms and conditions provided by UOB for a complete understanding of any applicable fees or charges.

How often is the interest credited to the UOB One Account?

The interest is typically credited to the UOB One Account on a monthly basis. This means that you can start earning interest on your savings as soon as you fulfill the requirements for the specific month.

Is UOB One Account a savings account?

Yes, the UOB One Account is considered a type of savings account. It’s a unique and innovative savings account offered by United Overseas Bank (UOB) in Singapore. This account is designed to help individuals grow their savings while offering competitive interest rates and cashback rewards. While it functions as a savings account, it offers a higher interest rate compared to many traditional savings accounts, making it an attractive option for those looking to maximize their savings.

Comments (11)

5 Compelling Reasons to Top-Up CPF SA for Long-Term Benefitssays:

August 13, 2023 at 6:58 am[…] rates, starting as low as 0.05% per annum. Even high-interest rate savings accounts such as the UOB One Account advertise returns over 7% per annum often come with conditions and requirements, resulting in […]

UOB One Card Review 2023: Maximize Your Cashback Rewardssays:

September 1, 2023 at 7:22 am[…] High Deposit Interest Rate: By using the card, you can also earn a high deposit interest rate, making your money work harder for you. I had also mentioned previously in my other blog on why I switch over to UOB One for its highest interest savings. […]

Saving in Singapore: How I Navigate the High Cost of Livingsays:

October 15, 2023 at 11:02 am[…] by the bank. This will help you optimize your savings potential. If you’re considering switching to a high-interest savings account, like my experience with UOB One, be sure to explore the options that best suit your financial […]

Trust Bank Review 2023: Is This The Future of Banking?says:

October 25, 2023 at 10:05 am[…] While Trust Bank’s offering is impressive, there are a couple of drawbacks to consider. The base interest rate of 1.5% p.a. might not compete with the best no-frills savings accounts in the market. Even for union members, the 2.5% p.a. the interest rate is still lower than what the top savings accounts offer. If you’re keen to find out more about high yield saving accounts, do hop over to my review on UOB One Account. […]

The Ultimate Guide for Beginners: How to Save 100K by 30says:

November 10, 2023 at 11:00 am[…] work for you, keeping pace with or even beating inflation. If you’re keen, you should read my UOB One Review which I’ve written […]

Curious Monkeysays:

January 5, 2024 at 10:12 amHi, if i do the paynow sala hack where i transfer an amount to my uob account, will i be taxed twice for my income by iras?

Eugene Chaisays:

January 14, 2024 at 7:43 amHi there, I highly doubt that you will be taxed twice by IRAS. I’ve heard of friends using this method but did not see any change in their income statement from IRAS. I will say try it at your own risk!

GXS Bank Review: GXS Savings Account Worth Switching To?says:

January 7, 2024 at 5:57 am[…] crediting, GIRO arrangements, bill payments, or credit card spending. My current favourite is the UOB One high interest savings account. However, it does have quite a lot of complex requirements as compared to the GXS Savings […]

5 Reasons Why I Am Not Transferring CPF OA To SAsays:

February 12, 2024 at 7:56 am[…] Exploring high-interest saving options, such as the UOB One account, can be a smart way to maintain liquidity, as detailed in our review of the UOB One savings account. […]

Instarem Amaze Card Review 2024: Is It Living To The Hype?says:

March 29, 2024 at 7:21 am[…] innovative digital banking solutions. Learn more about optimizing your savings with our reviews on High Interest Savings with UOB One and get insights into the latest digital banking trends in our Trust Bank […]

Saving Vs Investing In Singapore For Your Financial Goalssays:

June 26, 2024 at 7:58 am[…] A popular method of saving in Singapore involves depositing funds into savings accounts offered by local banks like DBS, OCBC, or UOB. While these accounts do offer some interest, it’s important to consider that they typically don’t provide compound interest. This can be a disadvantage when it comes to accumulating wealth over time. For a breakdown of high-interest savings accounts in Singapore, check out my guide to the UOB One Account. […]