Investing in Exchange-Traded Funds (ETFs) can be a smart move for anyone looking to grow their wealth in the stock market. As a newcomer to the world of ETFs, you might be overwhelmed by the options available. Two popular choices, CSPX and VOO, both track the S&P 500 index but have some crucial differences. In this comprehensive guide, we’ll not only explore these distinctions but also consider factors like brokerage fees, fractional shares, and historical performance. By the end, you’ll be better equipped to make an informed decision tailored to your investment goals.

Key Takeaways:

- Comparing CSPX and VOO: The article offers a thorough comparison between CSPX, managed by iShares, and VOO, by Vanguard. Both track the S&P 500 index, yet vary in domicile, cost, taxation, and trading platforms.

- CSPX’s Advantages: CSPX stands out due to its cost-efficiency, featuring a low expense ratio of 0.07% and favorable tax benefits owing to its Ireland domicile. Managed by iShares, it reflects the S&P 500’s performance historically, providing exposure to major U.S. companies.

- Understanding Expense Ratios: The article highlights the significance of expense ratios as silent influencers on investment returns, emphasizing that seemingly minor differences in expense ratios can considerably impact long-term outcomes.

- Historical Performance and Provider Reputation: It emphasizes the importance of assessing historical performance in conjunction with other factors, underlining the influence of iShares and Vanguard as reputable fund providers.

- Tax Efficiency and Dividend Handling: Exploring the tax implications and dividend aspects of CSPX compared to VOO, where CSPX benefits from a lower withholding tax rate and is an accumulating ETF, reinvesting dividends for potential compounding returns.

Table of Contents

Unpacking the Basics of ETFs

Before diving into the comparison, let’s establish a solid foundation by understanding what ETFs are. Think of ETFs as a diverse basket of assets, similar to mutual funds, but with the flexibility of trading on stock exchanges. They offer the benefits of diversification, liquidity, and ease of trading, making them an appealing choice for both novice and seasoned investors.

If you’re still wondering why ETFs should be a fundamental part of your investment strategy, you’ll find valuable insights in my article titled “Unlocking the Power of ETFs in Your Portfolio.” It discusses the numerous benefits that ETFs bring to the table, shedding light on why they’ve become a favourite tool for investors worldwide.

Exploring CSPX and VOO: A Detailed Comparison

CSPX – iShares Core S&P 500 ETF

Our first contender, CSPX, is managed by iShares, a respected name in the world of ETFs. CSPX aims to replicate the performance of the S&P 500 index, providing exposure to some of the largest U.S. companies. But is it the right choice for you?

VOO – Vanguard S&P 500 ETF

In the opposite corner, we have VOO, managed by Vanguard, another heavyweight in the ETF industry. VOO also tracks the S&P 500 index but comes with its unique advantages. Let’s explore further.

CSPX’s Cost-Efficiency: A Closer Look in Expense Ratios and Costs

The Importance of Expense Ratios

Expense ratios are the silent warriors of your investment. These ratios represent the annual cost of managing an ETF as a percentage of your invested assets. These seemingly small percentages have a significant impact on your investment. For instance, when we talk about a 0.07% expense ratio compared to a 0.10% ratio, the apparent difference might not immediately strike as a big deal. However, consider the implications over a longer investment period.

Early in my investing journey, I underestimated the impact of these seemingly small fees. Let me share a real-world example to illustrate their significance:

Imagine you’re investing $10,000 in an ETF. One option has an expense ratio of 0.07%, while another has a slightly higher ratio of 0.10%. On the surface, the difference appears minimal.

- For the first ETF (0.07% expense ratio), you’re paying $7 annually to maintain your investment.

- For the second ETF (0.10% expense ratio), the cost is $10 annually.

Initially, the $3 difference might not seem significant, but let’s examine how it compounds over time. Suppose you plan to hold this investment for 30 years, with no additional contributions.

Over three decades, the cumulative cost for the first ETF would be approximately $210, while the second ETF would cost you around $300. That’s a $90 difference in fees.

Now, let’s consider how these fees affect your final returns. Assuming a consistent annual return rate of 7%, after 30 years:

- The $10,000 investment in the first ETF would grow to roughly $38,697.

- The $10,000 investment in the second ETF would grow to about $36,740.

That seemingly minor $3 difference in annual fees translated to a final return difference of over $1,900. That’s money that could have been in your pocket if you had chosen the ETF with the lower expense ratio.Over time, they can erode your returns, reinforcing the significance of minimizing costs in your investment strategy.

The takeaway here is not just to look at the percentages, but to understand their long-term implications. Choosing an ETF with lower expense ratios means more of your earnings stay with you, compounding over time for substantial savings. So, when evaluating ETFs, don’t underestimate the silent warriors that are expense ratios—they can have a substantial impact on your long-term financial success.

CSPX vs. VOO: A Close Cost Duel

Both CSPX and VOO are known for their low-cost structure, but there’s a slight difference. CSPX tends to have a marginally higher expense ratio compared to VOO. However, this detail alone doesn’t make it an inferior choice.

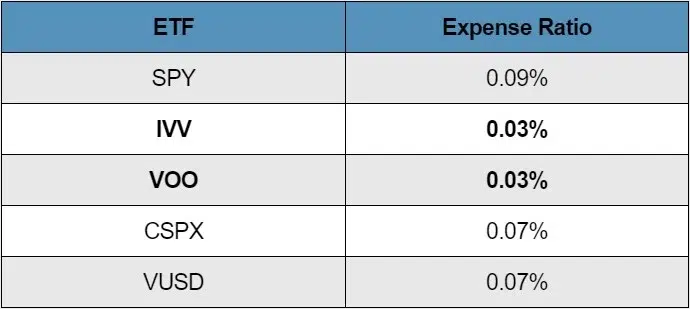

Statistics to Note: CSPX boasts an expense ratio of 0.07%, while VOO shines with an even lower 0.03% expense ratio. It’s essential to consider these figures when assessing the long-term impact on your investment.

Performance Histories of CSPX and VOO: Beyond the Numbers

Learning from Historical Performance

Analyzing historical performance can offer insights into an ETF’s potential future performance. While historical performance is a valuable indicator, it doesn’t predict the future. When an ETF shows strong performance over a period, it’s tempting to assume it will continue that trend. However, markets are dynamic, influenced by various factors such as economic changes, company developments, or global events.

For instance, consider a specific ETF that excelled in the past due to market conditions favoring a particular industry. But if the circumstances shift, that ETF might underperform. This happened to me when I relied solely on an ETF’s past success, neglecting the impact of evolving market dynamics.

So, while considering historical performance, it’s crucial to analyze it in conjunction with other factors. Look at how the ETF performed during various market conditions, not just during prosperous times. Assessing how it reacted during market downturns or fluctuations will provide a more complete picture of its resilience and adaptability.

Remember, it’s not a crystal ball; past performance is just one part of the puzzle.

CSPX vs. VOO: Historical Data Over 5 Years

Both CSPX and VOO have demonstrated strong returns over the years. However, it’s crucial to recognize that past results don’t guarantee future success.

Statistics to Consider: Over the past 5 years, CSPX and VOO have delivered impressive returns, going up 65% and 61%, respectively. These figures provide valuable context for your decision.

Fund Providers’ Impact: iShares vs. Vanguard

The Influence of Fund Providers

The entity managing an ETF, often referred to as the fund provider, plays a more substantial role than you might think. reputation and background of fund providers play a critical role in the ETF’s success. It can impact expenses, investment strategies, and ultimately, your returns. iShares and Vanguard, managing CSPX and VOO respectively, have their unique strengths.

iShares vs. Vanguard: A Battle of Giants

iShares, part of BlackRock, the world’s largest ETF provider, ensures a vast network and resources. Their credibility and extensive experience offer stability and reliability. On the other hand, Vanguard, known for its investor-centric approach, prides itself on maintaining low costs and excellent customer service. Their commitment to investors’ interests shapes their operational philosophy.

These differences influence the ETF’s expenses, investment strategies, and even the services provided. For instance, iShares might use a different approach to manage the ETF compared to Vanguard. Understanding these distinctions helps investors align their preferences with a provider that mirrors their investment philosophy.

Both bring credibility to the table, making the choice more challenging.

Distributions and Dividends: Maximizing Your Income

Navigating Income Maximization

Are you investing with the goal of generating income? Distributions and dividends from ETFs can significantly impact your bottom line.

CSPX vs. VOO: How Dividends Are Handled

CSPX and VOO both provide dividends, but the yields may differ. Pay close attention to their dividend histories to align your investment with your income objectives.

Tax Efficiency: A Silent Factor in Investment Decisions

Navigating Tax Efficiency

ETFs are known for their tax efficiency, but it’s essential to understand how taxes can affect your returns.

I once underestimated the tax benefits of ETFs, leading to unexpected tax liabilities. It’s crucial to factor in taxes when making investment decisions.

Notable Figures: The dividend withholding tax rate for Ireland-domiciled ETFs is only 15% as compared to 30% for US-domiciled ETFs. Factoring in these rates, the effective cost of this tax is 0.27% for CSPX and 0.56% for VOO. These numbers directly impact your potential returns and should weigh into your decision.

Unveiling Hidden Costs: Brokerage Fees and Fractional Shares

The Full Cost Picture

The choice between Ireland-domiciled and US-domiciled ETFs isn’t solely about expense ratios and taxes. Brokerage fees and the availability of fractional shares play a crucial role.

I’ve encountered the challenge of high share prices and limited funds when investing in ETFs. The ability to buy fractional shares can make a substantial difference in utilising your available cash.

Certain brokerages such as Syfe Trade allows you to buy fractional shares which is perfect for those that DCA regularly with a smaller capital.

Investment Strategies Using CSPX and VOO

These ETFs are well-suited for various investment strategies due to their low expense ratios and diversified holdings:

Long-Term Buy-and-Hold Strategy

The long-term buy-and-hold strategy is a cornerstone of passive investing, emphasizing patience and a belief in the long-term growth potential of the market. Both CSPX and VOO are well-aligned with this strategy due to their low expense ratios and broad exposure to the S&P 500 index. Research has consistently shown that actively managed funds struggle to consistently outperform the market over extended periods, making index-based ETFs like CSPX and VOO attractive choices for long-term investors.

One of the key advantages of the long-term buy-and-hold strategy is the ability to ride out market fluctuations without making knee-jerk reactions based on short-term volatility. By staying invested over the long term, investors benefit from the historical upward trajectory of the market, which has shown resilience and growth over time despite occasional downturns.

Investors pursuing this strategy should focus on factors such as their risk tolerance, investment time horizon, and overall financial goals. Rebalancing the portfolio periodically to maintain the desired asset allocation is also important in a long-term buy-and-hold approach.

Dollar-Cost Averaging Strategy

Dollar-cost averaging (DCA) is a disciplined investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy is particularly effective in reducing the impact of market volatility on investment returns.

CSPX and VOO are well-suited for dollar-cost averaging due to their low expense ratios, which help minimize fees that can erode returns over time. By investing a consistent amount at regular intervals (e.g., monthly or quarterly), investors automatically buy more shares when prices are low and fewer shares when prices are high. Over time, this can lead to a lower average cost per share and potentially higher returns compared to trying to time the market.

Dollar-cost averaging is a strategy that aligns well with a disciplined, long-term approach to investing. It can be particularly beneficial for investors who want to mitigate the psychological impact of market fluctuations and maintain a consistent investment strategy regardless of short-term market movements.

Both strategies offer distinct advantages for investors, and the choice between them depends on factors such as individual risk tolerance, investment goals, and time horizon. It’s essential for investors to understand their own financial situation and objectives before selecting an investment strategy using CSPX, VOO, or any other ETF.

Choosing Your Investment Path: CSPX or VOO?

In conclusion, personally, I would lean towards CSPX due to the higher cost savings it offers over time. The reduced expense ratios and tax benefits align well with my long-term investment strategy.

When you opt for the cost-efficient CSPX, you’re setting yourself up for long-term success. Lower expense ratios and tax advantages mean more of your hard-earned money stays where it belongs— in your pocket. Imagine the peace of mind that comes with knowing your investments are working diligently to grow your wealth.

On the other hand, VOO offers liquidity and advanced trading opportunities. Its higher trading volume allows you to buy and sell with ease, while the potential for trading options like selling covered calls opens up exciting possibilities for enhancing your returns.

Whether you prioritize cost savings or seek the flexibility of trading options, remember that your investment journey is your own. Tailor it to your unique financial goals and risk tolerance.

So, which path will you choose? Will it be CSPX, the steadfast champion of frugality, or VOO, the versatile contender of liquidity? Your decision today could shape your financial destiny tomorrow.

For those interested in exploring an alternative ETF choice, I recommend checking out my article on the Vanguard FTSE All-World UCITS ETF (VWRA). VWRA offers a diversified global investment opportunity that might align better with your financial goals and preferences.

Frequently Asked Questions (FAQs)

Should I buy VOO or CSPX?

The choice between VOO and CSPX depends on your specific investment goals and preferences. CSPX is an Ireland-domiciled ETF known for its lower expense ratios and favorable tax treatment. On the other hand, VOO, a US-domiciled ETF, offers liquidity advantages and the potential for advanced trading options like selling covered calls. Before making your decision, it is best to consider your long-term strategy and evaluate the stocks in detail.

Is CSPX same as VOO?

While both CSPX and VOO track the S&P 500 index and provide exposure to US large-cap stocks, they differ in domicile, tax treatment, and trading platform. CSPX is Ireland-domiciled, subject to a lower withholding tax rate, and traded on the London Stock Exchange (LSE). VOO, being US-domiciled, has a higher withholding tax rate but offers the convenience of trading on US exchanges. So, while they have similarities, they are not the same due to these differences.

Does CSPX pay a dividend?

Yes, CSPX pays dividends. However, the dividend yield and tax treatment may differ between the two due to their respective domiciles. CSPX may benefit from a lower withholding tax rate on dividends, potentially resulting in a more favorable after-tax yield for investors.

Why buy CSPX?

Investing in CSPX, the iShares Core S&P 500 ETF, offers a cost-efficient and tax-beneficial option with a strong track record. Boasting a low expense ratio of 0.07% and enjoying a 15% withholding tax rate on dividends due to its Ireland domicile, CSPX stands out. Managed by iShares, it mirrors the S&P 500’s performance historically, providing exposure to major U.S. companies. This combination of cost efficiency, tax benefits, provider credibility, and historical performance makes CSPX an appealing choice for diversified, reliable investment in leading U.S. companies.

Is CSPX accumulating or distributing?

Yes, CSPX is an accumulating ETF. This means that any dividends paid by the companies within the S&P 500 index are automatically reinvested into the fund. Instead of being distributed to investors as cash, the dividends are used to purchase more shares of the ETF, helping to increase the fund’s total value over time. This process allows for potential compounding of returns, as the reinvested dividends can contribute to the growth of the investment without incurring tax liabilities until the investor sells their shares.

Comments (2)

Saxo Markets Review 2024: Pros & Cons - Personal Financesays:

December 24, 2023 at 6:45 am[…] the US, Hong Kong, and an additional 50 global markets. This means you can access popular ETFs like CSPX and VWRA, providing an additional layer of flexibility compared to some other […]

VWRA ETF: A Global Investment For Long-Term Growth In 2024says:

March 29, 2024 at 8:13 am[…] to consider. While exploring the benefits of VWRA, the discussion regarding the nuances between CSPX and VOO provides further insights into the world of ETF […]