Setting up a budget is an essential part of managing your personal finances. It enables you to control your spending, prioritise your expenses, and put money aside for your financial goals. However, creating a budget can be quite intimidating, and sticking to it can be even more challenging. The 50/30/20 rule is a popular budgeting technique that can help you simplify the process and achieve your financial goals. In this ultimate guide, we will cover everything you need to know about the 50/30/20 rule, including how to implement it, its benefits, tips for success, and common mistakes to avoid.

Key Takeaways

Before diving into the details, let’s highlight some key takeaways:

- Budgeting is a vital tool for achieving financial control and realizing your goals. Personally, I found that creating a budget was the first step towards achieving my dream of traveling the world.

- The 50/30/20 rule simplifies budgeting by dividing your income into three distinct categories: needs, wants, and savings. This structure helped me prioritize my financial goals, from paying off student loans to planning for my future.

- Benefits of the 50/30/20 rule encompass prioritized spending, streamlined budget tracking, and a structured approach to saving for the future. I can vouch for how it made my financial life more organized and less stressful.

- Successful implementation involves categorizing your income and diligently monitoring your expenditures. It’s like having a financial GPS guiding your way.

- Achieving success with this rule requires adaptability, consistency, and vigilance against common financial pitfalls. Over the years, I’ve learned that staying flexible and avoiding impulse buying is key to financial success.

Table of Contents

What is the 50/30/20 Budgeting Rule?

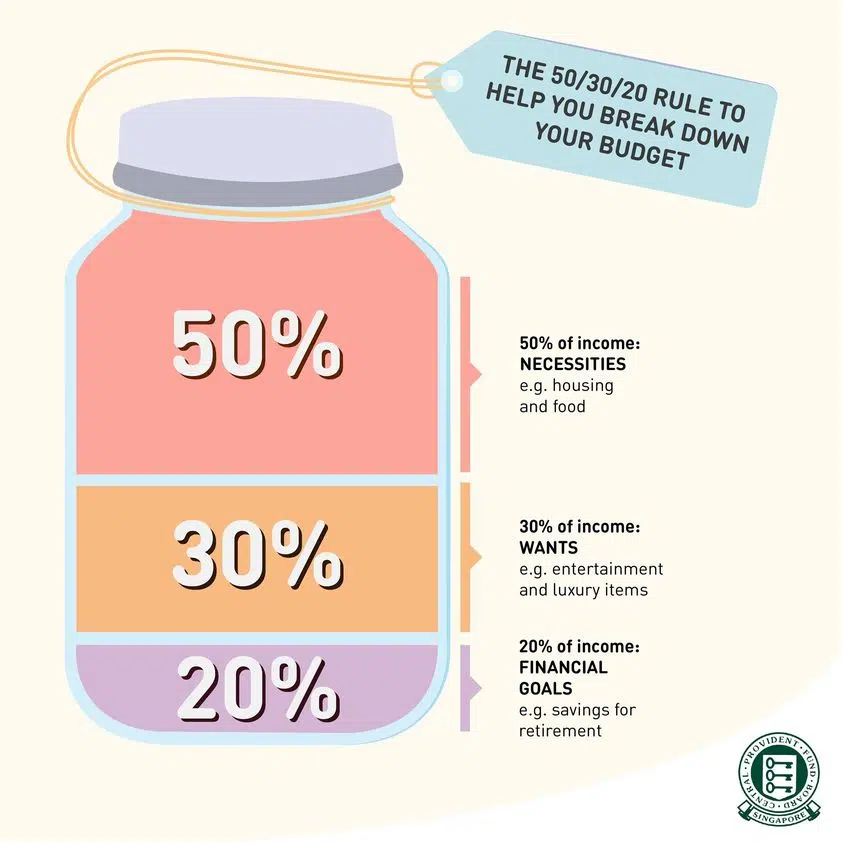

The 50/30/20 rule is a budgeting technique that divides your net income (after CPF contribution) into three categories: needs, wants, and savings.

Here’s a closer look at these categories:

- Needs (50%): This category covers essential expenses like housing, utilities, groceries, and transportation.

- Wants (30%): Non-essential expenditures such as dining out, vacations, and entertainment subscriptions fall under this category.

- Savings (20%): This allocation encompasses contributions to emergency funds, investments, and other long-term savings objectives.

Benefits of the 50/30/20 Budgeting Rule

Embracing the 50/30/20 rule offers several notable advantages:

- Prioritized Spending: By allocating a substantial portion to your needs, you ensure your essential expenses are consistently met, alleviating the stress associated with budget shortfalls.

- Streamlined Budgeting: Dividing your income into three primary categories simplifies the budgeting process. This clarity makes it easier to track expenses and remain within your financial boundaries.

- Savings Emphasis: The 50/30/20 rule encourages saving for the future by dedicating a significant portion of your income to savings and investments, empowering you to work toward your financial goals.

Understand the long-term benefits of saving with my article on the Power of Compound Interest.

Assessing Your Financial Situation

Before applying the 50/30/20 rule to your financial life, it’s essential to start with a thorough assessment:

- Calculate Your Total Monthly Income: Begin by determining your total monthly income. This includes your regular salary, any additional income sources, or side hustles. For instance, my freelance gig added a significant boost to my monthly income.

- List All Monthly Expenses: Categorize your expenses into two primary groups: “needs” and “wants.” “Needs” encompass essential expenditures like housing costs (rent or mortgage), utilities, groceries, transportation, insurance, and debt payments. “Wants” include non-essential spending, such as dining out, entertainment, subscriptions, and luxury purchases. My love for dining out was a “want” that needed some control.

- Consider Irregular or Annual Expenses: Don’t forget to account for irregular or annual expenses, such as car maintenance or holiday gifts. To create a comprehensive financial picture, average these costs into monthly amounts.

- Calculate Your Net Disposable Income: Determine your net disposable income by subtracting your total monthly expenses from your income. This reveals the funds you have available for budget allocation.

- Address Outstanding Debts: If you have high-interest debts, assess how they fit into your financial plan while adhering to the 50/30/20 rule. Allocate a suitable portion of your “needs” category to debt repayment. For me, tackling my student loans was a top priority.

This financial assessment lays the groundwork for budgeting and allows you to identify areas where adjustments may be necessary to align with the 50/30/20 rule.

| Step | Description | Amount ($) |

|---|---|---|

| 1. Calculate Monthly Income | Sum of regular salary and additional income sources | $4,500 (example) |

| 2. List All Monthly Expenses | Categorize into “Needs” and “Wants” | |

| 2.1 Needs | Rent/Mortgage, Utilities, Groceries, Transportation, Insurance, Debt Payments | |

| Rent/Mortgage | Monthly housing costs | $1,200 (example) |

| Utilities | Electricity, Water, Gas, Internet | $200 (example) |

| Groceries | Food and household essentials | $400 (example) |

| Transportation | Car payment, gas, public transit | $300 (example) |

| Insurance | Health, car, and home insurance | $150 (example) |

| Debt Payments | Student loans, credit card minimums | $250 (example) |

| 2.2 Wants | Dining out, Entertainment, Subscriptions, Luxury Purchases | |

| Dining Out | Meals at restaurants and cafes | $200 (example) |

| Entertainment | Movie tickets, concerts, etc. | $100 (example) |

| Subscriptions | Streaming, gym, magazines, etc. | $50 (example) |

| Luxury Purchases | Non-essential items and indulgences | $100 (example) |

| 3. Irregular or Annual Expenses | Average these costs into monthly amounts | |

| Car Maintenance | Average annual car maintenance cost divided by 12 | $50 (example) |

| Holiday Gifts | Average annual gift expenses divided by 12 | $30 (example) |

| 4. Calculate Net Disposable Income | Subtract total expenses from income | $1,170 (example) |

| 5. Address Outstanding Debts | Allocate a suitable portion of the “Needs” category to debt repayment | |

| High-Interest Debts | Portion allocated from the “Debt Payments” category | $150 (example) |

| Total Monthly Budget | Sum of “Needs” and “Wants” expenses | $2,480 (example) |

This financial assessment lays the groundwork for budgeting and allows you to identify areas where adjustments may be necessary to align with the 50/30/20 rule.

Explore more comprehensive strategies on saving in Singapore with my guide on navigating High Cost of Living in Singapore.

Setting Financial Goals

Your financial objectives serve as the compass guiding your budget. Here’s how to establish effective financial goals:

- Distinguish Between Short-Term and Long-Term Goals: Begin by identifying both short-term and long-term financial objectives. Short-term goals might include saving for a vacation, reducing credit card debt, or building an emergency fund. Long-term goals may encompass retirement planning, homeownership, or funding your children’s education.

- SMART Goals: Make your goals Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). Instead of a vague goal like “save more,” create a SMART goal such as “save $5,000 for a European vacation in 12 months.”

- Prioritize Goals: Determine the importance and urgency of your goals. Certain objectives, like paying off high-interest debt, may take precedence over others.

- Cost Estimation: Calculate the cost associated with each goal and ascertain how much you need to allocate from your “wants” and “savings” categories to reach them.

- Regular Review and Adjustment: Continually review and adjust your goals as your financial situation evolves. Flexibility is crucial to adapt to changing circumstances.

How to Implement the 50/30/20 Budgeting Rule

- Determine Your Net Salary: Begin by calculating your net salary, which is your income after deductions, including CPF contributions. Knowing my net salary was crucial for accurate budgeting.

- Allocate Into Categories: Divide your salary into the three broad categories: needs, wants, and savings. This step gave structure to my budget and financial plan.

- Track Spending Regularly: Consistently monitor your spending and make necessary adjustments to stay within your budget. This may require modifying your spending habits to align with the 50/30/20 rule. I had to cut back on dining out to stay within my “wants” category.

For those looking into investment platforms to grow their savings, my review on Saxo Markets Singapore provides an in-depth analysis.

Customizing the Rule to Your Life

One of the strengths of the 50/30/20 rule is its adaptability. Here’s how you can tailor it to suit your unique circumstances:

- Income Level Consideration: Your income level can influence your budget percentages. For instance, if you have a lower income, you might allocate 40% to needs, 30% to wants, and 30% to savings. Conversely, with a higher income, you could distribute 40% to needs, 25% to wants, and 35% to savings. My income level influenced me to allocate more to savings, as I wanted to build my emergency fund faster.

- Family Dynamics: If you have a family, your expenses may significantly differ from those of a single individual. Customize your budget to accommodate your family’s specific needs and priorities. When my family grew, I had to allocate more to needs, especially for childcare.

- Goal-Driven Customization: Your financial goals can also determine your “savings” category allocation. If you’re aggressively saving for a down payment on a home, you may temporarily allocate more than 20% to savings. For me, this meant allocating more to savings when I was saving for a down payment on my first home.

Remember, customization should be done thoughtfully, considering your actual financial situation. Striking the right balance is key to meeting your needs, enjoying your life, and saving for the future.

Tracking Your Expenses

Effective expense tracking is pivotal to financial management. Here’s how to do it efficiently:

- Budgeting Apps: Utilize budgeting apps that sync with your bank accounts, credit cards, and investments. These apps categorize your spending, providing a clear overview of your financial transactions. For me, using Mint made tracking expenses a breeze.

- Spreadsheets: If you prefer a hands-on approach, create a budget spreadsheet. Tools like Microsoft Excel or Google Sheets offer customizable templates. I found that using Google Sheets allowed me to tailor my budget to my specific needs.

- Receipts and Records: Keep and organize your receipts and records. This is especially helpful for cash transactions or expenses not reflected in your bank statements. Regularly input this data into your chosen tracking method. My habit of saving receipts made it easier to track cash expenditures.

- Establish a Routine: Cultivate a habit of tracking your expenses regularly. Allocate time weekly or monthly to review your financial transactions. Consistency is essential for maintaining a precise understanding of your spending patterns. This consistency was key in keeping my budget on track.

- Review and Adjust: Periodically assess your spending patterns. Identify areas where you may be overspending or incurring unnecessary expenses. Use these insights to fine-tune your budget and reallocate funds toward your savings objectives. My regular reviews helped me identify and eliminate unnecessary expenses.

Strategies for Reducing Expenses

Trimming expenses within both the “wants” and “needs” categories is a key aspect of successful 50/30/20 rule adherence. Here are effective strategies:

Needs Category:

- Utility Savings: Implement energy-efficient practices and technologies, reduce water consumption, and use programmable thermostats to lower utility bills. My energy-efficient upgrades reduced my monthly bills.

- Grocery Planning: Plan meals, create shopping lists, and avoid impulse purchases when grocery shopping. Also, please avoid going grocery shopping when you are hungry. You tend to buy a lot more than you need. I found this simple strategy significantly reduced my grocery bills.

- Transportation: Explore options such as carpooling, public transportation, or biking to reduce gas and parking expenses. I decided to carpool with a colleague, saving both money and reducing my carbon footprint.

Wants Category:

- Dining Out: Limit dining out to special occasions and seek restaurants with deals or discounts. I now reserve dining out for special celebrations, saving money in the process.

- Entertainment Subscriptions: Review your entertainment subscriptions and consider canceling those rarely used. I realized I was paying for multiple streaming services, and I canceled the ones I hardly used. In fact, I’m proud to say that I do not own a Netflix or Spotify subscription anymore.

- Retail Purchases: Before making non-essential purchases, pause and consider whether they genuinely add value to your life. I adopted a rule: if I didn’t need it, I didn’t buy it.

Building Your Savings

Fostering and growing your savings is a fundamental pillar of financial stability. Here’s how to allocate your savings effectively and understand the power of compound interest:

- Types of Savings Accounts: Explore various savings account options, including regular savings accounts, high-yield savings accounts, and certificates of deposit (CDs). Each has its advantages and interest rates, so select the one aligning with your financial goals. I chose a high-yield savings account to maximize my interest earnings.

- Investment Options: Consider directing a portion of your savings into stocks, bonds, or mutual funds for the potential of higher long-term returns. Consult with a financial advisor or leverage online investment platforms to embark on this journey. My investments allowed my savings to grow faster than traditional savings accounts.

- Compound Interest: Embrace the concept of compound interest. Your money not only earns interest but also generates interest on that interest over time. The earlier you commence saving and investing, the more potent the impact of compound interest. My early investments have grown significantly over time thanks to compound interest.

Emergency Funds and Why They Matter

Emergency funds provide a critical safety net during unexpected financial challenges. Here’s why they are indispensable and how to establish one:

- Understanding Emergency Funds: An emergency fund serves as a financial cushion to cover unexpected expenses like medical bills, car repairs, or job loss, safeguarding you from accumulating debt during unexpected life events.

- Savings Target: Aim to save at least three to six months’ worth of living expenses in your emergency fund. This reserve offers peace of mind and security during crises.

- Accessibility: Keep your emergency fund in a liquid and easily accessible account, such as a savings account or money market account, to ensure prompt access when needed.

Strategies for Increasing Income

Augmenting your income can accelerate your financial progress. Here are strategies to increase your income in Singapore:

- Side Hustles: Explore side hustles or freelance opportunities in your spare time. Online platforms like Upwork, Fiverr, and TaskRabbit offer avenues for finding freelance gigs.

- Negotiate a Raise: If you’re employed, don’t hesitate to negotiate a higher salary or pursue a promotion. Highlight your achievements and the value you bring to your organization.

- Skill Development: Invest in acquiring new skills or enhancing existing ones that can open doors to higher-paying opportunities.

Mastering Your Finances with the 50/30/20 Budgeting Rule

In the pursuit of financial stability, the 50/30/20 budgeting rule emerges as a powerful ally, guiding you towards your financial dreams. By embracing this rule, you unlock a host of tangible benefits that propel your journey to prosperity. Let’s break down the key advantages that make the 50/30/20 rule a game-changer for your financial well-being.

1. Controlled Financial Prioritization: With the 50/30/20 rule, you’re equipped to prioritize your spending wisely. Essential expenses, categorized as “needs,” are covered with the 50%, ensuring that your financial foundation remains strong. By controlling your spending, you reduce stress and worry, giving you the peace of mind to focus on what truly matters.

2. Streamlined Financial Management: This rule simplifies the complex landscape of budgeting, ensuring that your financial path is well-lit and easy to navigate. Dividing your income into three core categories – “needs,” “wants,” and “savings” – allows for a clear overview of your financial transactions. It eliminates confusion and empowers you to stay within your financial boundaries, reducing financial chaos and making your financial management journey smoother.

3. Empowered Savings Journey: The 20% allocated to savings underlines the rule’s emphasis on securing your financial future. This commitment empowers you to work systematically towards your financial goals, be it for that dream vacation, homeownership, or a comfortable retirement. It transforms your aspirations into actionable plans, creating a brighter financial tomorrow.

4. A Personalized Path: The 50/30/20 rule is adaptable to your unique circumstances. It allows for customization based on your income level, family dynamics, and financial goals. This flexibility ensures that your budgeting journey is tailored to your life, maintaining a balance that meets your needs, provides room for enjoyment, and secures your financial future.

5. Enhanced Financial Resilience: The “emergency fund” component of this rule ensures that you’re prepared for unexpected financial challenges. By saving three to six months’ worth of living expenses, you gain a financial safety net that shields you from accumulating debt during unforeseen life events. It’s a pillar of financial resilience, delivering peace of mind when you need it most.

6. Accelerated Earning Potential: The 50/30/20 rule doesn’t just focus on expenses; it also paves the way for income growth. By freeing up resources through efficient budgeting, you can explore side hustles, negotiate for higher salaries, or invest in skill development, boosting your earning potential and accelerating your journey towards financial success.

7. Long-Term Security: This rule extends your financial planning horizon. Whether it’s saving for retirement, planning for homeownership, or securing your family with comprehensive insurance coverage, it ensures that you’re well-prepared for the future. Your long-term financial goals become more attainable, and your financial security is enhanced.

In conclusion, the 50/30/20 budgeting rule isn’t just a guideline; it’s a transformative tool that propels you towards financial freedom. By adhering to its principles, you’re on a path to financial control, prioritized spending, and the realization of your dreams. It’s time to seize the reins of your financial destiny, align your priorities, and secure the prosperous future you deserve. Start applying the 50/30/20 rule to your financial life today, and witness your financial dreams becoming a reality. Your journey to financial mastery begins now.

To further enhance your financial planning, consider exploring my ‘Singapore CPF Shielding Guide for Retirement’ and learn effective tax-saving strategies with ‘Reduce Income Tax in Singapore’.

Frequently Asked Questions (FAQs)

What is the 50-30-20 rule in Singapore?

The 50-30-20 rule in Singapore is a budgeting guideline that proposes dividing your after-tax income into three categories for effective financial management. According to this rule:

50% of your income should go towards necessities or ‘needs,’ which include essential expenses such as housing, food, transportation, and utilities.

30% is allocated to ‘wants,’ which covers non-essential expenditures like dining out, entertainment, and leisure activities.

The remaining 20% should be directed towards savings and debt repayment. This could involve contributing to emergency funds, investments, or paying off loans. This rule aims to provide a simple and balanced framework for managing personal finances, particularly in Singapore’s economic context.

What is the 40 40 20 budget rule?

The 40 40 20 budget rule is another approach to personal finance management, differing slightly from the 50-30-20 rule. In this model:

40% of your income is allocated to your needs, slightly less than the 50% in the 50-30-20 rule. This includes essential expenses like rent, groceries, and utilities.

Another 40% goes towards your wants. This is a more generous allocation for non-essential spending compared to the 30% in the 50-30-20 rule, allowing for more leisure and luxury expenditures.

The remaining 20% is dedicated to savings and debt repayments, similar to the 50-30-20 rule. This portion is for building an emergency fund, saving for future goals, and reducing debts. The 40 40 20 rule offers a different balance, allowing for more discretionary spending while still emphasizing the importance of savings.

What are the flaws of the 50-30-20 rule?

While the 50-30-20 rule is a popular budgeting framework, it has its limitations and may not suit everyone. Some of the noted flaws include:

One-Size-Fits-All Approach: The rule doesn’t account for individual financial situations. For instance, people with lower incomes might find it challenging to allocate 50% to needs and still have room for 30% in wants.

High Cost of Living Areas: In places like Singapore where the cost of living can be high, dedicating only 50% of income to essential expenses might not be feasible for everyone.

Varying Definitions of ‘Needs’ and ‘Wants’: The distinction between needs and wants can be subjective and vary greatly from person to person, leading to potential misallocation of funds.

Inflexibility in Changing Circumstances: The rule may not adapt well to changing financial circumstances, such as a sudden increase in expenses or a drop in income.

Oversimplification of Financial Planning: It might oversimplify the complexities of personal finance, not accounting for specific goals like retirement planning, investments, or debt structuring. Despite these flaws, the 50-30-20 rule remains a useful starting point for those new to budgeting, but it may require customization to better fit individual financial situations.

Comments (18)

Envelope Budgeting: The Guide to Managing Your Financessays:

February 24, 2023 at 2:57 pm[…] it may not work for everyone. It’s important to consider other budgeting methods such as the 50/30/20 rule, zero-based budgeting, and the debt snowball method, and choose the method that best fits your […]

10 Easy Ways to Save Money on Groceries This Month: Tips and Trickssays:

March 4, 2023 at 12:45 pm[…] By following these 10 easy ways to save money on groceries in Singapore, you can significantly reduce your grocery bills while still enjoying delicious and healthy meals. If you want to know how you can stretch your budget further every month, you can start by using the 50/30/20 rule for budgeting. […]

4 Things You Should Do To Cope With Inflation in Singapore -says:

March 5, 2023 at 9:37 am[…] more out of your savings. Some of the popular budgeting strategies are envelope budgeting and the 50/30/20 budgeting rule. Lastly, always set aside an emergency fund to tide you through unexpected […]

Choosing the Perfect Credit Card for Your Singaporean Lifestyle!says:

March 12, 2023 at 5:54 am[…] important to understand your spending habits. This includes identifying your biggest expenses and categorising your spending into different categories such as groceries, dining, travel, and entertainment. By doing so, you can choose a credit card […]

The Ultimate Guide to Saving Money in Singapore - Tips & Insightssays:

March 18, 2023 at 3:06 am[…] I have written on how you can create a budget using the 50/30/20 budgeting rule and also envelope budgeting. These budgeting techniques are quick and simple to execute right […]

5 Budgeting Tips Every Young Adult Should Know | Budgetingsays:

March 23, 2023 at 2:20 pm[…] you’re looking for a simple budgeting strategy, the 50/30/20 strategy may be the one for you. It suggests allocating your income into three categories: needs, wants and […]

How I Got Started on My Investment Journey in Singaporesays:

March 25, 2023 at 2:53 pm[…] also made regular contributions to my investment portfolio. Based on the 50/30/20 budgeting rule, I invest a portion of my income into my investment account. This allowed me to take advantage of […]

The Ultimate Guide for Beginners: How to Save 100K by 30says:

April 22, 2023 at 8:11 am[…] can cut back, and allocate your money wisely. There are some popular budgeting strategies such as 50/30/20 budgeting and envelope budgeting. Here are some tips for creating a […]

10 Ways to Save Big by 30: Tips and Tricks for Financessays:

April 22, 2023 at 11:31 am[…] first step to saving money is to create a budget. In Singapore, expenses can add up quickly, so it’s essential to keep track of your spending. […]

Transform Your Finances: Saving $2,000 Monthly in Singaporesays:

May 2, 2023 at 1:10 pm[…] spending, you can now try a budgeting plan that works for you such as Envelope Budgeting or the 50/30/20 budgeting rule. Do remember to review your budget and modify along the […]

Navigating Parental Allowance: How Much Should You Give?says:

August 13, 2023 at 6:57 am[…] actively assisted my mother in creating a budget to manage her finances efficiently. My mother was not financially literate and I was afraid that […]

The Ultimate Guide to Saving Money in Singapore - 5 Tipssays:

August 13, 2023 at 7:05 am[…] The 50/30/20 rule is a popular budgeting strategy that suggests dividing your income into three categories: 50% for needs, 30% for wants, and 20% for savings. By following this rule, you can prioritize your expenses and save money for your financial goals. Here’s how you can apply the 50/30/20 rule in Singapore: […]

The Ultimate Guide for Beginners: How to Save 100K by 30says:

November 10, 2023 at 10:49 am[…] that may suit your financial goals and preferences. Two popular budgeting strategies are the 50/30/20 budgeting and envelope budgeting. Read on for some tips on creating a […]

10 Easy Ways to Save Money on Grocery Shopping This Monthsays:

November 12, 2023 at 7:59 am[…] on a successful money-saving journey starts with a well-thought-out budget. Following my 50/30/20 rule guide, I personally allocate $50 for my weekly grocery trips. This budget is primarily designed to cover […]

The Hidden Cost Of Waiting: The Risks Of Delaying Investmentsays:

February 28, 2024 at 9:31 am[…] As shown in the table above, even with Rachel’s diligent saving habits, the impact of inflation gradually erodes the purchasing power of her savings over time. What initially seemed like a substantial amount diminishes in real value, highlighting the importance of taking proactive steps to preserve and grow wealth through investment. Rachel could have benefited from a more structured approach to managing her finances such as budgeting using the 50-30-20 rule. […]

11 Best CrossFit Gyms In Singapore 2024says:

June 12, 2024 at 9:09 am[…] in shape requires dedication, but it shouldn’t break the bank. My budgeting guide on the 50-30-20 rule can help you optimize your finances to afford your CrossFit membership. After all, you deserve to […]

How To Start Investing As A Student In Singaporesays:

July 10, 2024 at 3:41 am[…] income and expenses, allowing you to identify areas to save and free up cash for investing. Many budgeting frameworks such as the 50-30-20 rule & envelope budgeting are popular in Singapore to help you manage your […]

50-30-20 Budgeting Method: A Simple Guide for Families! - Parenting Messy & Unscriptedsays:

October 7, 2024 at 4:26 am[…] online tools and calculators are available to assist […]