Did you know that a good number of Singaporeans invest in Investment-Linked Policies (ILPs) as a means of securing their financial future? In a country where financial planning and insurance coverage are highly valued, ILPs have emerged as a popular choice for those seeking both investments and protection.

However, ILPs can also be complex and come with high fees and charges, which can impact investment returns. Therefore, it’s essential to understand the pros and cons of ILPs and consider your financial goals and risk appetite before investing in one. I have heard of too many regrets from my friend who did not do their due diligence before investing in one and suffered as a result.

In this blog post, we will explore the advantages and disadvantages of investment-linked policies and provide tips on how to invest in an investment-linked policy that aligns with your financial goals.

Table of Contents

Pros of Investment-Linked Policies

1. Provides Life Insurance Protection

Unlike traditional investment vehicles like mutual funds or exchange-traded funds (ETFs), an ILP provides life insurance protection. This means that if the policyholder were to pass away, their beneficiaries would receive a payout. This payout can be a crucial financial lifeline during a difficult time, helping cover immediate expenses, outstanding debts, and providing financial security for the family’s future.

Imagine a scenario where a breadwinner unexpectedly passes away. Their family would be left not only with the emotional loss but also with potential financial difficulties. In such cases, the life insurance component of an ILP can provide a substantial payout to ease the family’s financial burden. This is something traditional investment vehicles often lack.

2. Offers Flexibility in Investment Options

One of the standout features of ILPs is the flexibility they offer in terms of investment options. Policyholders have the autonomy to choose from a diverse range of investment funds, including equities, bonds, and alternative investments like real estate. This versatility allows individuals to tailor their investments to align with their specific financial goals and risk appetite.

Personal Example: Let’s consider an investor who has varying financial objectives. They may want to save for retirement, plan for their children’s education, and perhaps also set aside funds for a down payment on a home. An ILP’s flexibility enables them to allocate different portions of their premiums to various funds based on the time horizon and risk tolerance associated with each goal.

3. Has Potential for Higher Returns

ILPs have the potential to deliver higher returns compared to traditional insurance policies. Unlike the latter, which tend to offer modest returns, ILPs allow policyholders to invest in a diversified portfolio of funds. Over the long term, this diversification can lead to potentially higher returns.

Personal Example: Consider an investor who started an ILP years ago with a focus on long-term wealth accumulation. Over time, they have allocated a portion of their premiums to equity funds. As the stock market experienced growth, their investment value increased significantly. This demonstrates how an ILP’s investment component can harness the potential for higher returns.

4. Can Be Used as a Long-Term Investment Tool

ILPs are well-suited for individuals with long-term financial goals, such as retirement planning or saving for their children’s education. The beauty of an ILP is that it evolves with the policyholder’s changing financial needs. They can adjust their investment allocation over time to ensure it aligns with their evolving goals.

Take for example a family that started their ILP as a young professional, primarily focused on building a nest egg for retirement. As they progressed in their career, they might have chosen to reallocate their investments to a more balanced mix to accommodate additional financial goals, like buying a home or funding their child’s college education. The adaptability of ILPs makes them a versatile financial planning tool.

Cons of Investment-Linked Policies

1. Higher Fees and Charges

It’s important to be aware that ILPs typically come with higher fees and charges than traditional insurance policies or standalone investment products. These fees can include management fees, policy fees, and mortality charges. These costs, especially when front-loaded, can significantly impact the policy’s overall returns.

Personal Example: My mother, Patricia, wasn’t fully aware of the fee structure of her ILP. In the initial years of her policy, a substantial portion of her premiums went toward covering these fees. This meant that the actual investment component of their ILP remained relatively small. The impact of fees became apparent when comparing the returns to a lower-cost investment alternative.

2. Lower Protection Coverage

Despite offering life insurance coverage, ILPs may not provide adequate protection in the event of the policyholder’s untimely demise. The life insurance component of an ILP might not be enough to cover the policyholder’s outstanding debts, family’s living expenses, and other financial obligations.

Picture yourself contemplating the purchase of an ILP, believing it would adequately safeguard your family in the event of your untimely passing. Regrettably, you may later discover that if a critical situation were to arise, you could face unforeseen financial difficulties, highlighting the fact that the life insurance coverage provided by the ILP may prove insufficient. This situation underscores the limitations of relying solely on an ILP for comprehensive protection.

3. Investment Returns Are Not Guaranteed

It’s crucial to emphasize that investment returns from ILPs are not guaranteed. Unlike traditional insurance policies, where returns are predetermined, ILP returns depend on the performance of the selected funds and market conditions. As a result, there’s always an inherent risk of investment losses.

I had a friend who experienced a significant setback during a bear. Like many investors, they allocated a substantial portion of their premiums to equities within their ILP, driven by the hope of reaping substantial returns. However, the reality unfolded quite differently. As the stock market took a downturn, their investments failed to meet their expectations, and the value of their ILP witnessed a sharp decline.

4. Investment Risk Involved

Investment-linked policies are essentially investment products and, as such, carry investment risk. The policyholder’s investments are subject to market fluctuations and volatility. These market dynamics can lead to variations in the performance of the ILP’s investment component.

Similar to the example that I used earlier, ILPs come with inherent risks and that returns are not guaranteed. The policy holder will be vulnerable to market volatility.

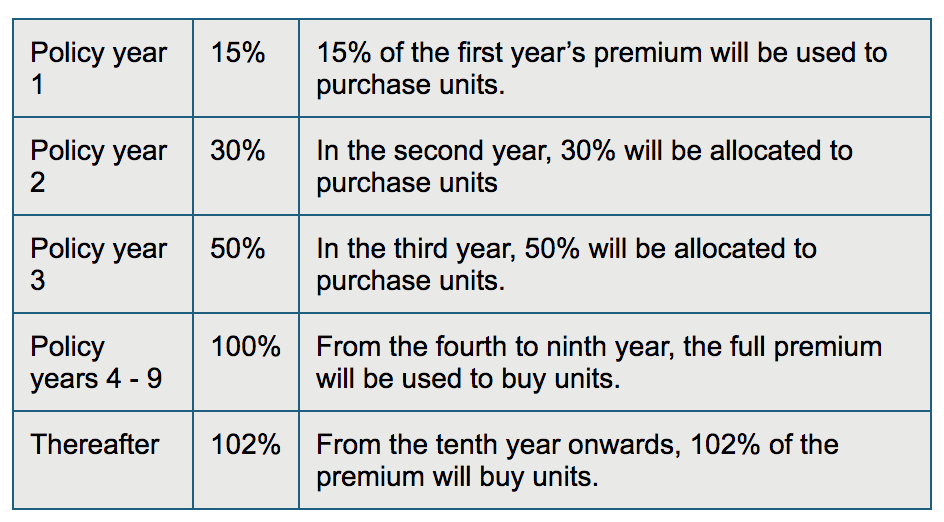

5. Front Loading

Many ILPs feature front loading, a characteristic where a substantial portion of the initial premiums is allocated to cover fees and charges. Consequently, the investment component of the ILP remains relatively small during the early years, which can impact potential growth.

Picture an investor who wanted to build wealth quickly through their ILP. They were unaware that the majority of their initial premium payments would be channeled toward covering fees. As a result, their investment didn’t experience substantial growth in the initial years. Only after a considerable period did the investment component start to catch up.

Break-even point for investment-linked policies based on different premium amounts and policy durations:

| Policy Name | Insurer | Premium Amount | Policy Duration | Break-Even Point |

|---|---|---|---|---|

| PRUActive Life | Prudential | $100/month | 10 years | 6.9 years |

| Manulife InvestReady | Manulife | $150/month | 20 years | 10.8 years |

| AXA Wealth Treasure | AXA | $100/month | 15 years | 8.4 years |

| NTUC Income VivaLink | NTUC Income | $150/month | 25 years | 13.4 years |

| AIA Triple Critical Cover | AIA | $100/month | 20 years | 11.3 years |

| Tokio Marine FlexiWealth | Tokio Marine | $200/month | 25 years | 15.9 years |

Is Investment-Linked Policy the Right Choice for You?

Assessing the suitability of an Investment-Linked Policy (ILP) for your financial portfolio is a crucial step in your financial journey. It depends on several factors, including your unique financial goals, risk tolerance, and level of investment knowledge. For more insights into understanding your insurance needs in Singapore, you might want to explore our blog on How Much Insurance Coverage Do You Really Need in Singapore?

ILPs strike a balance between investment opportunities and life insurance coverage, making them an attractive choice for those looking to protect their financial future while growing their wealth. If you’re someone who values both aspects – the potential for returns and financial security for your loved ones – an ILP might align perfectly with your needs.

On the other hand, individuals primarily seeking comprehensive life insurance coverage may find traditional policies a more suitable option. These policies offer the assurance of predetermined benefits, ensuring that your family’s financial needs are met without the complexities of investment decisions. To delve deeper into the intricacies of insurance in Singapore, you can refer to our blog about The Ins and Outs of Insurance in Singapore.

In essence, your choice between ILPs and traditional policies should be a reflection of your financial aspirations and risk appetite, guiding you towards a secure and fulfilling financial future. for those looking for a balanced approach that combines investment opportunities and financial security, another option may pique your interest. Explore why many investors opt for Exchange-Traded Funds (ETFs) as part of their investment strategy, and how these versatile investment vehicles can benefit your financial portfolio.

The Alternative: Investing in ETF

When it comes to building wealth and managing investments, Exchange-Traded Funds (ETFs) have emerged as a preferred approach for many savvy investors, myself included. ETFs offer a simple yet powerful investment strategy that has gained popularity for several compelling reasons.

Understanding ETFs: ETFs are a type of investment fund and exchange-traded product, which is designed to offer investors exposure to a diversified portfolio of assets, such as stocks, bonds, or commodities. They are traded on stock exchanges, much like individual stocks, making them easily accessible to investors.

Why ETFs are Preferred:

- Diversification: ETFs provide instant diversification by holding a basket of assets within a single fund. This diversification helps spread risk and reduce the impact of poor-performing individual assets, making it a more secure investment choice.

- Low Costs: One of the most attractive features of ETFs is their cost-effectiveness. These funds typically have lower expense ratios compared to mutual funds, which means you keep more of your returns over the long term.

- Liquidity: ETFs are traded on stock exchanges throughout the trading day, offering liquidity to investors who can buy or sell shares at prevailing market prices. This flexibility allows you to react quickly to changing market conditions.

- Transparency: ETFs disclose their holdings daily, providing transparency about the assets within the fund. This transparency helps investors make informed decisions about their investments.

- Flexibility: ETFs cover a wide range of asset classes and investment strategies, allowing you to tailor your portfolio to your specific financial goals and risk tolerance. Whether you’re interested in equities, bonds, commodities, or sector-specific investments, there’s likely an ETF that suits your needs.

- Tax Efficiency: ETFs are structured in a way that can be tax-efficient. They generally generate fewer capital gains distributions compared to actively managed mutual funds, potentially reducing your tax liability.

In summary, ETFs offer a straightforward and cost-effective way to build wealth and manage investments. Their diversification, low costs, liquidity, transparency, flexibility, and tax efficiency make them a preferred choice for those seeking a solid investment strategy. By incorporating ETFs into your investment portfolio, you can take advantage of these benefits while working towards your financial objectives

Tips for Investing in an Investment-Linked Policy

If you decide to invest in an ILP, here are some tips to help you make an informed decision:

- Research and compare policies from different insurers to find the one that best suits your investment goals and risk appetite.

- Understand the investment options available and the risks involved.

- Consider the fees and charges associated with the policy and how they will impact your investment returns.

- Read and understand the policy’s terms and conditions, including the surrender charges and the minimum investment period.

- Regularly review and adjust your investment allocation to ensure it aligns with your financial goals and risk appetite.

- Consider seeking advice from a financial advisor who can help you assess your investment needs and recommend suitable ILPs.

Truth be told, I am not a huge believer of ILPs. I have done a lot of research and heard multiple horror stories about it. The front load process of an ILP is extremely taxing on the policyholder. In fact, you can only expect to break even after holding the policy for more than 10 years. Even so, it does not mean that the returns are guaranteed.

I believe in ETF investing and prefer to keep insurance coverage and investment products separate. The high fees and charges of an ILP can eat into your investment returns. Instead, what you can do is to invest in low-cost index funds that offer diversification and lower fees and buy a separate insurance policy to provide adequate coverage for life, disability and critical illness.

Do Your Due Diligence

In conclusion, it’s crucial to approach Investment-Linked Policies (ILPs) with a thoughtful and cautious mindset. While ILPs offer the dual benefits of investment opportunities and life insurance coverage, they also come with their fair share of complexities and risks.

- Evaluate Your Needs: Before diving into an ILP, assess your financial goals, risk tolerance, and investment knowledge. Consider whether you prioritize both investment growth and insurance protection or if a more focused insurance policy suits your needs better.

- Understand the Pros and Cons: We’ve explored the advantages and disadvantages of ILPs, from the potential for higher returns to the higher fees and charges. Be sure to weigh these factors carefully when making your decision.

- Do Your Due Diligence: Proper research is key. Understand the terms and conditions of the policy, the fees involved, and how the investment component operates.

Adequate Research and Guidance:

Remember, with the right research and professional guidance, an investment-linked policy can play a valuable role in your overall investment portfolio. It can offer a unique blend of financial security and growth potential when aligned with your specific goals and risk appetite.

Now, we invite you to share your own experiences or pose any questions you might have in the comments section below. Your insights can be invaluable to our community of readers.

Furthermore, for personalized advice tailored to your financial situation, don’t hesitate to consult with a trusted financial advisor. They can provide the guidance needed to make well-informed decisions and navigate the intricate landscape of investment-linked policies. Your financial future deserves the attention it demands, and a financial advisor can help you secure it.

Frequently Asked Questions

Is ILP good or bad?

Investment-Linked Policies (ILPs) are neither inherently good nor bad. Their suitability depends on your individual financial goals, risk tolerance, and investment knowledge. ILPs can be a valuable addition to your financial portfolio if you seek a balance between investment opportunities and life insurance coverage. However, for those primarily seeking comprehensive life insurance protection, traditional insurance policies might be a more suitable choice.

Is investment-linked insurance good?

The suitability of investment-linked insurance depends on your financial objectives and risk tolerance. If you value both investment growth and life insurance protection and are comfortable with investment risk, ILPs can be a good choice. However, if you primarily seek life insurance coverage, traditional insurance policies may be more suitable. It’s crucial to assess your individual needs and conduct thorough research before making a decision. Consulting a financial advisor can help you make an informed choice tailored to your circumstances.

What is the difference between ILP and life insurance?

The fundamental distinction between ILPs and traditional life insurance is that ILPs merge life insurance coverage with investment opportunities, offering the potential for higher returns but also carrying investment risk. Traditional life insurance, on the other hand, provides guaranteed death benefits with no investment component, making it a straightforward safety net for beneficiaries. The choice between the two depends on your financial goals, risk appetite, and whether you prioritize both investment and insurance or just insurance coverage.

Should I cancel my Investment-Linked Policy (ILP)?

Deciding to cancel your Investment-Linked Policy (ILP) is a significant financial choice requiring thoughtful consideration. Start by evaluating your current financial goals, investment performance, and risk tolerance to determine if the ILP aligns with your objectives. Weigh the costs associated with the policy against the benefits it provides, being mindful of any surrender charges. Explore alternative financial products and consult with a financial advisor for personalized guidance. Also, factor in any tax implications and assess how your long-term financial goals have evolved. Ultimately, the decision to cancel your ILP should be well-informed, reflecting your unique financial situation and objectives.

Leave a Reply