Updated Jan 2024. Ah, banking, the age-old chore we’ve all come to accept as a necessary part of adulting. For years, I was a loyal DBS user, content with what I considered a decent banking experience. That was until I stumbled upon Trust Bank Singapore. Intrigued by the buzz and curious about the hype, I decided to give this new digital bank a try. Fast forward, and I’ve chucked my DBS app into the digital wastebasket and embraced Trust Bank as my go-to banking companion alongside my favourite UOB One Account. So, why the change of heart? Let’s dive into my Trust Bank Singapore review to find out.

Key Takeaways

- Trust Bank Singapore is a digital banking sensation, quickly accumulating a billion dollars in deposits by April 2023 and aiming to become Singapore’s fourth-largest retail bank.

- Trust Bank’s partnership with Standard Chartered Bank and FairPrice Group provides it with a strong foundation.

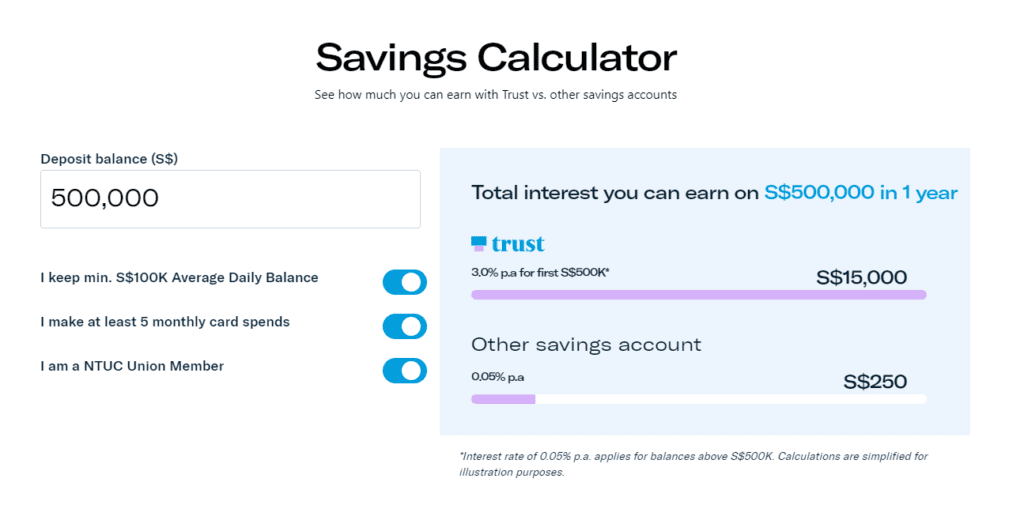

- The Trust Bank savings account offers a competitive interest rate of up to 3% p.a. on the first S$500,000, with no lock-in period, no monthly fees, and no account closure fees. (Updated Jan 2024)

- Exclusive offers, such as coupons, stamp cards, and vouchers, make Trust Bank a compelling choice for users looking for added value.

- The banking industry is evolving, and Trust Bank is leading the charge with its agile and user-focused approach.

- Overall, Trust Bank Singapore offers a fresh, modern alternative to traditional banks and is worth considering for those seeking a more streamlined, rewarding, and efficient banking experience.

Table of Contents

What is Trust Bank Singapore?

Trust Bank Singapore has been making headlines, having recently amassed a staggering S$1 billion in deposits as of April 2023. In just seven months, over 500,000 retail customers hopped on board, and their ambition is sky-high – they’re aiming to be Singapore’s fourth-largest retail bank in terms of customer numbers by next year. To put that into perspective, that’s right behind the banking giants, DBS, UOB, and OCBC.

But what exactly is Trust Bank Singapore? Launched on September 1, 2022, it’s not just another digital bank. It’s a digital bank backed by a powerhouse partnership between Standard Chartered Bank and FairPrice Group, with Standard Chartered owning 60% and the remaining 40% belonging to FairPrice Group’s enterprise arm.

Trust Bank goes beyond the basics. It offers a range of financial products, including savings accounts, debit/credit cards, and accident insurance coverage. What sets Trust Bank apart from other digital banks is that it holds a full banking licence and boasts a network of 20 ATMs across Singapore, including 19 StanChart ATMs and one ATM at FairPrice Xtra (Vivocity).

A Bank, Redesigned as a Digital Native

Trust Bank stands out not just for its generosity but for its innovative approach to banking. When you receive your Trust Bank card, you won’t find a slew of numbers on it. Instead, it arrives without any numbers, which is a smart security feature. No more fretting about your card being misused.

Additionally, Trust Bank simplifies the login process. Say goodbye to tedious authentication steps and say hello to a witty joke. It’s not only refreshing but also lightning-fast. Transactions, like depositing money, used to take a while with local banks. But with Trust Bank, it’s a different story. The funds arrive almost instantly. It’s the kind of speed we’ve all been secretly craving.

Trust Bank Savings Account

Now, let’s talk about money. Trust Bank’s savings account deserves special attention. The interest rate is what piqued my interest: up to 2.5% per annum on the first S$125,000 deposit. This rate isn’t just one flat number; it’s broken down into components. Update in 2024: Earn up to 3.0% p.a. interest rate on your deposit balance up to S$500K deposit.

- Base interest: A cool 1.5% p.a. with no strings attached.

- Bonus interest: 1% p.a. if you’re a union member with five eligible card transactions, or 0.5% p.a. for non-union members who make five eligible card transactions.

- Balance Bonus Rate (New): +0.05% p.a. if you maintain min. S$100K Average Daily Balance (ADB) for the month to unlock this bonus rate on deposit balance up to S$500K.

- Balances exceeding S$125,000 earn a modest 0.05% p.a.

Oh, and did I mention there’s no lock-in period, no monthly fees, and no account closure fees on Trust Bank’s savings account? Just one minor caveat: you must be at least 18 years old to be eligible for a Trust Bank savings account. Yeah and that’s probably the only reason you continue to use DBS.

What Users May Like About Trust Bank

Beyond the attractive interest rates, Trust Bank offers a host of perks. You can accumulate LinkPoints while shopping with your NTUC Link Card or Trust Link Card. These points are easily tracked using the Trust mobile app. Plus, there are significant savings on FairPrice Group groceries and food.

- NTUC Link Card: With a credit card, get up to 21% savings when you spend a minimum of S$350 per month. Debit card users enjoy up to 11% savings with a minimum monthly spend of S$200.

- Trust Link Card: Credit cardholders receive up to 15% savings when spending a minimum of S$450 per month, while debit card users get up to 5% savings with a minimum monthly spend of S$200.

Spending with the Trust Card

One key advantage of Trust Bank is that it offers LinkPoints. While some prefer cashback, LinkPoints give you an idea of how much you’ve earned. Traditional banks have made it a hassle to track rewards, but Trust Bank makes it straightforward.

It’s not without its quirks, though. Tracking rewards can be a bit convoluted and requires navigating through various screens. That’s one area where Trust Bank could use some improvement.

Coupons, Stamp Cards, and Exclusive Offers

But Trust Bank doesn’t stop at just banking. The Trust App adds an exciting dimension to your experience. It lets you discover and save coupons that you can redeem at merchants islandwide. Imagine getting discounts on your favorite meals, shopping, or even rides with Gojek and Foodpanda.

Stamp cards are another nifty feature. When you shop with your Trust card, you earn stamps that unlock rewards at your preferred merchants. It’s like your loyalty being rewarded every time you spend.

Trust Bank has a series of exclusive offers with popular merchants like BurgerKing, Gojek, Foodpanda, and many more. As a welcome gesture, new credit card customers can receive a S$25 FairPrice E-Voucher on their first card spend. For savings account customers, you can snag the E-Voucher when you make your first S$500 deposit. Do note that terms and conditions apply, so be sure to read the fine print.

What Users May Not Like About Trust Bank

While Trust Bank’s offering is impressive, there are a couple of drawbacks to consider. The base interest rate of 1.5% p.a. might not compete with the best no-frills savings accounts in the market. Even for union members, the 3% p.a. the interest rate is still lower than what the top savings accounts offer. If you’re keen to find out more about high yield saving accounts, do hop over to my review on UOB One Account.

Also, there’s a catch. The 3% interest rate only applies to the first S$500,000 of savings. Beyond that threshold, your interest drops to a mere 0.05% p.a. – not as enticing.

How Does Trust Bank Compare to GXS and MariBank?

Now, here’s the real clincher. You’re likely wondering how Trust Bank stacks up against its digital bank competitors, GXS and MariBank. So, let’s do a side-by-side comparison.

Savings Account Interest Rates:

- MariBank: Offers a generous 2.88% p.a. interest rate until December 31, 2023.

- GXS Bank: Provides an attractive 2.68% p.a. interest rate for deposits in savings pockets from August 17. I did a review on GXS Bank previously.

- Trust Bank: Offers up to 3% p.a., but only on the first S$500,000 of savings.

Maximum Deposit Limits:

- MariBank: Capped at S$75,000.

- GXS Bank: Also limited to S$75,000.

- Trust Bank: No maximum deposit, but the high 3% p.a. interest rate is only applicable to the first S$500,000.

Eligibility Requirements:

- MariBank: Open to those 18 years and older, Singaporean Citizens/Permanent Residents.

- GXS Bank: Available to individuals aged 16 and above with a residential address in Singapore, including Singaporean Citizens/Permanent Residents/Foreigners.

- Trust Bank: Requires customers to be 18 years and above, Singaporean Citizens/Permanent Residents.

Benefits and Features:

- MariBank & GXS Bank: Nil.

- Trust Bank: Offers promotional discounts on FairPrice Group spending and boasts 20 ATMs islandwide.

Here’s a quick comparison chart for a better overview:

| Bank | Interest Rate | Maximum Deposit Limit | Eligibility Requirements | Benefits and Features |

|---|---|---|---|---|

| MariBank | 2.88% p.a. | S$75,000 | 18 years and older, Singaporean Citizens/Permanent Residents | Nil |

| GXS Bank | 2.68% p.a. | S$75,000 | 16 years and above, Singaporean Citizens/Permanent Residents/Foreigners with a residential address in Singapore | Nil |

| Trust Bank | Up to 3% p.a. | No maximum deposit, but 3% p.a. applies to the first S$500,000 | 18 years and above, Singaporean Citizens/Permanent Residents | Promotional discounts on FairPrice Group spending, 20 ATMs islandwide |

This table provides an overview of the three banks’ savings account interest rates, maximum deposit limits, eligibility requirements, and key benefits and features.

My Experience with Trust Bank

Let me share an example about my friend. As a self-employed individual, my friend hadn’t contributed to CPF since January 2022, which left his credit score in a sorry state. He tried applying for credit cards from UOB and Standard Chartered, but he was flatly rejected. It seemed that nobody wanted to extend any credit to my friend. That is until Trust Bank entered the picture.

Trust Bank didn’t shy away from offering my friend a credit line of $6,700, which came as a pleasant surprise. We’re not sure if they were being generous to attract new customers or if it was a glitch in their system. Either way, it’s worth mentioning that Trust Bank takes a different approach, one that favours accessibility.

Personally, I frequently use Trust Bank for all my NTUC grocery shopping, as well as to take advantage of coupons and deals from my favourite merchants such as Burger King and Food Panda. The rewards are pretty insane and Trust Bank does exclusive partnerships with merchants to offer exclusive deals on Trust Bank such as one month free trial on Burpple or exclusive Popeyes bundle box.

What’s great is that Trust Bank also offers an excellent referral program, which I’ve enthusiastically shared with my friends, family, and colleagues. When I refer a friend to Trust Bank, they earn a S$10 FairPrice E-Voucher when they sign up, and I earn S$10 for every successful referral. It’s a win-win, and I’m happy to introduce my friends to a bank that provides such benefits and rewards.

Here’s my referral code if you’re keen to sign up: Q4F5R6AJ

Trust Bank’s Impact on the Industry

Trust Bank is shaking up the banking industry, particularly in Singapore. It’s no longer business as usual for big players like DBS, UOB, and OCBC. With a fresh, user-centric approach, Trust Bank has exposed the flaws in traditional banks’ apps. Bloat and slow load times are giving way to agile and streamlined interfaces. It’s not about doing everything on an app; it’s about focusing on what’s most crucial for users: quick money transfers, easy balance checks, and real-time spending updates.

My Verdict

Trust Bank Singapore has carved a unique niche in the digital banking landscape. It offers competitive interest rates, safety, and a hassle-free experience, all while challenging traditional banking giants. If you’re an NTUC union member, Trust Bank might be an attractive choice with a 3% p.a. interest rate, similar to MariBank. Update Jan 2024: With the increase in the interest rate, Trust Bank now shines a lot more as compared to the rest of the other saving accounts.

So, if you’re ready to embrace a new era of digital banking, Trust Bank is worth a try. You might find, like me, that it’s the fresh breath of air you’ve been looking for in the world of personal finance.

Frequently Asked Questions (FAQ)

What is the interest rate for Trust Bank in 2024?

In 2024, Trust Bank Singapore offers a competitive interest rate of up to 3% per annum on your savings. However, please note that this rate applies to the first S$500,000 of savings in your account.

How safe is Trust Bank Singapore?

Trust Bank Singapore is committed to ensuring the security and safety of your financial assets. It is regulated by the Monetary Authority of Singapore (MAS), and your deposits with Trust Bank are eligible for protection under the Singapore Deposit Insurance Scheme (SDIC). This means that your deposits are insured up to S$75,000 per account holder.

Is the Trust Card good for overseas use?

The Trust Card is generally a versatile financial tool that can be used overseas. It is widely accepted at most international merchants and ATMs that display the Visa/Mastercard logo. However, it’s always a good practice to inform your bank about your travel plans to prevent any potential issues with overseas transactions due to security measures. Additionally, consider checking the specific terms and conditions associated with the Trust Card for any foreign transaction fees or currency conversion rates.

Can I withdraw money from Trust Card Singapore?

Yes, you can withdraw money from a Trust Card in Singapore. Trust Bank Singapore provides you with the convenience of accessing your funds through ATMs and over-the-counter transactions, allowing you to withdraw cash as needed from your Trust Card. However, it’s important to be aware of any associated fees or charges that may apply when making ATM withdrawals, especially if you’re using an ATM that is not operated by Trust Bank. These fees can vary depending on your specific account type and the ATM network you use, so it’s a good idea to review your account terms and conditions or contact Trust Bank for more details on withdrawal options and associated costs.

Leave a Reply