Are you in your 20s and wondering how you can save 100K by the time you turn 30? It may seem like a daunting task, but with the right mindset, strategies, and tools, it’s definitely achievable. Saving money not only helps you reach your financial goals but also gives you a sense of security and freedom to pursue your dreams.

Before we get started, you may have already come across many similar articles nagging about the importance of saving a particular amount by a certain age. But imagine hitting 30 with $100,000 in your savings account — a financial milestone that could set the stage for a future of possibilities and opportunities.

In this ultimate guide for beginners, we will provide you with practical tips and tricks on how to save 100K by 30. From setting achievable goals to creating a budget and investing wisely, we’ve got you covered. So, let’s dive in!

Key Takeaways: Achieving Financial Milestones in Your 20s

- Aim for $100k by 30 as more than a milestone—it’s your financial toolkit for life goals.

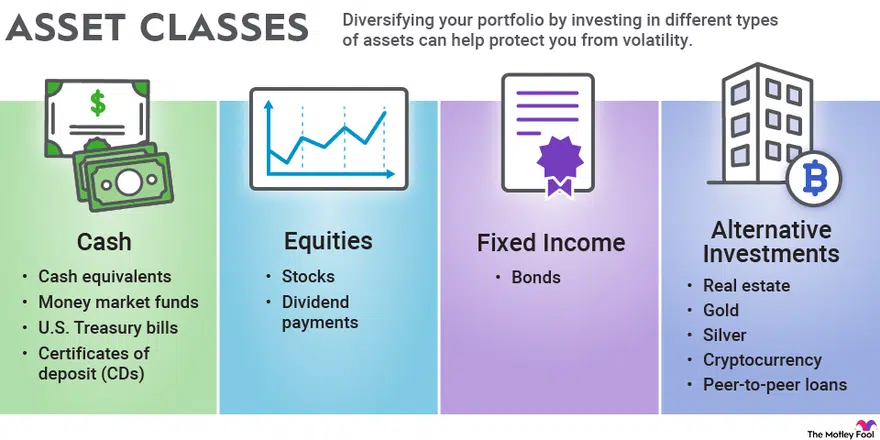

- Include diverse assets like cash, stocks, bonds, and property in your $100k goal.

- Set SMART goals, understand your current financial status, and create a budget for effective planning.

- Track and categorize expenses, cut back where possible, and focus on spending less than you earn.

- Maximize earning power by making smart career choices and negotiating salaries.

- Make your money work harder through high-yield savings accounts and diverse investments.

- Post $100k, set new financial goals, explore investments, and maintain an emergency fund.

- It’s never too late to save for retirement; stay motivated by tracking progress and celebrating wins.

- Use this comprehensive guide to turn financial dreams into reality—start early, stay disciplined, and achieve your goals.

Table of Contents

Why 100k by 30?

As I’m getting closer to 30, the idea of saving up $100,000 isn’t just about hitting a big number. It’s more like having a financial game plan for some pretty grown-up stuff. Picture this: my dream wedding, finding a cozy place in Singapore to call home, maybe a BTO or a resale flat. That $100,000? It’s like the ticket to making these dreams real.

Now, forget about any magic in that $100,000—it’s just a number that makes sense for what’s coming up. It’s not just about covering regular bills; it’s about having a safety net for life’s surprises and being ready for those ‘adulting’ moments.

For me, chasing that $100,000 isn’t just math; it’s about making sure I can say “I do” without stressing about the costs. It’s about putting a chunk down for a place where I can build a life and maybe start a family. And yeah, it’s also about thinking ahead to a time when I’m not stuck in the usual work routine.

So, why $100,000 by 30? It’s not some magical number; it’s more like a savings toolkit for making real-life plans happen. It’s about turning money goals into actual life moments—like having a home to call your own, saying your vows, and having the freedom to shape your future. It’s about facing the next chapter not with a bunch of worries but with the excitement of what’s to come.

What assets should you include in the 100k by 30 goal?

When crafting the $100,000 by 30 goal, it’s crucial to consider a diverse mix of assets that reflect both liquid and long-term investments. Here’s what you should include and exclude:

Include:

- Cash: The foundation of your financial liquidity, including savings in your bank accounts.

- Stocks: Investments in equities, representing ownership in companies and potential for capital appreciation.

- Bonds: Fixed-income securities providing regular interest payments and serving as a stable component of your investment portfolio.

- Cash value of whole-life or endowment plans: The accumulated cash value of insurance plans, contributing to your overall asset portfolio.

- Paid-up capital in a property (e.g., HDB flat): The amount you’ve invested in your property, building equity and contributing to your net worth.

- Non-housing debt: Any outstanding debts excluding mortgage, such as personal loans or credit card balances.

- Resale value of other assets (e.g., a car): The estimated market value of assets like a car that can be sold.

Exclude:

- CPF (OA, SA, MA): While CPF is a valuable component of your overall financial picture, it’s excluded for this specific goal due to its restricted accessibility before retirement age.

- Money spent on renovation: Expenses incurred for home renovations, which are considered part of lifestyle choices and not reflective of liquid assets.

- Money spent on experiences: Expenditures on experiences, as these are typically considered personal consumables rather than assets.

The exclusion of CPF aligns with my goal of early retirement and the issue about CPF is that it is locked up and non-liquid. However, it’s worth noting that over time, reassessing CPF as part of your net worth may become relevant. As you progress, periodically review and adjust your asset allocation to ensure it aligns with evolving financial objectives and market conditions.

How can we reach 100k by 30?

Achieving $100,000 by the age of 30 is within reach, and contrary to popular belief, it doesn’t involve the rollercoaster of meme stocks on WallStreetBets like AMC or Dogecoin with hopes of striking jackpot returns. In reality, the path is simpler than you might imagine—just a matter of strategic planning and disciplined execution. Forget the complex schemes; focus on these straightforward steps to pave your way to financial success.

Setting Realistic Goals

Embarking on the journey to save $100,000 by the age of 30 requires a strategic approach, and the first step is establishing a realistic target. Breaking down your goal into smaller, achievable milestones not only makes the objective more manageable but also provides a roadmap for progress. Specifically, SMART goals.

What are SMART goals? SMART goals are a framework for setting clear and achievable objectives and stands for Specific, Measurable, Achievable, Relevant, and Time-bound. To further explain the importance of setting SMART goals:

Be Specific and avoid ambiguity – having clear and well-defined goals ensure a clear path and keeps you on track.

Next, your goal should be Measurable. Most of us are guilty of this – have you ever told your friends or colleagues ‘I need to save money’ but never really got to it or never saw ‘results’? This is why having a measurable goal is important – How much do you want to save? By when do you want to achieve this?

Set a goal that is realistic and Achievable within your means. This also comes when you have a clearer understanding of your financial status.

Ensure that your goal is Relevant and meaningful, and should part of your overall growth and success.

Your goals should be Time-bound by setting a specific timeframe for completion. This provides a sense of urgency, encourages commitment and facilitates planning.

Putting this altogether, instead of a relatively vague goal of “I want to save 100K by 30” follow the SMART rule to derive at “I want to save 20K per year for the next five years.” This way, you set a timeline and specific amount to achieve.

By setting tangible benchmarks along the way, you create a structured path that transforms a seemingly monumental task into a series of attainable steps. This process ensures a clear focus and allows you to make regular assessments and adjustments, making the overarching goal of reaching $100,000 by 30 more feasible and attainable.

Determine Your Current Financial Status

Many of you may wonder if saving the first $100k includes all your savings, assets, liabilities etc. This is entirely up to you and keeping in mind that we all have different levels of financial literacy and risk tolerance.

Before deciding on a financial goal, it’s essential to assess and understand your current financial status. Calculate your net worth, including your assets and liabilities, and figure out your monthly income and expenses. This will give you a clearer picture of where you stand financially and how much you can save.

Creating a Budget

Creating a budget is the foundation of effective financial planning, providing a structured framework to navigate your income and expenditures allowing you to hit 100k by 30. This helps you track your expenses – revealing spending patterns and identifying areas where you can make adjustments. There are many budgeting strategies out there with different advantages that may suit your financial goals and preferences. Two popular budgeting strategies are the 50/30/20 budgeting and envelope budgeting. Read on for some tips on creating a budget.

Let’s break down the 50/30/20 budgeting strategy and its application to saving $100,000 by the age of 30.

At 25, earning a net income of $4,000, the allocation would look like this:

- 50% for Needs: Dedicate 50% of your income to essential needs. With a $4,000 net income, this would be $2,000. Covering rent or mortgage, utilities, groceries, and transportation ensures your basic living expenses are met.

- 30% for Wants: Allocate 30% of your income, which amounts to $1,200, to discretionary spending. This includes non-essential items like dining out, entertainment, and personal indulgences, providing flexibility for enjoyment without compromising financial stability.

- 20% for Savings and Debt Repayment: Reserve 20% of your income, which equals $800, for savings and debt repayment. This category becomes the financial engine driving you towards your $100,000 goal by the age of 30.

Now, to calculate your annual savings: $800 (monthly savings) x 12 (months) = $9,600 per year.

If you’re starting at 25 and aiming to reach $100,000 by 30, you have five years to accumulate the desired amount. Multiply your annual savings by the number of years:

$9,600 (annual savings) x 5 (years) = $48,000.

This implies that following the 50/30/20 rule with a $4,000 net income could lead to saving $48,000 by the time you turn 30. To bridge the gap to $100,000, you’d need additional strategies, such as exploring investment opportunities to generate returns on your savings.

Remember, this is a simplified illustration, and individual circumstances may vary. Adjustments may be necessary based on changes in income, unexpected expenses, or shifts in financial goals. Regularly reviewing and adapting your budget ensures you stay on track towards achieving your financial milestones.

Track Your Expenses

First step to creating a budget, is to track your expenses for at least a month. Use a budgeting app or spreadsheet to record all your spending, including bills, groceries, transportation, entertainment, and other miscellaneous expenses. Here are the 10 best budgeting apps for 2023 that could help you out.

Categorise Your Expenses

Once you have a record of your expenses, categorise them into fixed and variable expenses. Fixed expenses are those that remain the same each month, such as rent, utilities, and insurance. Variable expenses, on the other hand, fluctuate from month to month, such as dining out, shopping, and entertainment.

Cut Back on Unnecessary Expenses

After categorising your expenses, identify areas where you can cut back. Look out for subscriptions or memberships that you’re not using or are under-utilised. Avoid taking taxis or grab as often and take public transport. It is also useful to review your recurring phone and internet bills – explore other providers that might be offering similar services at a lower cost. Dine out less and cook more at home. Here are some ways you can save money on groceries to reduce your expenses. Every bit counts when it comes to saving money!

Maximizing your earning power

Maximizing your earning power is a critical strategy for achieving the ambitious goal of $100,000 by the age of 30. I learnt this from my own experience and I will illustrate this point using my personal examples. Let’s dive into the journey from a modest salary to a more substantial income, and the key principles that played a pivotal role to drive my goals.

When I embarked on my career in 2021 after graduating from NTU, my initial salary of $3,200 felt like a starting point, but after CPF deductions, my net income was a modest $2,560. Following the 50/30/20 budgeting rule, this translated to saving only around $512 a month—a slow pace toward the $100,000 milestone.

But here’s the interesting part: as I moved up in my job, got promotions, and got paid more, my savings started going up faster. Imagine I’m making $4,000 now after CPF. After taking out the necessary stuff, I’m left with $800 a month for savings—way closer to my $100,000 goal.

Now imagine that I was still drawing the same salary of $3,200 even in 2023, I could only be saving $6,144 annually as opposed to now which is $9,600. The difference is extremely significant and I can’t stress how important it is to maximize your earning power.

Getting a better salary means making smart choices in your job. Like taking on more responsibilities, doing more work (maybe even some extra freelance gigs like my personal finance blog), or picking a job that pays well even if it’s not your dream job. And don’t forget about negotiating your salary and being open to better job opportunities when they come up.

Even though I was making less than the average salary in my early twenties, I am closing in on the $100,000 mark. The lesson here is that making more money is a big deal in reaching your money goals. It’s about making smart choices and being proactive, and it can really make a difference in reaching those big financial goals you set for yourself.

Spend less than you earn

“Spend less than you earn” might sound like common sense, but many folks miss the memo. Simply put, there are two main ways to get more money: spend less or earn more. Some people make good money but end up living paycheck to paycheck because they splash out on fancy stuff like designer bags, cars, and entertainment.

When I was making $3,200, I lived pretty frugally because, let’s be honest, it wasn’t a ton of money. But after a promotion and some pay bumps, my lifestyle started to get a bit fancier. I found myself spending more on things like alcohol and treating friends to meals without really keeping track of where my money was going. It didn’t take long for me to realize I was making a big mistake, so I had to cut back on those vices.

Living a bit more frugally—meaning, not spending all your money—lets you save more and make your money work better for you. If you can, staying with your parents can save you a bunch because renting in a place like Singapore can be crazy expensive.

Here’s the real deal: it’s tough to never spend more than you make, but if your income covers your basics with some leftover, it’s smart to spend less than you earn. Use that extra money wisely—maybe build up an emergency fund for unexpected expenses or invest it to reach your goals faster.

But, it means being smart about how you spend. Sure, you can treat yourself sometimes, but it’s about avoiding those impulse buys, especially the big-ticket ones. Creating a budget helps a lot. Yeah, it might be tricky at first, but the more you do it, the easier it gets.

It’s okay if, sometimes, you end up spending more than you earn. Life happens. Maybe you have a big medical expense, and it’s more than your emergency fund can handle. It’s essential to build an emergency fund to cover unexpected expenses, such as medical bills or car repairs. Aim to save three to six months of living expenses in your emergency fund. But overall, the smart move is to spend less than you earn.

Here’s the bottom line: Making spending less than you earn a habit is a good idea. It gives you extra cash for saving and investing and keeps you from diving into unnecessary debt. If you’re not doing it yet, start as soon as you can. Pay off any debts first so you can focus on saving later. And watch out for lifestyle inflation—just because you make more money doesn’t mean you need to spend more. Stick to your budget, and that extra money can really work for you.

Make your money work harder for you

“Make your money work harder for you” is a game-changer when it comes to achieving financial goals. If you’re looking to reach that $100k milestone, letting your money sit in a regular savings account won’t cut it, especially with the current inflation rates. As of October 2023, the core inflation rate has been eased to 3.4%, which means stashing your hard-earned $100k in your traditional POSB Savings Account mere return could erode its value over time.

Here’s a smart move to kick things off: consider a high-yield savings account. Take, for example, the UOB One Account, providing an attractive 5% p.a. interest on balances up to $100,000. It’s a savvy way to make your money work for you, keeping pace with or even beating inflation. If you’re keen, you should read my UOB One Review which I’ve written previously.

Now, let’s talk about the big guns—investing. Beyond a high-yield savings account, you can allocate the rest of your funds into avenues that offer higher returns, accelerating your journey toward financial milestones. Here are some options:

- Stocks: Investing in individual stocks can be rewarding if chosen wisely. Research and diversification are key to mitigating risks.

- Bonds: Bonds offer a more stable investment, providing regular interest payments over a fixed period.

- Unit Trusts: Unit trusts pool funds from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- ETFs and Index Funds: Exchange-traded funds (ETFs) and index funds track the performance of a specific market index, offering a diversified and cost-effective investment option.

- Property/REITs: Real estate investment trusts (REITs) allow you to invest in real estate without directly owning properties.

While these avenues promise higher returns, it’s crucial to understand that higher returns come with higher risks. Only invest what you can afford to lose, and always ensure sufficient cash flow for your living expenses.

For those who prefer a hands-on approach, diving into stocks or ETFs might be exciting. On the other hand, if you favor a more hands-off strategy, a high-yield savings account and diversified investment funds like ETFs or unit trusts could be the way to go. Balancing risk and return is the name of the game when making your money work harder for you. Remember, it’s not just about accumulating wealth but preserving and growing it over time.

When investing, it’s essential to diversify your portfolio. Don’t put all your money in one basket. Instead, invest in a mix of stocks, bonds, and other assets to spread your risk and maximise your returns.

What’s after 100k by 30?

Even though I’m just 26 and haven’t quite hit my goal of reaching $100k by 30, I’m feeling pretty confident about the journey. Why? Because I’ve planned ahead. The road to financial milestones may have its twists and turns, but having a roadmap in place makes all the difference. So, let’s talk about what comes after that coveted $100k mark.

Once you’ve reached the $100k milestone, it’s time to set new financial goals. Maybe you’re eyeing a down payment for a home, planning to invest in further education, or thinking about starting your own business. Having a clear vision of what comes next is key to maintaining your financial momentum.

Consider exploring new investment opportunities. With a solid foundation of $100k, you can delve into more advanced investment strategies or allocate funds to areas that align with your long-term financial objectives.

Don’t forget about the importance of an emergency fund. Even as you pursue new financial goals, maintaining a safety net for unexpected expenses ensures that you’re prepared for whatever life throws your way.

Remember, reaching $100k is just one milestone on your financial journey. The key is to keep evolving your financial plan, adapting it to new goals and circumstances. Celebrate your achievements, but always keep an eye on the future. The journey doesn’t end; it merely transforms into new and exciting possibilities.

Frequently Asked Questions

How much should I save each month to reach my goal of 100K by 30?

The amount you need to save each month depends on your current financial situation, your income, expenses, and your savings goal. Use a savings calculator to determine how much you need to save each month to reach your goal.

| Timeframe | Monthly Savings Required |

| 5 years | $1,667 |

| 7 years | $1,190 |

| 10 years | $833 |

| 15 years | $556 |

| 20 years | $417 |

These numbers assume that you are starting from $0 and want to save $100,000 by the end of the time frame. Of course, if you already have some money saved, you can adjust the monthly savings amount accordingly.

It’s also important to remember that these figures are based on a few assumptions, such as a consistent savings rate and a reasonable rate of return on your investments. Your actual savings and investment results may vary, so it’s always a good idea to consult a financial advisor to develop a customised plan that meets your specific needs and goals.

Is it too late to start saving for retirement in my 20s?

No, it’s never too late to start saving for retirement. The earlier you start, the more time your money has to grow, but even if you’re in your 20s, you still have plenty of time to save and invest for the future.

How do I stay motivated to save money?

One way to stay motivated to save money is to remind yourself of your financial goals and why you’re saving. Another way is to track your progress and celebrate small wins along the way. Finally, surround yourself with people who support your financial goals and encourage you to save.

Achieve Your Financial Goals: Use This Ultimate Guide to Save 100K by 30

In wrapping up, envision the empowerment that comes with achieving $100,000 by the age of 30. Beyond a mere financial milestone, it serves as your key to unlocking life’s possibilities. This comprehensive guide equips you with practical steps, from setting SMART goals to maximizing your earning potential and making your money work smarter for you.

Embark on this journey armed with the knowledge to diversify assets wisely, create a budget, and foster disciplined spending habits. Witness the transformation of your financial landscape, allowing you to confidently pursue dreams like homeownership, further education, or entrepreneurship.

Remember, this isn’t just about accumulating wealth; it’s about securing a future where you’re in control. As you post $100k, set new goals, explore advanced investments, and maintain a robust emergency fund. Your financial journey doesn’t end—it evolves, offering you continuous opportunities to shape the life you desire.

So, why wait? Start now, and let $100,000 by 30 be the catalyst for a lifetime of financial freedom and fulfillment. Your future self will thank you for the proactive steps you took today. For those who want to achieve their goals quicker, here’s 10 tips on how you can save big by 30. Good luck!

Comments (1)

Empowering Your Finances: Taking Control Of Your Savingssays:

November 24, 2023 at 5:45 am[…] ambitious milestones such as aiming to save 100k by 30 and discover actionable strategies to achieve this final […]