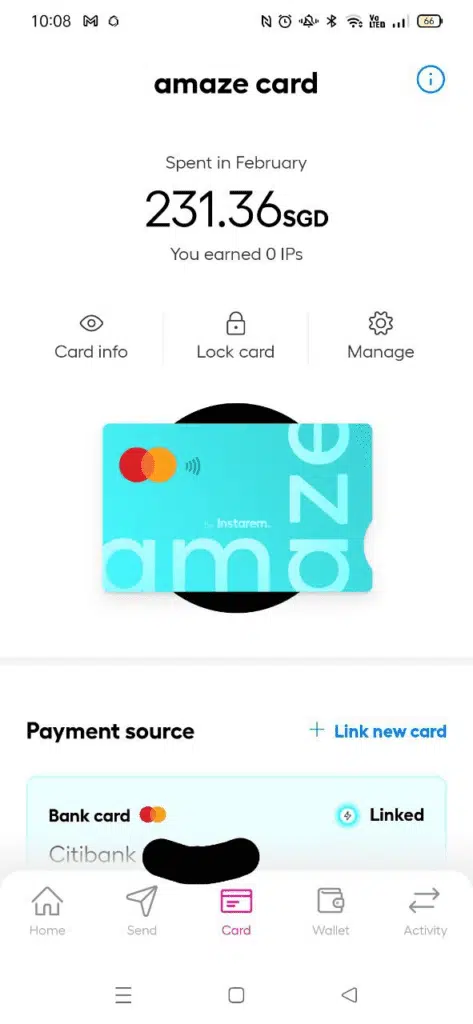

In a world where digital solutions are reshaping our everyday lives, the Instarem Amaze Card emerges as a beacon in the realm of digital banking. Having used this card for over six months, I can confidently say that it’s a fantastic financial tool that has significantly streamlined my transactions, particularly for overseas spending.

Instarem’s Amaze card was initially very popular due to its great features like excellent exchange rates, 1% cashback, and regular credit card rewards. It was so in demand that there were delays in shipping the physical cards.

However, over time, many of these attractive features were reduced or removed, similar to how a lavish party gradually cuts costs as the budget runs low. Despite these changes, the Amaze card is still a preferred choice for many, especially for overseas spending and pairing with cards like Citi Rewards.

This review delves into the intricate details of the Instarem Amaze Card, unraveling its features, benefits, and how it stands out in the bustling market of digital financial solutions. As we embark on this journey, we’ll understand why this card is more than just a financial tool; it’s a gateway to a more efficient and streamlined banking experience.

Table of Contents

What is the Instarem Amaze Card?

The Instarem Amaze Card is a financial product offered by Instarem, a company known for international money transfers and financial services. The Amaze Card is designed as a multi-currency card, much similar to Wise, Revolut, which allows users to make payments and transactions in different currencies. It’s particularly useful for those who travel frequently or engage in cross-border transactions, as it can help minimize currency conversion fees and provide a convenient way to manage foreign currency expenses.

Key Features of the Instarem Amaze Card

- Link Multiple Cards: You can connect up to five Mastercard debit or credit cards to the Amaze Card. This unique feature allows you to accumulate cashback, miles, or rewards from your linked cards. Additionally, you have the flexibility to select your preferred Mastercard as the primary card for billing purposes.

- Offline to Online Transformation: The Amaze Card transforms all qualifying offline expenditures into online transactions, enabling you to earn enhanced rewards on local purchases. For example, when used in conjunction with the Citi Rewards Card, it effectively lets you earn 4 miles per dollar (mpd) on eligible purchases, including local transactions.

- Competitive Exchange Rates: The card offers excellent currency conversion rates, making it a cost-effective option for international spending.

While exploring the benefits of the Instarem Amaze Card, you might be curious about how it pairs with other popular credit cards for maximized rewards. Check out my detailed reviews of the Citi Rewards Card and the UOB One Card to see how you can combine them effectively with your Amaze Card for greater benefits.

How to apply for the Instarem Amaze Card?

Apply for the Instarem Amaze Card is extremely easy. You can simply follow the steps below:

- Eligibility and Account Setup: The Amaze Card is accessible to anyone with an Instarem account. There are no minimum income requirements or annual fees, making it a convenient option for a wide range of users.

- Application Process: You can apply for the Amaze Card directly through the Instarem app, which is available for both Android and iOS devices. The application process is streamlined within the app.

- Immediate Virtual Card Access: Upon approval of your application, you will immediately receive a virtual card. This enables you to start using the card’s features right away, even before the physical card arrives.

- Physical Card Delivery: Initially, the delivery of physical cards could take up to a month. However, the process has been expedited and based on personal experience you should now receive your physical card within about a week.

- Using the Virtual Card for In-Store Purchases: If you need to make pay wave purchases while waiting for your physical card, you can add the virtual card to your mobile wallet. The Amaze Card is compatible with both Apple Pay and Google Pay, allowing for convenient and secure transactions. (Updated 5/8/2024: After checking with other iOS users, I found out that Amaze is finally compatible with Apple Pay. Previously, the integration wasn’t working properly although Instarem has mentioned that they are working on that integration)

Haven’t joined the Amaze community yet? Now is the perfect time! Sign up using my referral code [944Tpc] and receive an instant bonus of 200 Insta points. Simply click here to get started.

How does the Instarem Amaze Card work?

Think of the Amaze Card like a smart wallet with two pockets. One pocket is the Amaze Wallet, and the other is your regular Debit or Credit Card. When you make a payment, you choose which pocket to use, but you can’t use both pockets for the same payment.

Amaze Wallet vs Debit/Credit Card: A Tale of Two Pockets

- Amaze Wallet: This is like a magical pocket where you can store different types of currency notes – like Australian Dollars, Euros, or Japanese Yen. You can ‘lock in’ the exchange rate, kind of like buying currency when it’s cheap and using it later. It’s like a currency exchange shop in your pocket. But, remember, you don’t get rewards for filling up this pocket, and there’s a small fee (1.5%) if you use a Visa card to add money.

- Debit/Credit Card: This is your usual pocket. It’s straightforward but can be a bit expensive when spending in foreign currencies because the exchange rates are not as favorable as the Amaze Wallet. However, the upside is you can earn rewards on your spending, just like collecting points for buying something in a store.

How it works in real life:

Imagine you’re in a toy store in Japan. You have some Japanese Yen (JPY) and Singapore Dollars (SGD) in your Amaze Wallet. If the toy costs 1,500 JPY, and you only have 1,000 JPY, the Amaze Wallet will automatically use your 1,000 JPY and then convert the remaining amount needed (500 JPY) from your SGD, using the best available rate. It’s like having a personal currency exchange assistant in your wallet, always ready to give you the best deal.

Top-Up and Limits:

You can add money to your Amaze Wallet, but the minimum amount is S$20. There’s a cap on how much you can store (S$5,000) and spend (S$30,000 per year) from the wallet. These limits are like having a safety cap on your wallet, making sure you don’t overstuff it.

Cashing Out:

You can’t directly move money from your Amaze Wallet back to your bank. But, there’s a workaround. You can use the Amaze Card to add money to an e-wallet like GrabPay, and then move it to your bank from there. However, since July 2023, Amaze started charging a 2% fee for such transfers, so it’s like paying a small fee for the convenience.

In summary, the Amaze Card is like a hybrid wallet, giving you the flexibility of using different currencies efficiently and the traditional benefits of your regular cards, all in one place. It’s particularly handy for travelers or people who deal with multiple currencies regularly.

Instarem Amaze Card’s Currency Exchange Rates

When you use a credit card for foreign currency transactions, typically there are two costs involved: the first is a hidden charge that comes from the difference between the market rate and the rate the card network (like Visa or Mastercard) applies. The second is a foreign currency (FCY) transaction fee, usually around 3.25%, charged by the bank. The Amaze Card, however, eliminates this second fee.

Think of it like shopping overseas. Normally, when you buy something in another currency with a credit card, you’re not just paying the price tag; there’s an added cost due to currency conversion. Traditional credit cards include an extra bank fee on top of this. Amaze skips this bank fee, but there’s still a cost for currency conversion.

It’s important to note that Amaze’s rates shouldn’t be directly compared to the market or ‘spot’ rate. Instead, compare them to what you’d pay using a Mastercard directly, as that’s the standard you’d face otherwise.

Here’s a way to see if Amaze is cost-effective for you: Compare the Amaze spread (about 1.8%) minus any InstaPoint rebates (up to 0.5%) with the typical bank FCY fee (3.25%). If the result is less than the bank’s fee, Amaze comes out ahead.

For example, if you’re buying something from Sephoria USA, you might earn 4 miles per dollar (mpd) with a Citi Rewards Card, which includes a 3.25% fee. With Amaze plus the Citi Rewards Card, you could still earn 4 mpd, but with a lower overall fee of around 1.3% (considering the 1.8% spread minus the 0.5% rebate). In this scenario, Amaze is the better choice, as long as its spread remains significantly lower than 3%.

In simpler terms, if you were fine with a 3.25% fee for earning miles with a credit card before Amaze, then using Amaze makes sense. It offers the same rewards but at a lower overall cost. Although the FX spread of Amaze is a bit higher than the rates offered by services like YouTrip, Revolut, and Wise, it’s still considerably lower than the typical charges by regular credit cards.

| Card | Foreign Transaction Fee | FX Spread |

|---|---|---|

| Amaze | None | From 1.8% |

| Revolut | None (1% to 2% on weekends) | Real-time exchange rate |

| YouTrip | None | Real-time exchange rate |

| Wise | None | From 0.41% |

| Credit Cards | 2.95% to 3.5% | From 2.8% |

Instarem Amaze Card Fees & Usages

Important Note: Starting from April 1st, 2024, a 1% fee will be charged on all local spending exceeding S$1,000 per month. This includes transactions made in SGD using the Amaze wallet. Additionally, the previous 1% fee on transactions categorized under MCC for insurance, education, and healthcare has been removed. However, these transactions are still subject to the S$1,000 monthly limit for domestic spending and will incur a 1% fee if exceeding that amount.

The Amaze Card is like a magic pass – it lets you shop without worrying about yearly membership fees or administrative charges. However, when you use it for certain local currency transactions, top up your Amaze Wallet with a Visa card, or withdraw cash overseas, it’s like paying a small toll fee. For instance, a 1% fee is charged on some local transactions, and topping up the wallet with a Visa card costs an additional 1.5%. Withdrawing cash overseas will cost you a 2% fee.

The card is like a free ticket to shopping convenience, and you can use it just like any other card. It automatically handles currency conversion for you, making sure you always get a good exchange rate without extra charges. You can check your spending details in the Instarem app, and there’s no need to preload the card before use.

Understanding how to leverage financial tools like the Instarem Amaze Card is part of a broader strategy for smart financial planning. To further enhance your retirement savings, don’t miss my comprehensive Singapore CPF Shielding Guide for Retirement, where we delve into effective methods for maximizing your CPF funds

S$1,000 Monthly Cap and Its Impact on Citi Rewards

For those using the Citi Rewards Card with the Amaze Card, the new S$1,000 monthly cap on local spending introduces some challenges. While S$1,000 is sufficient to max out the spending capacity of a single Citi Rewards card in a month, the cap’s alignment with the calendar month complicates matters.

Here’s a personal example to illustrate this: my Citi Rewards card’s statement cycle begins and ends in the middle of each month. This means I can spend S$1,000 in the first half of the month and another S$1,000 in the second half, effectively splitting my spending across two statement months. For instance, spending S$1,000 in the first half of March 2024 counts towards the March statement, and another S$1,000 in the second half counts towards the April statement. This allows me to maximize my 10X bonus points.

However, with Amaze’s new fee structure, I would incur a 1% fee on any spending above S$1,000 within the same calendar month. This means that even though my Citi Rewards card statement months are different, if I spend S$2,000 in March (S$1,000 in the first half and S$1,000 in the second half), I would be subject to the 1% fee on the second S$1,000 because Amaze considers the calendar month for its cap.

This new fee structure requires careful planning to avoid additional costs while still maximizing rewards. Users need to be mindful of the calendar month when managing their spending with the Amaze Card, especially when aiming to leverage the benefits of their Citi Rewards Card.

Best Credit Card to Pair with Instarem Amaze Card

Pairing the Instarem Amaze card with the right credit card can maximize your rewards and benefits. Among the best options to consider are the Citi Rewards Card, UOB Lady’s Card, and UOB Lady’s Solitaire Card. Here’s why these cards are great choices:

- Citi Rewards Card: Known for its high rewards on online and retail shopping, the Citi Rewards Card offers 4 miles per dollar (mpd) on online and fashion retail spends, up to a monthly cap. When paired with the Amaze card, which codes most transactions as online, you can maximize your rewards on a wide range of spending.

- UOB Lady’s Card: This card is tailored for women, offering rewards on categories like fashion, dining, and beauty. When used with the Amaze card, it provides enhanced rewards in your selected spending category, making it a solid choice for those who focus their spending in specific areas.

- UOB Lady’s Solitaire Card: A premium version of the UOB Lady’s Card, the Solitaire variant offers higher rewards and a broader range of benefits. It’s particularly effective for frequent shoppers and travelers, providing enhanced rewards on overseas spending, which can be maximized when used alongside the Amaze card.

By strategically using these credit cards with the Amaze card, you can enjoy a higher rate of rewards on both local and international spending, making your financial transactions more rewarding. Remember, the effectiveness of this pairing depends on your personal spending habits and the categories in which you spend most frequently.

InstaPoints (IPs)

Amaze introduced its InstaPoints rewards program in July 2022, which allows users to earn points on top of any existing credit card rewards. This program replaced the previous cashback system. Here’s a simplified breakdown of how it works:

Earning InstaPoints

- Amaze Wallet: You don’t earn InstaPoints for local currency (SGD) transactions. For foreign currency (FCY) spending, you earn 1 InstaPoint for every S$1 spent.

- Debit & Credit Card: For FCY transactions, you earn 0.5 InstaPoints per S$1. However, from 1 August 2023, this rate will be applicable for all linked debit and credit card transactions.

There’s a minimum transaction amount of S$10 to earn InstaPoints, and you can earn a maximum of 500 InstaPoints per transaction. This cap means if your spending exceeds S$500 (or S$1,000 for linked cards after 1 August 2023), the value of your rewards decreases for each additional dollar spent. Ideally, to maximize rewards, you would split your spending into S$500 chunks, but this isn’t always practical.

InstaPoints are typically credited very quickly, usually within 3 business days of the transaction.

Redeeming InstaPoints

You can convert your InstaPoints into cash rebates at the following rates:

- 2,000 InstaPoints = S$20

- 10,000 InstaPoints = S$100

- 50,000 InstaPoints = S$500

There’s also an option to use 400 InstaPoints for a S$5 discount on your next Instarem FX transfer, but this is not a direct cashback option. With 1 InstaPoint equating to 1 cent, the Amaze Card offers up to a 1% rebate on FCY spending (up to 0.5% for linked debit & credit cards from 1 August). However, you need a minimum of 2,000 InstaPoints to redeem for cashback, which means any lower amount remains unusable.

Cashback from InstaPoints redemptions is immediately credited to the Amaze Wallet.

Frankly speaking, the InstaPoints from referral and mechanism is not too attractive. Thus far, I haven’t been able to effectively redeem my InstaPoints before they expire although it could be due to my limited overseas spend.

Expiry of InstaPoints

- InstaPoints earned before 1 October 2022 expire six months after they are credited.

- InstaPoints earned from 1 October 2022 onwards expire 12 months after crediting.

Aside from spending, you can also earn InstaPoints through referrals and overseas remittances. However, note that Amaze has a list of merchant categories excluded from earning points, including public transport transactions.

| MCC | Description |

| 4111 | Railroads, Transportation Services |

| 4784 | Tolls and Bridge Fees |

| 4900 | Utilities: Electric, Gas, Water, and Sanitary |

| 5047 | Medical, Dental, Ophthalmic and Hospital Equipment and Supplies |

| 5199 | Nondurable Goods (Not elsewhere classified) |

| 5960 | Direct Marketing: Insurance Services |

| 5993 | Cigar Stores and Stands |

| 6012 | Financial Institutions: Merchandise, Services, and debt Repayment |

| 6211 | Security Brokers/Dealers |

| 6300 | Insurance Sales, Underwritting, and Premiums |

| 6513 | Real Estate Agents and Managers: Rentals |

| 6540 | Non-Financial Institutions – Stored Value Card Purchase/Load |

| 7299 | Other Services (Not elsewhere classified) |

| 7349 | Cleaning, Maintenance and Janitorial Services |

| 7523 | Parking Lots, Parking Meters and Garages |

| 8062 | Hospitals |

| 8211 | Elementary and Secondary Schools |

| 8220 | Colleges, Universities, Professional Schools, and Junior Colleges |

| 8241 | Correspondence Schools |

| 8244 | Business and Secretarial Schools |

| 8249 | Vocational and Trade Schools |

| 8299 | Schools and Educational Services |

| 8398 | Charitable Social Service Organisations |

| 8661 | Religious Organisations |

| 8675 | Automobile Associations |

| 8699 | Membership Organisations |

| 9211 | Court Costs, including Alimony and Child Support |

| 9222 | Fines |

| 9223 | Bail and Bond Payments |

| 9311 | Tax Payments |

| 9399 | Government Services |

| 9402 | Postal Services |

Conclusion

The Amaze card, while it’s seen its share of adjustments over the years, remains a key player in my personal financial strategy. Pairing it with the Citi Rewards Card has been particularly beneficial, enabling me to earn a substantial 4 miles per dollar (mpd) on my transactions, a cornerstone of my approach to maximizing rewards.

One of the standout features of Amaze for me has been its adaptability for overseas usage. The combination of competitive FX rates and the ability to still earn InstaPoints makes it a more appealing option than many traditional credit cards for international spending.

However, it’s important to recognize that Amaze has undergone several changes (“nerfs”) over time. This evolution is a reminder that the benefits we enjoy today might not be permanent. For instance, DBS’s move to exclude Amaze transactions was a significant change, and it’s likely that other banks may follow suit in the future. This could shift the landscape considerably, potentially reducing Amaze to a level playing field with services like Revolut or YouTrip.

In addition to utilizing the Instarem Amaze Card, you might be looking for high-yield savings accounts or innovative digital banking solutions. Learn more about optimizing your savings with our reviews on High Interest Savings with UOB One and get insights into the latest digital banking trends in our Trust Bank Review.

In light of these changes, my consistent advice remains: take advantage of the current benefits while they last. Remember, strategies like these are subject to change based on the financial landscape and the policies of financial institutions. It’s always a good idea to stay informed and adapt your strategies accordingly.

Haven’t joined the Amaze community yet? Now is the perfect time! Sign up using my referral code [944Tpc] and receive an instant bonus of 200 Insta points. Simply click here to get started.

Frequently Asked Questions (FAQs)

Can you use Amaze in Singapore?

Yes, you can use the Amaze card in Singapore. It is designed for both local and international use. You can make transactions in multiple currencies, and it is accepted anywhere Mastercard is accepted. This includes usage for public transport in Singapore through the SimplyGo feature.

What is the limit on the Amaze card?

The spending limits on the Amaze card vary based on how you use it. When using the Amaze wallet, there is an annual spending limit of SGD 30,000.

For transactions linked to a Mastercard debit or credit card, the per-transaction limit is SGD 50,000 or its equivalent in other currencies. This limit is also subject to the limits of the linked card

Can you withdraw money from the Amaze card?

You cannot directly withdraw the balance from the Amaze wallet. However, the Amaze card can be used for payments, including international transactions. For withdrawals from ATMs outside Singapore using the Amaze card, a 2% fee applies.

How long does the Amaze card take to arrive?

After applying for the Amaze card through the Instarem app and getting your account approved, the physical card typically arrives within 7 to 14 working days.

Comments (2)

SYsays:

February 16, 2024 at 3:19 amHi Eugune,

Is the amaze card compatible with Apple Pay? Seems that they have not included this yet.

Eugene Chaisays:

February 18, 2024 at 7:44 amHi SY,

I did note that Instarem is working on an integration with Apple Pay based on Milelion but after double checking on my friend’s iPhone, seems like it is not compatible yet.

Eugene