In today’s fast-paced world, where every dollar counts, cashback credit cards have become a game-changer in the way we manage our finances. One card that stands out among the crowd is the UOB One Credit Card. If you’re someone who enjoys getting rewarded for your spending habits, this card could be your financial ally.

With the potential for a flat 5% rebate, which can be supercharged to an impressive 10% cashback for expenditures at Dairy Farm, Grab, Shopee, and select UOB Travel purchases, this card stands out in the market. Additionally, it offers a solid 6% cashback rate on utility expenses. At this level of spending, cardholders have the potential to earn up to S$300 per quarter, equivalent to S$100 per month, making it one of the most lucrative cashback rates available.

Even if you’re a lower spender or your monthly budget tends to fluctuate, you can still benefit from a respectable 3.33% cashback rate. Ultimately, if you’re seeking a user-friendly card that generously rewards consistent budgets, the UOB One Credit Card is a top choice. If you’re able to maintain a monthly spend of S$2,000 for three consecutive months, the UOB One Credit Card emerges as a frontrunner for the title of the most generous cashback card in the market. However, even without reaching these spend thresholds, the base 3.33% cashback rate is still a competitive offering.

This comprehensive review will take you through the features, benefits, and the cashback potential of the UOB One Card in 2023. But it’s not just about cold facts and figures; I’m here to provide you with a personal perspective. As an avid user of the UOB One Card, I’ll share my own experiences and insights, weaving in prompts for you to reflect on how this card might benefit your unique financial journey.

Table of Contents

UOB One Credit Card Rewards 2023

Get up to S$510* cash credit when you apply now!

- S$350 cash credit:

Valid until 31 Dec 2023, for the first 200 new-to-UOB credit card customers in each month of Nov 2023 and Dec 2023 who successfully apply for an eligible UOB Credit Card and spend a min. of S$1,000 per month for 2 consecutive months from their card approval date. - Up to S$160 cash credit:

Valid till 30 Dec 2023 for New/Existing-to-UOB Deposits customers. Visit uob.com.sg/uobsavers for more details!

UOB One Credit Card Features and Benefits

The UOB One Card offers a world of benefits for its users. First, let’s look at the basic features:

| Annual Fee | S$194.40, Waived for 1 year |

|---|---|

| Income Requirement | S$30,000 for citizens & PRs, S$40,000 for foreigners |

| Key Features | |

| Annual fee | S$192.60 (first year waived) |

| 5% rebate on general spend | Up to S$200/quarter (S$2,000 min spend) with min 5 transactions/month |

| Up to 10% on – Grab – Shopee – Dairy Farm Singapore – Select UOB travel | |

| 1% on utilities bills | |

| 3.33% rebate, up to S$100/quarter 3.33% rebate, up to $50/quarter | (S$1,000 min spend) ($500 min spend) |

| 0.03% rebate on all spend if no rebate earned for calendar year | |

| Up to 21.15% savings at Shell | |

| Up to 22.66% savings at SPC |

Annual Fee: The annual fee for this card is S$194.40, but the good news is it’s waived for the first year. This provides a hassle-free entry into the world of cashback credit cards.

Income Requirement: To be eligible for this card, you need to have a minimum income of S$30,000 if you’re a citizen or permanent resident, and S$40,000 if you’re a foreigner.

Now, let’s get to the exciting part – the features that set the UOB One Card apart.

Understanding UOB One Card’s Cashback Rewards

One of the standout features of the UOB One Card is its exceptional cashback rewards. For most spenders, this card offers a flat rebate of up to 5%, which can be boosted to an impressive 10% for specific categories. These categories include Dairy Farm, Grab, Shopee, and select UOB Travel purchases. (Update: From 2nd Oct onwards, Enjoy up to 15% cashback on UOB One Credit Card across your favourite brands, now including McDonald’s.)

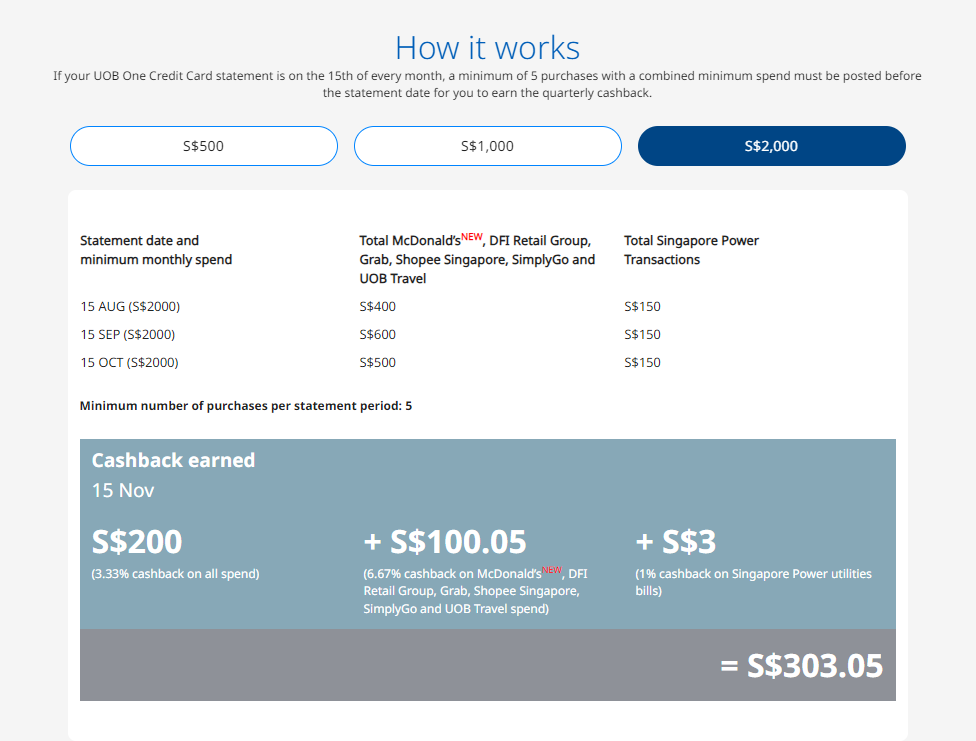

Here’s how it works:

- 5% Rebate on General Spend: You can earn up to S$200 per quarter (with a minimum S$2,000 spend) by making at least 5 transactions per month.

- Up to 10% Cashback: Enjoy up to 10% cashback on Grab, Shopee, McDonald’s, Dairy Farm Singapore, and select UOB Travel transactions.

- 3.33% Cashback: Even lower or inconsistent spenders with budgets as low as S$500 per month can still earn a 3.33% cashback.

During the 10.10 sale, I made a significant purchase using my UOB One Card on Shopee and earned 10% cashback on top of maximizing Shopee vouchers and coins. It was a delightful surprise to see the rewards pile up. Can you recall a purchase where you could have benefited from this cashback rate?

Tailoring Rewards to Different Budgets

The UOB One Card caters to a wide range of budgets.

Maintaining a monthly spend of S$2,000 for three consecutive months unlocks the full potential of the UOB One Card with a 5% cashback rate on everything, making it a frontrunner for the title of the most generous cashback card in the market. But, here’s the beauty – even without hitting these spend thresholds, the base 3.33% cashback rate remains a competitive offering.

I’ve been using the UOB One Card for a while now, and the flexibility to earn cashback on all my expenses, not just specific categories, has been a game-changer for my budget. How do you think this feature might align with your spending habits?

Extra Perks of the UOB One Card

Apart from the generous cashback rewards, the UOB One Card offers additional perks that make it an even more appealing choice.

- High Deposit Interest Rate: By using the card, you can also earn a high deposit interest rate, making your money work harder for you. I had also mentioned previously in my other blog on why I switch over to UOB One Account for its highest interest savings.

- Savings at Fuel Stations: Enjoy up to 21.15% savings at Shell and 22.66% at SPC when you fuel up with your UOB One Card. Perfect for those who drive in Singapore.

The high deposit interest rate is one of the unsung heroes of the UOB One Card. I was pleasantly surprised by the extra money I earned through interest. By pairing it with the UOB One Account, you can potentially earn up to $400 interest monthly.

How UOB One Card’s Cashback Scheme Works

The UOB One Card’s cashback scheme is unique and ideal for individuals with consistent monthly spending habits. Cardholders earn cashback based on their lowest monthly spend within a quarter. To maximize your cashback, you need to spend a minimum of S$2,000 each month and make at least 5 transactions with your card.

Quarterly Rebate Tiers

Low Spend: If your minimum monthly spend is S$500, you can qualify for a S$50 rebate at a rate of 3.33%.

Medium Spend: With a minimum monthly spend of S$1,000, you can get a S$100 rebate at the same 3.33% rate.

High Spend: The real magic happens here. If you can consistently maintain a minimum monthly spend of S$2,000, you’re eligible for a hefty S$300 rebate at a 5% rate.

To qualify for cashback, you must make at least 5 transactions per month for all three months within the quarter.

Achieving a $2,000 monthly spend is fairly simple for me due to my lifestyle. Whenever I go out for dinner with friends, I usually settle the bill first then collect the money back from them. This approach not only ensures we have a smooth dining experience but also helps me consistently meet the $2,000 spend requirement. The result? A game-changing 5% cashback that has significantly improved my financial situation.

Unlocking Quarterly Rebate Tiers

Achieving the different rebate tiers can be a strategic game, and it’s all about understanding your spending patterns. Here are some practical tips to help you maximize your cashback:

- Strategic Planning: Plan your significant expenses during quarters where you know you can hit the high spend tier.

- Use Your Card Smartly: Maximize the benefits by using your UOB One Card for all eligible transactions.

- Track Your Spending: Keep an eye on your monthly spending to ensure you’re on track to meet the requirements.

- Automate Transactions: Set up automated payments for regular expenses to guarantee you meet the 5-transaction minimum.

The Bonus Cashback

While the quarterly rebates are impressive on their own, there’s more to this card’s cashback system. The bonus cashback opportunities can add substantial value to your rewards. You can earn bonus cashback of up to S$100 per month. Here’s how it works:

+5% for Dairy Farm Singapore, Grab, Shopee, and Select UOB Travel Transactions:

For those who frequent Cold Storage or Giant, the UOB One Card is a game-changer. Earn a fantastic 10% cashback on Dairy Farm Singapore merchants, including favorites like Cold Storage, Giant, Guardian, 7-Eleven, Market Place, Jason’s, and Jason’s Deli.

Even if I don’t hit the S$2,000 spend tier, I still enjoy a steady 5% cashback on groceries. With the UOB One Card, every supermarket visit feels like a rewarding experience, making it the ideal companion for my grocery runs. Looking for more ways to make your grocery shopping even more rewarding? Check out my tips on budget grocery shopping.

+1% on Singapore Power Bills:

The UOB One Credit Card rewards you with an additional 1% on your Singapore Power Utilities bills when you qualify for your quarterly cash rebate. This adds up to a total of 4.33% cashback on your total utility bill.

Select Merchant Bonuses

Another fantastic aspect of the UOB One Card is the additional cashback you can earn at select merchants. These include dining, groceries, shopping, travel, and utilities. These bonuses are like a cherry on top, making your shopping and dining experiences even more enjoyable.

On my mother’s birthday, I decided to treat her to a memorable meal at Haidilao. To my delight, when I paid with my UOB One Credit Card, I received a pleasant surprise – a complimentary plate of succulent chicken slices. It added an extra touch of delight to our celebratory dinner. Find out more exclusive promotions on UOB’s Exclusive Rewards.

Is UOB One Card Right for You?

The UOB One Card’s cashback system is designed for individuals with stable budgets. If your monthly spending is consistent and you can meet the minimum spend requirements, this card can be one of the most rewarding cashback cards available in Singapore. However, it may not be the best choice if your monthly spending varies significantly.

Pros of UOB One Card

- High cashback rates for consistent spenders.

- Cashback on various spending categories.

- Additional bonuses for select merchants.

- High deposit interest rate.

- Significant savings at fuel stations.

Cons of UOB One Card

- Quarterly cashback may not suit everyone.

- Minimum monthly spend requirements.

- Cashback on the lowest monthly spend within a quarter.

- Confusing mechanism based on tiers

While the UOB One Card offers substantial advantages, it’s important to consider whether these pros outweigh the cons based on your unique financial situation. As a cardholder, I’ve had my fair share of pros and cons. What’s your take on these aspects?

How to Maximize UOB One Card Benefits

Now that you’re well-versed in the features and benefits of the UOB One Card, let’s explore some strategies to maximize these benefits.

- Choose a Monthly Spend Level That Aligns with Your Budget: It’s important to set a monthly spend level that aligns with your budget and allows you to consistently meet the requirements for higher cashback tiers.

- Use the Card for Transactions at Select Merchants for Bonus Cashback: Take advantage of the bonus cashback opportunities by strategically using your card for transactions at eligible merchants.

- Make at Least 5 Transactions Per Month to Qualify for Cashback: This is a crucial step in ensuring you qualify for cashback every quarter. Set up automated payments if needed.

- Pair Your UOB One Card with a UOB One Account to Maximize Your Savings: Consider opening a UOB One Account, which can complement your card by offering additional interest rate benefits.

- Use the UOB One Cashback Calculator: Now, if you’re wondering how you can calculate your potential cashback with the UOB One Card, that’s where the UOB Cashback Calculator comes in handy. This nifty tool allows you to estimate your cashback earnings based on your spending patterns. Experimenting with the Cashback Calculator can provide valuable insights into how you can optimize your spending to maximize your cashback.

These strategies have been invaluable for me as a cardholder. They’ve helped me get the most out of the UOB One Card. Can you see how these strategies could fit into your financial planning?

Why I chose the UOB One Credit Card

The UOB One Credit Card is undoubtedly one of the top cashback credit cards in Singapore for those with consistent spending habits. Its unique cashback scheme rewards you based on your lowest monthly spend within a quarter, making it perfect for individuals who maintain stable budgets.

With the potential to earn up to 10% cashback on specific categories and the opportunity to enjoy additional bonuses, the UOB One Card offers substantial rewards. However, it’s essential to evaluate whether it suits your spending habits and budget.

Whether you’re a seasoned cashback enthusiast or someone new to the world of rewards cards, the UOB One Card is worth considering for its potential to boost your savings.

As a user of the UOB One Card, my journey with this card has been a rewarding one. I hope this blog has provided you with valuable insights into how you can make the most of this powerful financial tool. What are your final thoughts? Are you considering adding the UOB One Card to your wallet?

Before you sign up for your UOB One Card, always keep a lookout for attractive credit card promotions on the UOB website or other financial platforms. These promotions can include limited-time offers, sign-up bonuses, and exclusive deals that can further enhance your experience with the card. By staying informed about the latest promotions, you can ensure that you’re making the most of your UOB One Card and maximizing your financial benefits. So, keep an eye out for these opportunities, and you’ll be well on your way to unlocking the full power of the UOB One Credit Card in 2023.

Frequently Asked Questions (FAQs)

What is the annual fee for the UOB One Card in Singapore?

The annual fee for the UOB One Card in Singapore is S$192.60. However, the first-year annual fee is typically waived for new cardholders.

To qualify for the annual fee waiver for the UOB One Card, you typically need to make a minimum number of transactions with the card each year. Be sure to check the latest terms and conditions on the UOB website for specific details.

What is the income requirement for a UOB One Card?

The income requirement for a UOB credit card may vary depending on the specific card you’re interested in. As a general guideline for UOB, Singapore citizens and Permanent Residents (PRs), the income requirement is typically S$30,000 annually. For foreigners, the requirement is usually S$40,000 annually. Be sure to check the UOB website for the most up-to-date income requirements for the card you wish to apply for.

What is the maximum cashback I can earn with the UOB One Card in a year?

The maximum cashback you can earn with the UOB One Card depends on your spending patterns. With a cashback cap of S$200 per quarter for general spending and S$100 per quarter for specific categories, you can potentially earn up to S$800 in cashback annually. Additionally, there is no cap on bonus cashback.

How can I apply for the UOB One Credit Card?

To apply for the UOB One Credit Card, you can visit the UOB website or head to a UOB branch to complete the application process. The online application is quick and convenient.

Comments (7)

High Interest Savings: Why I switched to UOB One - Personal Financesays:

October 21, 2023 at 3:13 am[…] […]

Citi Rewards Card Review 2023: Awesome with Amazesays:

October 29, 2023 at 9:35 am[…] I transition to using my primary cashback credit card for the remainder of the month which is the UOB One Credit Card. This diversified approach ensures that I can continue benefiting from cashback rewards on other […]

10 Easy Ways to Save Money on Grocery Shopping This Monthsays:

November 12, 2023 at 8:02 am[…] Explore the world of cashback credit cards, such as the UOB One card, designed to reward your spending habits. With benefits tailored for grocery shoppers, these cards offer a percentage of your spending back in cashback. For instance, the UOB One card provides up to 10% cashback when you shop at Dairy Farm Singapore merchants, which include popular grocery stores. If you want to delve deeper into the benefits and features of the UOB One card, do check out my UOB One Card Review 2023. […]

HSBC Revolution Credit Card Review 2024says:

January 2, 2024 at 5:37 am[…] is remarkably straightforward, involving regular expenses like transportation and food. Unlike the UOB One Credit Card, which I’ve reviewed, there are no intricate hoops to […]

How To Beat Inflation And The GST Hike In Singapore 2024says:

January 7, 2024 at 4:46 am[…] For example, the UOB One Account requires you to have a minimum credit card spend of $500 on their UOB One Credit Card and crediting your salary. Before diving in, it’s wise to carefully review the terms and […]

Instarem Amaze Card Review 2024: Is It Living To The Hype?says:

February 12, 2024 at 3:05 am[…] credit cards for maximized rewards. Check out my detailed reviews of the Citi Rewards Card and the UOB One Card to see how you can combine them effectively with your Amaze Card for greater […]

Citi PremierMiles Card vs. UOB One Card (2025) - RateXsays:

March 20, 2025 at 5:59 am[…] UOB One Card Review – Eugene Chai […]