Important Update (As of February 1, 2024): Saxo Markets has introduced a new account tier system and pricing strategy that applies to all clients. This change is significant for both new and existing clients, and here’s what you need to know:

- For New Clients (Post February 1, 2024): If you opened your Saxo account on or after February 1, 2024, the new account tiers and pricing will apply to you immediately.

- For Existing Clients (Pre-February 1, 2024): If your account was opened before February 1, 2024, the new system will come into effect starting March 4, 2024. It’s crucial to note that the existing Account Plans will be discontinued after this date.

Despite these changes, the mechanism for earning points remains the same. You can refer to the full point catalogue on Saxo’s website for more details.

In the dynamic realm of online investments, finding a platform that aligns seamlessly with your financial goals is important. As we embark on this comprehensive review of Saxo Markets and its flagship platform, SaxoTraderGO, it’s not just a dissection of features; it’s a personal journey.

Having been a user of Saxo for approximately three years, I’ve witnessed the platform’s evolution in response to the changing landscape of low-cost brokers (such as Webull, Moo Moo, Tiger Brokers) entering the scene. It’s not merely an exploration from an outsider’s perspective; it’s a firsthand account of navigating the platform, embracing its strengths, and noting the improvements made along the way.

Before we dive into the intricacies of Saxo Markets, it’s crucial to acknowledge the ever-evolving nature of the investment landscape. The emergence of low-cost brokers has reshaped investor expectations, ushering in an era where zero-commission trades are not just a buzzword but a tangible reality. To delve deeper into the implications of this shift, you can explore my insights on the truth behind zero-commission trades.

Now, let’s navigate the landscape of Saxo Markets and SaxoTraderGO, exploring their features, fees, pros, and cons, drawing from both a broader industry perspective and the nuanced lens of personal experience. Join me on this journey of uncovering the intricacies of Saxo, a platform that has become an integral part of my investment journey.

Update as of 20/6/2024: I’ve transferred my portfolio from Saxo to Interactive Brokers as the commission was too expensive for me to upkeep my options trading strategy. Every trade cost me around $2 USD and if I am rolling my positions, that commission fee would double. For small cap stocks that I am trading on, the commissions and the premium received just doesn’t make sense for me.

Key Takeaways from the Saxo Markets Review

- Comprehensive Product Offering: Saxo Markets stands out for its extensive product offerings, encompassing stocks, ETFs, bonds, mutual funds, futures, CFDs, forex, and commodities. With access to over 23,500 stocks and 7,000 ETFs across global markets, Saxo caters to a diverse range of investment preferences.

- Flexible Account Plans: The tiered pricing plans, ranging from Bronze to Diamond, provide users with options based on their trading frequency and preferences. The ability to switch plans at any time adds a layer of flexibility, allowing users to align their choice with evolving needs.

- User-Friendly Interface and Platform Navigation: Saxo’s platform, particularly SaxoTraderGO, boasts a clean design and an intuitive dashboard. Navigating through various features is a seamless experience, contributing to a positive user experience across devices.

- Monthly Fee Structure and Commission Rebates: While the monthly fee structure may differ from conventional models, Saxo’s approach involves strategic offsetting through commission rebates. This structure can be advantageous for regular users, presenting a unique and potentially cost-effective investment model.

Table of Contents

What is Saxo?

Saxo Markets boasts a heritage of over 30 years, with its APAC headquarters established in Singapore since 2006. The platform offers a comprehensive suite of services, catering to a diverse range of investors.

Saxo is a wholly owned subsidiary of the Danish investment bank Saxo Bank A/S and their trading platform is used by investors worldwide.

According to Saxo’s website, they boast 260,000+ daily trades, service over 1,000,000+ clients, hold up to 100+ billion in client assets, and oversee over 17+ billion in USD daily trade volume.

They are also licensed with and regulated by the Monetary Authority of Singapore [Co. Reg. No: 200601141M], holding both a capital markets services licence and their status as an exempt financial adviser.

Saxo’s Service Portfolio

Saxo provides three distinct investment platforms: SaxoInvestor, SaxoTraderGO, and SaxoTraderPro.

- SaxoInvestor has an easier interface designed for your average user who wants access to stocks and ETFs.

- SaxoTraderGo, is designed for active traders who prefer to use a wide range of features for deeper stock analysis for their trading decisions.

- SaxoTraderPro comes with even more professional-grade features and greater access to more asset classes available to Gold, Platinum, and Diamond users.

All 3 products are available within a single Saxo account. These cater to different investor preferences, from casual users seeking easy access to stocks and ETFs to active traders who demand advanced features for in-depth stock analysis.

Saxo’s Commission and Trading Fees

One of the critical aspects investors consider when choosing a platform is the cost involved. Saxo Markets implements tiered commission fees, varying based on account types and the specific exchange. Let’s break down the commission fees for stocks and ETFs across different account tiers:

| Bronze | Silver | Gold | Diamond | Platinum | ||

| Singapore Exchange | 0.08% (min SGD 5) | 0.06% (min SGD 3) | 0.05% (min SGD 2) | 0.04% (min SGD 1.50) | 0.03% (min SGD 1) | |

| NYSE & NASDAQ | 0.06% (min USD 2.00) | 0.04% (min USD 1.50) | 0.03% (min USD 1.00) | 0.025% (min USD 0.50) | 0.02% (min USD 0.25) | |

| Hong Kong Exchange | 0.15% (min HKD 90) | 0.12% (min HKD 80) | 0.10% (min HKD 60) | |||

| Shanghai & Shenzhen Stock Exchange | 0.15% (min CNH 40) | 0.10% (min CNH 30) | 0.08% (min CNH 20) | |||

| London Stock Exchange | 0.10% (min GBP 8) | 0.07 (min GBP 7) | 0.05 (min GBP 5) | |||

It’s essential for investors to refer to Saxo’s pricing structure for a complete list of commission fees, considering their trading preferences and frequency.

Saxo’s Wide Product Selection

Saxo Markets offers a diverse range of products, including stocks, ETFs, bonds, mutual funds, futures, CFDs, forex, commodities, and more. Investors have the opportunity to explore a vast selection, with access to over 23,500 stocks and 7,000 ETFs spanning across Singapore, the US, Hong Kong, and an additional 50 global markets. This means you can access popular ETFs like CSPX and VWRA, providing an additional layer of flexibility compared to some other brokers.

For forex enthusiasts, Saxo Markets provides access to a whopping 185 forex pairs, covering majors, minors, and exotics. The platform offers competitive rates, starting from as low as 0.5 pips, with no commissions charged. Active traders can enjoy even lower spreads, adding to the appeal for forex trading.

If commodities are your game, Saxo Markets has you covered. Beyond the traditional route of buying stocks and ETFs linked to the commodities market, you can take it a step further. The platform allows you to engage in both long and short positions with commodity CFDs, spanning energy, agriculture, metals, and emissions. It’s a comprehensive suite for those looking to diversify their investment portfolio and delve into the exciting world of commodities trading.

In my personal investment journey, I’ve found Saxo Markets to be a versatile platform, catering to a wide range of financial instruments. While my focus revolves around ETFs, individual stocks, and options, Saxo Markets offers a comprehensive suite that extends beyond my specific preferences.

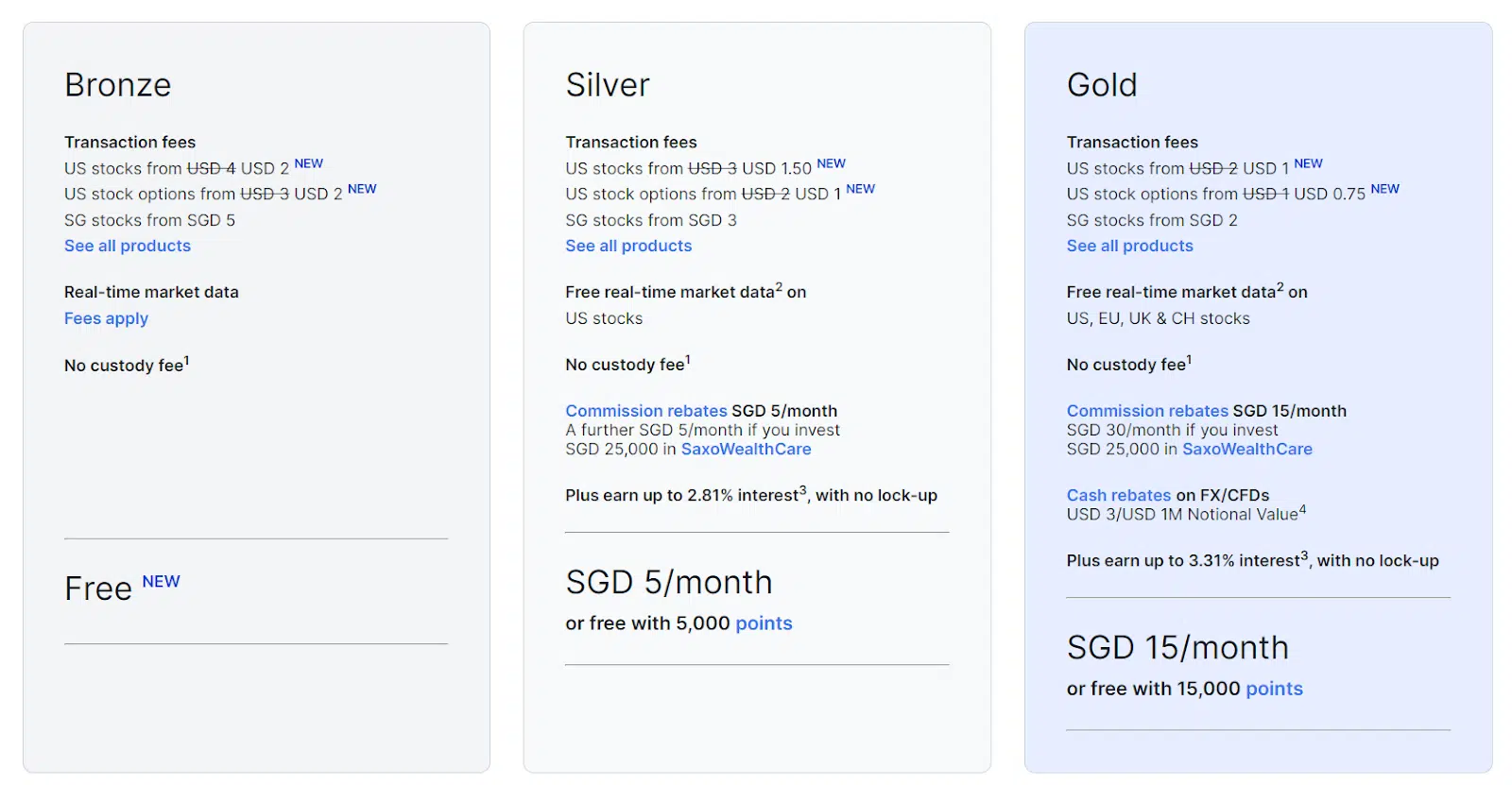

Saxo’s Account Plans

Saxo provides a range of tiered pricing plans to accommodate diverse user needs. The Silver, Gold, and Platinum accounts come with competitive rates, providing access to live prices, and do not impose any custody fees. These plans are well-suited for users who engage in various levels of trading activity.

On the other hand, Diamond accounts are tailored for active traders, while Bronze accounts are more suitable for those who trade less frequently. The flexibility of Saxo’s plans is a standout feature, allowing users to switch between them at any time based on their evolving preferences and trading patterns.

Let’s break down the transaction fees and additional perks across these plans:

| Bronze | Silver | Gold | Platinum | Diamond |

| Transaction fees:US stocks from USD 2US stock options from USD 2SG stocks from SGD 5 | Transaction fees:US stocks from USD 1.50US stock options from USD 1SG stocks from SGD 3 | Transaction fees:US stocks from USD 1US stock options from USD 0.75SG stocks from SGD 2 | Transaction fees:US stocks from USD 0.50US stock options from USD 0.50SG stocks from SGD 1.50 | Transaction fees:US stocks from USD 0.25US stock options from USD 0.25SG stocks from SGD 1 |

| Fees apply for real-time market data | Free real-time market data on US stocks only | Free real-time market data on US, EU, UK, CH, SG & HK stocks | ||

| Annual custody fee of 0.06% | No custody fee | |||

| NIL | Commission rebates:SGD 5/monthA further SGD 5/month if you investSGD 25,000 in SaxoWealthCare | Commission rebates:SGD 15/monthSGD 30/month if you investSGD 25,000 in SaxoWealthCare | Commission rebates:SGD 45/monthSGD 100/month if you investSGD 100,000+ in SaxoWealthCare | Commission rebates:SGD 145/monthSGD 365/month if you investSGD 300,000+ in SaxoWealthCare |

| NIL | NIL | Cash rebates on FX/CFDs:USD 3/USD 1M Notional Value | Cash rebates on FX/CFDs:USD 5/USD 1M Notional Value | Cash rebates on FX/CFDs:USD 10/USD 1M Notional Value |

| NIL | Plus earn up to 2.81% interest, with no lock-up | Plus earn up to 3.31% interest, with no lock-up | Plus earn up to 3.81% interest, with no lock-up | Plus earn up to 4.56% interest, with no lock-up |

| Price: SGD 1/month | Price: SGD 5/month | Price: SGD 15/month | Price: SGD 45/month | Price: SGD 145/month |

| Source: Saxo Markets as of 1 October 2023 | ||||

Apart from transaction fees, Saxo offers various benefits, such as commission rebates and cash rebates on FX/CFDs, depending on the chosen plan. Notably, the Diamond plan provides enticing opportunities, including substantial commission rebates and cash rebates on FX/CFDs.

It’s important to note that there are no custody fees for any of the plans, and Saxo even offers free real-time market data on selected stocks. Additionally, users can earn attractive interest rates with no lock-up period, further enhancing the overall value proposition of each plan.

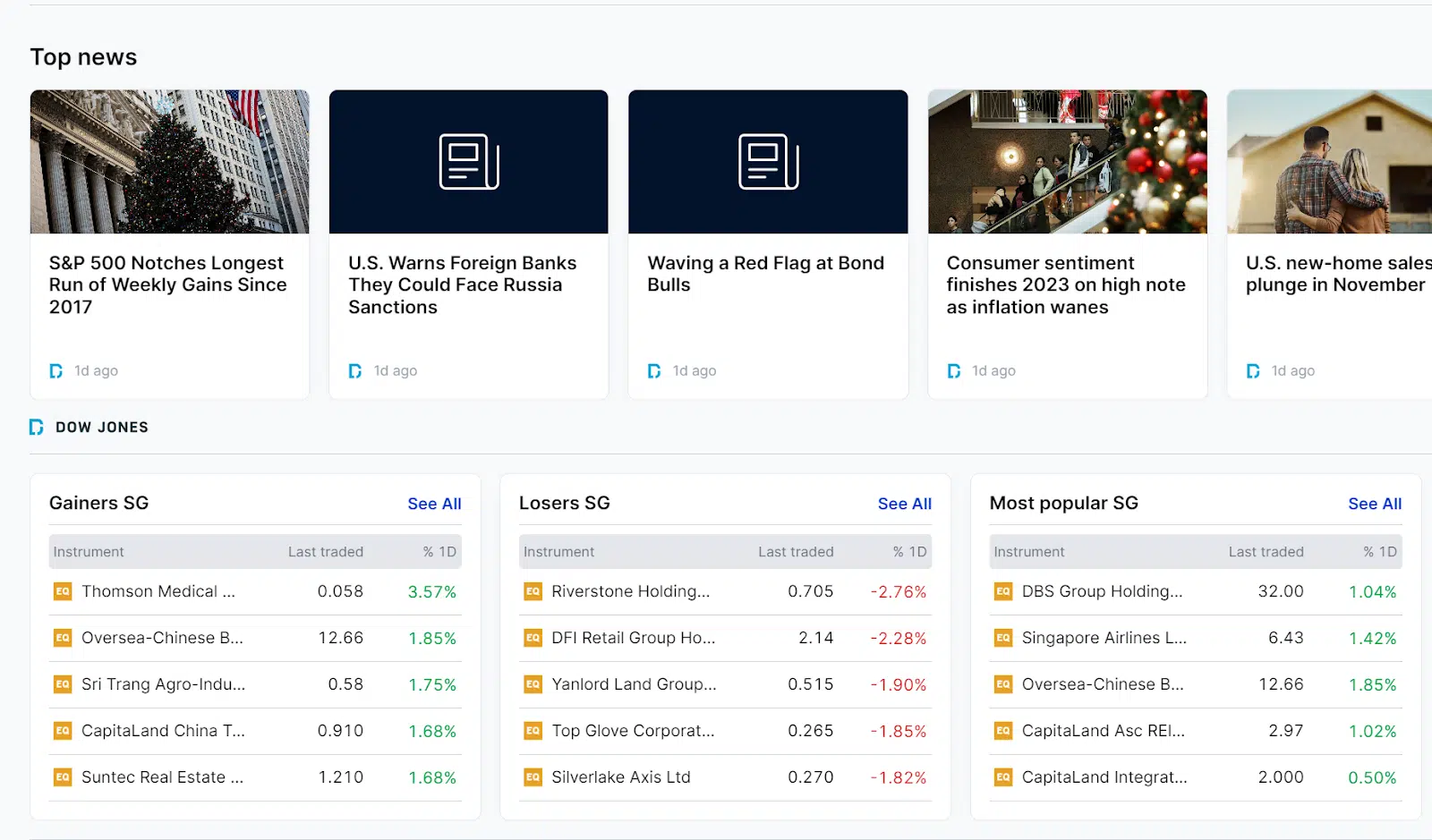

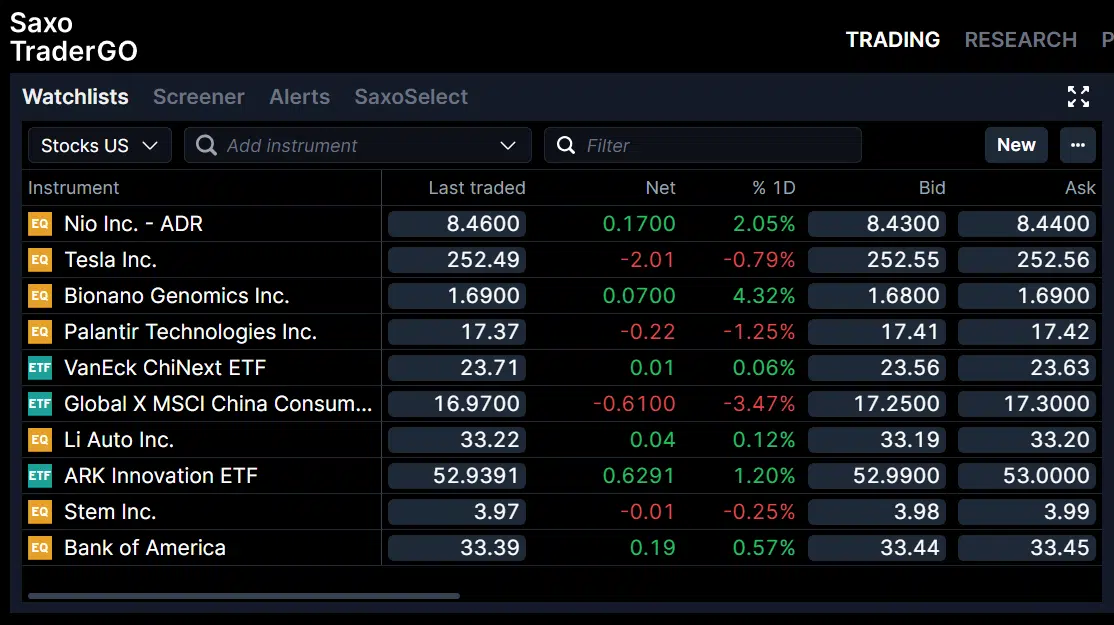

Saxo’s User-Friendly Interface

Navigating Saxo’s platform is a breeze, thanks to its clean design and intuitive dashboard. Whether accessing the platform from a desktop, phone, or laptop, users can seamlessly move through tabs, from portfolio overview to market insights and curated stock watchlists.

Honestly speaking, after trying out multiple online brokerages, Saxo undeniably stands out as the winner in terms of its platform interface and user experience. The platform not only looks awesome but also avoids intimidating users with overly complex designs. Trust me, some brokerages have platforms that can be downright horrible in terms of user experience, making the investment journey more of a headache than a smooth ride. I’ve tried many over the years and although Saxo is not the most affordable platform out there, its user experience is certainly one of the best feature, making it a standout choice among the competition.

Saxo’s Monthly Fee

Saxo’s monthly fee structure may differ from the traditional commission-only model. While some investors accustomed to commission-only fees might find it unusual, the monthly fee can be considered an investment in regular usage, offset by commission rebates for active traders.

Being personally on the Gold plan, I’ve found it to be a sweet spot that aligns perfectly with my investment style. The Gold plan, part of Saxo’s tiered pricing structure, suits me well given my preference for trading ETFs, individual stocks, and options. With a fairly high trading volume, the Gold plan not only provides competitive transaction fees but also opens up a world of benefits that make it my go-to choice. For those interested in understanding more about investment strategies, you might find my guides on making $200 weekly with options and investing for beginners insightful.

Now, let’s talk about something that might raise an eyebrow for some investors. The monthly fee structure at Saxo might seem a tad different for those accustomed to paying solely for trading commissions. However, here’s the kicker – if you’re a regular on the Saxo platform, that monthly fee comes back to you in the form of commission rebates.

For traders who frequently engage with Saxo, these rebates essentially offset the monthly fee, making it a strategic move for those making consistent investments.

So, while the fee structure might be a shift from the conventional, it’s a win-win for those who see the bigger picture and engage with Saxo on a regular basis.

SaxoTraderGO: On-the-Go Trading for the Modern Investor

For the contemporary investor, flexibility is key. SaxoTraderGO emerges as a go-to platform for those who prefer to actively manage their investments, even while on the move. Whether you’re commuting, waiting for a meeting, or just relaxing at home, SaxoTraderGO provides a seamless experience for monitoring and managing your investment portfolio with its user-friendly mobile interface.

In-Depth Review of SaxoTraderGO: Unraveling the Features

Platform Overview

SaxoTraderGO stands as Saxo’s flagship platform, designed for active traders who prioritize mobility. The platform is accessible with a single Saxo account, offering three variations: SaxoInvestor for the average user, SaxoTraderGo for active traders, and SaxoTraderPro for experienced users with professional-grade features.

Account Tiers and Benefits

Similar to the account plans mentioned above, SaxoTraderGO’s tiered account plans come with added benefits in exchange for higher monthly fees. Benefits include lower commission rates, free live prices, and commission rebates for more active traders. Users can choose from Bronze to Diamond accounts based on their trading frequency and preferences.

User Experience

The platform’s sleek interface provides a visually appealing and intuitive experience. SaxoTraderGO allows users to seamlessly navigate through various features, from real-time market data to advanced stock analysis tools. The platform is accessible on desktop, phone, or laptop, offering a one-touch solution for investors.

Pros & Cons of Saxo Markets

Navigating the realm of online investments requires careful consideration of the pros and cons of different platforms. There are some features which users may like/dislike about the platform. Here, we dissect the strengths and potential drawbacks of Saxo Markets, drawing from both industry perspectives and my personal experience.

| Pros | Cons |

|---|---|

| 1. Wide Product Selection: Saxo offers a diverse range of financial instruments, including stocks, ETFs, bonds, mutual funds, and more. | 1. Monthly Fee Structure: The monthly fee might seem different for those accustomed to commission-only models. |

| 2. Global Market Access: Access to over 23,500 stocks and 7,000 ETFs across global markets. | 2. Platform Learning Curve: While user-friendly, the platform may have a learning curve for beginners. |

| 3. Competitive Forex Rates: Access to 185 forex pairs with competitive rates starting from 0.5 pips. | 3. Additional Fees for Real-Time Data: Fees apply for real-time market data on certain accounts. |

| 4. Comprehensive Commodity Trading: Engage in both long and short positions with commodity CFDs. | 4. Not the Most Affordable: While feature-rich, Saxo may not be the most affordable option for all investors when compared to other online brokerages |

| 5. Flexible Account Plans: Tiered pricing plans cater to different user needs, providing flexibility. | |

| 6. User-Friendly Interface: Intuitive platform design for seamless navigation. | |

| 7. Commission Rebates: Opportunities for commission rebates, offsetting monthly fees for active traders. |

Conclusion: Eugene’s Verdict

In conclusion, despite my initial reservations due to the higher costs I encountered during my earlier experiences with Saxo, the platform has undergone significant improvements, notably in terms of pricing. Saxo Markets now stands as a robust and competitive option in the ever-evolving landscape of online investment platforms.

Personally, I am inclined to continue using Saxo for my investment needs. The extensive product selection, ranging from stocks and ETFs to forex and commodities, aligns seamlessly with my diverse investment portfolio. The platform’s commitment to user-friendly interfaces, coupled with a clean design, enhances the overall investing experience.

While my journey with Saxo has seen its fair share of ups and downs, the positive trajectory of improvements speaks volumes about the platform’s dedication to refining its services. The reduction in pricing, in particular, has been a welcome change, making Saxo more accessible to a broader range of investors.

As a satisfied user, I’ve even taken the step of recommending Saxo to friends, considering its comprehensive suite of features and the ongoing enhancements. If you’re interested, I can extend a referral offer where you stand a chance to earn 100 SGD upon a successful sign-up. Feel free to reach out if you’d like to explore this opportunity.

In essence, Saxo Markets has emerged as a reliable and feature-rich platform, and I look forward to continuing my investment journey with them.

Disclaimer: Referral terms and conditions may apply. Please contact Saxo Markets for specific details regarding the referral program.

Frequently Asked Questions (FAQs)

Is Saxo Bank trustworthy?

Yes, Saxo Bank is considered a trustworthy platform. As a well-established Danish investment bank, Saxo Bank has been in operation for over 30 years. Saxo Markets, its subsidiary, is licensed and regulated by the Monetary Authority of Singapore, providing an additional layer of credibility.

Is Saxo a good investment platform?

Saxo Markets is widely regarded as a good investment platform, offering a comprehensive suite of services. With a diverse range of products, user-friendly interfaces like SaxoTraderGO, and competitive pricing, Saxo caters to various investor preferences, from long-term investing to active trading.

Is it safe to trade on Saxo?

Yes, trading on Saxo is considered safe. Saxo Markets is licensed and regulated by the Monetary Authority of Singapore, ensuring compliance with financial regulations. Additionally, Saxo employs industry-standard security measures to protect user data and transactions.

Are Saxo fees high?

Saxo’s fee structure is tiered, offering different plans to accommodate various user needs. While the fees may vary based on the chosen plan and trading frequency, Saxo provides competitive rates. It’s important for investors to review the fee structure based on their trading preferences to determine the most suitable plan.

Comments (1)

Amossays:

January 12, 2024 at 1:46 pmGreat post. Just a quick question on which broker is better – Saxo or IBKR?