$200 a week. Yes, you heard me right. That’s my profit from trading stock options every week. The amount may seem small but considering my monthly expenses of around $1000, the profits from trading stock options could almost negate my expenses for the entire month.

Trading options was something I considered for finance gurus with insane levels of intelligence and that was unfortunately not me. I decided to give a shot at options trading regardless.

After years of trading stock options, I manage to make at least $200 every week consistently. As someone who has been trading options for several years now, I can tell you that it is possible to make consistent profits without risking too much capital. In this article, I will explain what options trading is, why it can be a good investment strategy, how to get started, strategies for success, and more.

Table of Contents

Options Trading

Options trading is a type of investment strategy that allows you to buy and sell contracts that give you the right (but not the obligation) to buy or sell a stock at a certain price by a certain date. When you buy an options contract, you are essentially betting on whether the price of the underlying stock will go up or down. If you think the stock will go up, you can buy a call option. If you think the stock will go down, you can buy a put option.

I started trading options as a way to make extra money on the side. At first, I was hesitant because I thought it was too complicated and risky. But after doing some research and practising with a demo account, I realised that it was actually quite simple and profitable. In fact, one of the main drivers that got me started on options trading was asking myself how I could make additional income on the stocks that I have already invested in. In this article, I will share with you what I’ve learned and how you can get started with options trading.

Note: Options trading can be a complex strategy, and having a solid understanding of technical analysis is crucial for success. If you’re new to options trading, I highly recommend checking out Heicoders Academy’s trading course in Singapore. This course equips you with the skills to perform precise market analysis, making it ideal for those entering or advancing in stock trading.

What are Options?

Options are contracts that give you the right (but not the obligation) to buy or sell a stock at a certain price by a certain date. The price at which you can buy or sell the stock is called the strike price. The date by which you must exercise your right to buy or sell the stock is called the expiration date. Option contracts comes in a lot of 100 shares, thus it can be quite pricey depending on the trading price of the stock.

Simply put, a stock option contract gives the holder the right to buy or sell a set number of shares for a pre-determined price over a defined time frame.

Investopedia.com

There are two types of options: calls and puts. A call option gives the holder the right to buy an underlying asset at a specified price, while a put option gives the holder the right to sell an underlying asset at a specified price.

Options can be a bit difficult to understand at first, so let’s use some creative analogies and examples to help explain them.

Analogy: The Farmer’s Option

Imagine you’re a farmer who has just planted a crop of corn. You’re worried that the price of corn might go down before you’re able to harvest your crop and sell it. So, you buy a put option on corn at a specified price. This option gives you the right, but not the obligation, to sell your corn at the agreed-upon price if the price of corn falls. If the price of corn goes up, you can simply sell your crop at a higher price. But if the price of corn falls, you can exercise your option and sell your crop at the higher, agreed-upon price, protecting yourself against potential losses.

Here’s another example of call options on Apple.

Let’s say you think that Apple is going to have a great quarter and that its stock price is going to go up. You could buy shares of Apple outright, but that would require a significant investment. Alternatively, you could buy a call option on Apple at a specified price. This option would give you the right, but not the obligation, to buy shares of Apple at the agreed-upon price if the price of Apple’s stock goes up. If the price of Apple’s stock doesn’t go up, you can simply walk away and let the option expire. But if the price of Apple’s stock does go up, you can exercise your option and buy shares of Apple at the lower, agreed-upon price, profiting from the increase in price.

Grasping Options Trading

Options trading reminds me of the magnetic toy blocks that children like playing with. Depending on your goals, you can organise them in whatever way you like.

What I mean is that there are an infinite number of techniques you can use based on your market perception. If you believe the market is on the rise, you will employ one set of methods. There are tactics available if you are unsure which way the stock will move but believe it will move in either direction. And if you believe the market is in a downtrend, simply employ those tactics! And the names of these techniques are quite cool, too: iron condor, bull call spread, calendar straddle, wheel strategy and iron butterfly.

Compared to passive investing, options trading offers the potential for greater returns because of the leverage involved. With options, traders can control a larger number of shares with a smaller investment, which can lead to greater profits if the trade goes in their favour.

However, it’s important to note that options trading also involves greater risk. The buyer of an option can lose the entire investment if the trade goes against them and the option expires worthless. It’s essential to have a solid understanding of the market and the securities being traded, as well as a sound trading strategy and risk management plan.

Diving into Specifics

Now that we have covered the basics of options trading, let’s dive into some more specific details. Options are essentially a contract, and like most contracts, there is a contract period. They can range anywhere from a week to a few years until the contract expires. To make a consistent income via options trading, it is best to be selling the options contracts rather than buying them.

The strategy that has become the bread and butter of what I do is called the Wheel Strategy. In a nutshell, I will sell puts on a stock I want to own and sell covered calls on stocks to collect premium. The main objective of the Wheel Strategy is to generate income from the premiums received, while also potentially owning the stock at a lower cost basis.

To illustrate the Wheel Strategy, let’s use Apple (AAPL) as an example. Assume that AAPL is currently trading at $130 per share, and we want to use the Wheel Strategy to potentially acquire shares of AAPL at a lower cost basis while also generating income. Here’s how it works:

- Sell a put option: We sell a put option with a strike price of $120 and an expiration date of one month from now. We collect a premium of $2 per share, or $200 for 100 shares. If AAPL stays above $120, we keep the $200 premium and the put option expires worthless.

- Get assigned: If AAPL falls below $120 and the put option is exercised, we get assigned 100 shares of AAPL at a cost basis of $118 ($120 strike price – $2 premium received).

- Sell a covered call: With our 100 shares of AAPL, we then sell a covered call with a strike price of $135 and an expiration date of one month from now. We collect a premium of $2 per share, or $200 for 100 shares.

- Repeat: If AAPL stays below $135, the covered call expires worthless and we keep the $200 premium. We can then repeat the process by selling another put option with a strike price of $120 and an expiration date of one month from now. If the covered call is exercised, we sell our shares of AAPL for $135, making a profit of $17 per share ($135 selling price – $118 cost basis – $2 put premium received – $2 call premium received).

| Step | Action | Outcome |

|---|---|---|

| 1 | Sell a put option | Collect $200 premium |

| 2 | Get assigned | Acquire 100 shares of AAPL at a cost basis of $118 |

| 3 | Sell a covered call | Collect $200 premium |

| 4 | Repeat | If the covered call expires worthless, repeat the process by selling another put option with a strike price of $120 and an expiration date of one month from now. If the covered call is exercised, sell AAPL shares for $135 and make a profit of $17 per share. |

Steps of the wheel strategy using AAPL as an example

The wheel strategy works well with my investment profile as it enables me to earn premiums on selling puts on stocks that I want to own and covered calls on my existing stocks. AAPL is a relatively stable stock and it is quite likely for its trading price to drop significantly in a short time frame unless there are huge market movements. Therefore, it is always very likely that the option may expire worthless and you will receive the premiums. Similarly for covered calls, AAPL as a stable stock will unlikely have huge market movements thus it is likely that the contract will also expire worthless which allows you to keep your stock and the premiums. In the event that your covered call is exercised, you get to sell your stock at a higher trading price.

It is important to note that the Wheel Strategy requires a significant amount of capital to implement properly, and it also involves taking on the risk of potentially owning the underlying stock at a lower cost basis. However, with proper risk management and careful stock selection, the Wheel Strategy can be an effective way to generate income and potentially acquire shares of a stock at a lower cost basis.

Rolling Options

Another important concept to understand when it comes to options trading is rolling options. Rolling options involves closing out an existing option position and simultaneously opening a new option position with the same underlying stock, but with a different expiration date and/or strike price.

Rolling options can be used to either lock in profits or limit losses, depending on the situation. For example, if you sell a covered call on a stock and the stock price rises above the strike price of the call option, you may want to roll the option up to a higher strike price to capture additional upside potential. On the other hand, if the stock price falls and the put option you sold is in the money, you may want to roll the option out to a later expiration date to give the stock more time to recover.

Let’s say that you sold a covered call on AAPL with a strike price of $140 and an expiration date of May 21st. As the expiration date approaches, you realize that AAPL has not reached the strike price and you still own the underlying stock. In this scenario, you have a few options.

One option is to allow the option to expire worthless and keep the underlying stock. Another option is to close out the position and sell a new call option with a later expiration date and potentially a higher strike price.

For example, let’s say that AAPL is currently trading at $130, and you decide to close out the May 21st call option for a profit of $100. You then sell a new call option with a strike price of $135 and an expiration date of June 18th, receiving a premium of $200. This would allow you to generate additional income and potentially profit from any further upside in AAPL.

Alternatively, you could also roll your position in the opposite direction by buying back your existing option and selling a new option with a closer expiration date and potentially a lower strike price. This would allow you to lock in profits and potentially limit your downside risk.

My Experience with Options Trading

Less is More

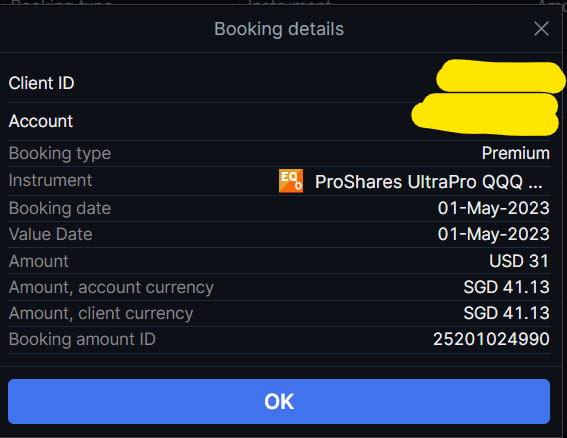

Options trading can be a great way to generate consistent income, as I’ve found through my own experience. When it comes to trading options, I’ve found that consistency is key. And for me, that consistency has resulted in making around $200 a week trading options like TQQQ and SQQQ. Personally, I only stick to a few stocks for options trading as I feel that it allows me to have a greater focus and monitor the movements of the stock prices. A weekly trade on TQQQ can net me around SGD $40-70 a week depending on the market outlook.

Only Trade Weekly

There are many different types of options contracts available to traders, each with its own unique characteristics and advantages. While some traders prefer longer-term options contracts, I have found that trading weekly options suits my personal trading style and goals much better.

Trading weekly options can be less volatile than trading longer-term options. Since weekly options have a shorter lifespan, they are often less affected by unexpected market events or news that can cause sudden price fluctuations. This can make them a more stable and predictable option for traders who want to minimise their risk.

Additionally, weekly options offer more frequent opportunities to trade and generate income. With traditional monthly options contracts, traders have to wait a full month before they can execute another trade. However, with weekly options, traders can make trades every week, which means they have more opportunities to capitalise on market movements and generate consistent profits.

Simplicity of Wheel Strategy

One specific strategy that has worked well for me is the wheel strategy, which involves selling covered calls and cash-secured puts. This strategy is great for generating consistent income and can be less risky than some other options trading strategies, especially when you use it on stocks that you already own.

Recently, I used the wheel strategy on SOFI and it worked out quite well for me. I sold a covered call with a strike price of $6 and an expiration date of the following week. After so many trades, the premium I received from selling the options eventually covered the cost of the stock. As I really liked the stock a lot, a weekly routine of mine is to sell a put option so that I can accumulate more shares of SOFI in the event that I get assigned and also sell covered calls on it as it does not have much movement in the short run. Since SOFI is only trading at $5, I could sell multiple contracts of it and earn larger premiums as compared to stocks like AAPL which requires me to have a large capital.

So if you’re interested in generating consistent income through options trading, I highly recommend considering the wheel strategy, which has worked well for me and can provide a way to generate income on stocks that might otherwise be stagnant.

My Path Ahead

Options trading can be a great way to make some extra money on the side. By buying and selling contracts that give you the right to buy or sell stocks at a certain price, you can profit from the fluctuations in the stock market. However, it’s important to approach options trading with caution and to have a clear strategy in place. By doing so, you can minimise your risk and maximise your potential profits. So if you’re looking for a new investment strategy to try, give options trading a shot!

Personally, as part of my investment learning journey, I will also be looking forward to trying out new option strategies and also attempting to be more aggressive in terms of Risk/Reward ratio. I am aiming to make at $400/week via options trading which could add up to an additional income of $1,600 a month. Find out more on other investment options for risk averse Singaporeans.

Comments (1)

TD Ameritrade Transition: Exploring Tiger Brokers Platformsays:

October 17, 2023 at 12:53 am[…] feature of Tiger Brokers that stands out, especially for someone like me who mainly trades options selling puts and covered calls, sometimes requiring me to roll the contracts, is its commitment to offering cost-effective trading […]