Stock investing can be a rewarding experience, but it can also come with its fair share of risks. One of the biggest risks in stock investing is the possibility of losing money. It is important for investors to learn how to cut their losses and minimise their risks.

As a long-time investor, I have experienced my fair share of ups and downs in the stock market. I have made some successful investments that have yielded significant returns, but I have also made some costly mistakes along the way. One of the most painful lessons I have learned is the importance of cutting your losses in stock investing. In this blog, I will share with you my own personal experience of losing $7,000 on a single stock investment, and the valuable lessons I learned from that experience. I hope that my story will help you to avoid making the same mistakes I did and to become a more successful investor.

Table of Contents

Personal Experience

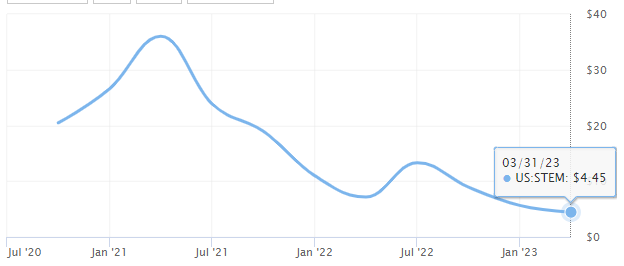

In 2021, I made a significant investment in a promising technology company called STEM. At the time, STEM was a relatively new player in the market, but it had a lot of potential due to its innovative technology solutions. I bought in at $30 per share, believing that it would be a wise long-term investment.

However, my investment did not go as planned. Over the next few months, the price of STEM stock began to drop. Instead of cutting my losses and getting out, I made the mistake of continuing to hold on to the stock, hoping that it would recover. I even doubled down on my investment by dollar-cost averaging down on the stock, purchasing more shares as the price continued to fall.

By the first quarter of 2023,, the STEM stock price had fallen below $5 per share. I had lost over $7,000 on this investment alone. I was devastated and felt like I had made a huge mistake. It was at this point that I realised I could not continue to hold on to the stock, as I may lose all my capital. I made the difficult decision to cut my losses and sell the stock.

What Does Cutting Your Losses Mean?

Cutting your losses means selling a stock that is underperforming and not meeting your expectations. It is a strategy that is used to minimise losses and preserve capital. Having a stop loss strategy is important in stock investing as it allows you to exit a position when the stock price reaches a certain level. For instance, let’s consider the importance of having a stop loss strategy. Imagine you’re going on a road trip from New York to Los Angeles. You have a GPS to guide you, but you don’t set any limits or boundaries for your journey. As a result, you end up taking unnecessary detours, getting lost in unfamiliar cities, and wasting time and resources.

Similarly, investing in stocks without a stop loss strategy is like embarking on a road trip without any limits or boundaries. Without a clear plan for when to cut your losses, you risk getting lost in market fluctuations and making impulsive decisions based on emotions rather than rational analysis.

There are different types of stop loss orders, including:

| Type of Stop Loss Order | Description |

| Market Order | An order to sell a stock immediately at the best available price in the market. |

| Limit Order | An order to sell a stock at a specific price or better. If the stock price drops to the specified level, the order executes. |

| Trailing Stop Order | An order to sell a stock if it drops a certain percentage or dollar amount from its peak value. |

The type of stop loss order you choose will depend on your investment strategy and risk tolerance.

Signs You Need to Cut Your Losses

Knowing when to cut your losses is important in stock investing. Here are some signs that may indicate it is time to cut your losses:

- Consistent underperformance: If a stock is consistently underperforming and shows no signs of recovery, it may be time to cut your losses.

- Lack of positive news: If a company is not releasing any positive news or updates, it may be an indication that the stock is not performing well.

- Setting a limit: Setting a limit on your losses can help you avoid holding on to a losing stock for too long.

The Downfall of My Investment

My investment in STEM was a classic example of how not to invest in the stock market. As I mentioned earlier, I made the mistake of holding on to the stock for too long, hoping that it would eventually recover. This was a costly mistake that resulted in a significant loss of money.

One of the biggest contributors to the downfall of my investment was my decision to continue to buy more shares of STEM even as the stock price was plummeting. This is known as “dollar-cost averaging down,” which is a strategy that some investors use to try and lower their average cost per share. In theory, this strategy can work well, but in practice, it can lead to significant losses if the stock price continues to fall.

To illustrate the impact of dollar-cost averaging down on my investment, let’s take a look at the table below:

| Date | Shares Bought | Price Per Share | Total Invested | Total Shares Owned |

| Jan 2021 | 100 | $30 | $3,000 | 100 |

| Feb 2021 | 100 | $25 | $2,500 | 200 |

| Mar 2021 | 100 | $20 | $2,000 | 300 |

| Apr 2021 | 100 | $15 | $1,500 | 400 |

| May 2021 | 100 | $10 | $1,000 | 500 |

| Jun 2021 | 100 | $5 | $500 | 600 |

As you can see, as the stock price dropped from $30 to $5, the investor continued to buy more shares through dollar cost averaging down. By buying more shares at a lower price, the average price per share decreased. However, this strategy also led to the investor sinking more and more money into a losing investment. In this case, the investor ultimately decided to cut their losses before they lost all their capital.

This table shows the importance of setting a limit on losses and sticking to it. While dollar cost averaging down can be a valid strategy in some cases, it’s important to weigh the potential risks and rewards before continuing to invest in a losing stock.

The STEM stock price began to drop shortly after I made my initial investment in 2021. It continued to decline over the next two years, eventually falling to just a few dollars per share. This was a clear sign that I should have cut my losses and gotten out of the investment much earlier.

In hindsight, I can see that my downfall in this investment was largely due to my lack of knowledge and experience in the stock market. I was too focused on the potential upside of the investment, rather than the potential downside. I was also too emotionally attached to the stock, which prevented me from making rational decisions about when to sell.

Strategies to Cut Your Losses

Now that we have covered the importance of cutting your losses and the signs that it is time to do so, let us explore some effective strategies to limit your losses in stock investments or when to sell your stock.

1. Diversification

One key strategy to limit your losses is to diversify your portfolio. By spreading your investments across different sectors and industries, you can reduce the impact of any one company or industry on your portfolio. This can help cushion the blow if one of your investments experiences a significant decline in value. An easy way to diversify your portfolio is to invest directly into exchange-traded funds (ETFS).

For example, let us say you invested heavily in the technology sector and the market suddenly experiences a downturn. If your portfolio is heavily weighted towards tech stocks, you may suffer significant losses. However, if you have also invested in other sectors such as healthcare, finance, and consumer goods, you may be better able to weather the storm.

2. Consideration of Investment Time Frame

Another important factor to consider when cutting your losses is your investment time frame. If you are a long-term investor, short-term fluctuations in the market may not have as much of an impact on your portfolio as they would for a short-term investor.

In general, the longer your investment time frame, the more you can withstand short-term volatility. This means that you may not need to cut your losses as quickly as someone who is investing for the short term.

3. Set a Target Price and Stick to It

Setting a target price for your investments can help you avoid emotional decision-making and make more rational decisions about when to sell. For example, you may decide to sell a stock if it drops below a certain price point or if it reaches a certain level of profit.

By setting a target price, you can remove some of the emotion from your decision-making and focus on your investment strategy. This can help you avoid the temptation to hold on to a stock in the hopes that it will rebound, even if the signs indicate that it is unlikely to do so.

Don’t Make My $7,000 Mistake

In conclusion, cutting your losses is an essential component of successful stock investing. By understanding the signs that it is time to cut your losses, setting a stop loss strategy, and implementing effective strategies to limit your losses, you can protect your capital and maximise your returns.

My personal experience with STEM stock taught me a valuable lesson about the importance of cutting your losses. While it was painful to let go of the stock and take a loss, it was the right decision in the long run. I encourage you to learn from my experience and take the necessary steps to protect your investments.

Remember to diversify your portfolio, consider your investment time frame, and set a target price to make rational decisions about when to sell. By following these guidelines, you can be on your way to successful stock investing.

*This blog post is for informational purposes only and should not be construed as professional advice. The information provided is based on research and personal experience, and may not be suitable for every individual’s financial situation.

Read more: 7 Investment Mistakes to Avoid in Singapore

FAQs

1. Can I recover my losses if I hold on to my stock investment?

It is possible to recover your losses if you hold on to a stock investment, but it largely depends on the company’s future performance. If the company is able to turn things around and increase its stock price, then you may be able to recover your losses. However, there is no guarantee that this will happen, and it could take a long time for the stock to rebound. Based on personal experience, I did have successful and failure examples on recovering losses by holding on to a stock investment. It is generally recommended to have a stop loss strategy in place to limit your losses and prevent them from getting too large.

2. How can I determine the right time to cut my losses?

Determining the right time to cut your losses can be a difficult decision, and it largely depends on your individual investment strategy and risk tolerance. One approach is to set a stop loss order at a predetermined price, which will automatically sell your shares if the stock price falls to that level. Another approach is to regularly monitor the company’s financial performance and news events that could impact its stock price, and make a decision to sell if the company’s prospects begin to look bleak. Ultimately, the decision to cut your losses should be based on your own individual goals and risk tolerance.

3. What is a stop loss order?

A stop loss order is a type of order that is placed with a broker to sell a stock at a predetermined price. This order is designed to limit your losses if the stock price begins to fall. For example, you could place a stop loss order at 10% below the current market price, which would trigger the sale of your shares if the stock price falls by that amount. This can be a useful tool for managing risk in your investment portfolio.

4. Should I use market orders or limit orders to cut my losses?

Whether you should use a market order or limit order to cut your losses largely depends on your individual investment strategy and goals. A market order is executed immediately at the current market price, while a limit order is executed only if the stock reaches a predetermined price. A market order can be useful if you need to sell your shares quickly, but it can also result in a lower sale price if the stock price is falling rapidly. A limit order can help you get a better price for your shares, but it may take longer to execute. Ultimately, the decision to use a market or limit order should be based on your own individual goals and risk tolerance.

Leave a Reply