Every day, thousands of working mothers in Singapore navigate the complex dance of career and family. Imagine her – a working mother in the heart of bustling Singapore. She skillfully juggles career aspirations with the timeless role of raising a family. These women are the unsung heroes, balancing professional aspirations with the timeless role of motherhood. Thankfully, the Singaporean government offers a helping hand through the Working Mother’s Child Relief (WMCR) scheme.

Table of Contents

Understanding WMCR: A Tax Relief Tailored for Working Moms

Launched in 2004, the WMCR is a tax relief program designed specifically for working mothers. It acknowledges the unique challenges they face by reducing their taxable income, translating to a lower tax bill. This frees up valuable resources for childcare, education, and other expenses essential for raising a family. Fast forward to 2024, and the program continues to evolve, adapting to the changing needs of working mothers across the nation.

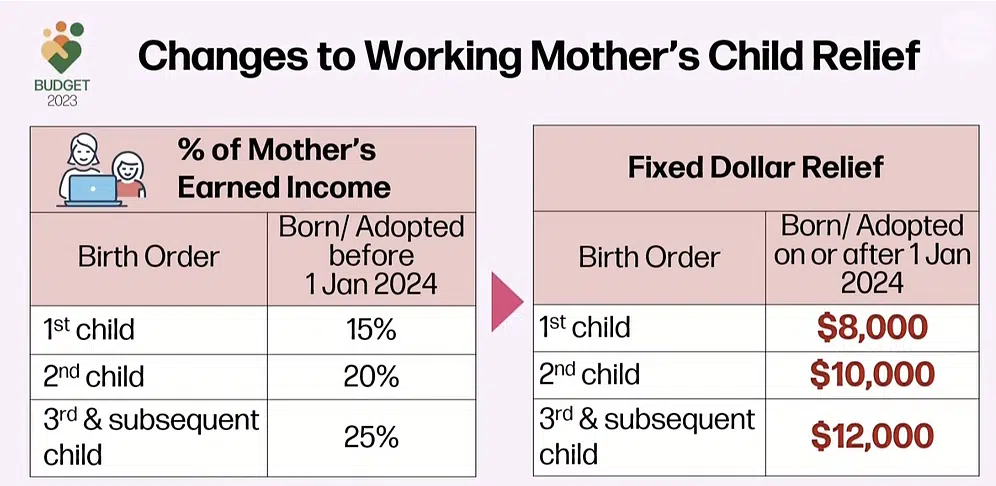

Recent Changes to WMCR: Transitioning to Fixed Relief Amounts

Budget 2023 brought significant changes to the WMCR. Previously, the relief was calculated as a percentage of a working mother’s income. This has been replaced with a system of fixed relief amounts per child, effective from the Year of Assessment (YA) 2025 onwards. This simplifies calculations and potentially benefits lower- and middle-income mothers more.

The recent changes to the Working Mother’s Child Relief (WMCR) scheme announced in Budget 2023 have sparked discussions and mixed reactions. While the WMCR remains a valuable program for working mothers, the shift from a percentage-based relief to fixed amounts has created some concerns.

Why the Change? Supporting Lower-Income Mothers

The government’s aim is to provide greater support for working mothers with lower incomes. Under the old system, a higher salary meant a larger tax break in absolute terms. The new fixed amount system ensures all mothers receive a set amount per child, regardless of income, potentially leading to a more significant tax break for those who need it most.

Here’s a Breakdown:

- Old System (Percentage-Based Relief): A percentage of the mother’s earned income was deducted from her taxable income. Mothers with higher salaries received a larger tax break.

Example: Comparing Tax Relief Under Old and New Systems

Let’s consider Sarah, a working mother with two children (born before January 1, 2024):

- Mother’s Annual Salary: S$40,000

- Old System: Assuming a 15% relief for the first child and 20% for the second, her total WMCR could be around S$6,000. This reduces her taxable income to S$34,000.

New System (Fixed Relief Amounts):

- Sarah receives S$8,000 for the first child and S$10,000 for the second, totaling S$18,000 in WMCR. This significantly reduces her taxable income to S$22,000.

As you can see, the new system offers a more substantial tax break for Sarah compared to the old one.

Concerns and Potential Impacts

However, the change has also raised concerns, particularly among middle-income and high-income earners. Here are some of the potential impacts:

- Disincentive for Higher Earners: Some argue that the new system offers less benefit for high earners, potentially impacting their decision to have more children.

- Impact on Middle-Income Mothers: Calculations suggest that some middle-income mothers might even end up paying slightly more taxes under the new system compared to the previous percentage-based benefit they received.

- Rising Costs and Financial Burden: Concerns remain about the overall financial burden of raising a family, even with the increased Baby Bonus, especially considering rising living costs.

Expert Opinions on WMCR

Despite the concerns, experts acknowledge the program’s value. Ms. Lee Hui Min, a renowned financial expert, says, “The WMCR is more than just a tax relief program; it’s a statement of our society’s values. It recognizes the invaluable contribution of working mothers and provides tangible support in their journey.” Similarly, Dr. Ahmad bin Sulaiman, a respected sociologist, adds, “This scheme not only benefits the immediate family but also positively impacts the broader socio-economic fabric of Singapore.”

Eligibility for WMCR: Who Can Claim?

Not all working mothers qualify for WMCR. Here’s a breakdown of the eligibility criteria:

- Citizenship: You must be a Singapore Citizen or Permanent Resident.

- Marital Status: You must be married, widowed, or divorced.

- Child’s Status: You must have a child who is a Singapore Citizen (born before January 1, 2024, or born/adopted after on the new scheme).

- Employment: You must be working and earning an income.

- Financial Dependency: Your child must be financially dependent on you (annual income below S$4,000).

Benefits of WMCR: Real-Life Examples

Let’s see how the WMCR translates into real-life benefits for working mothers:

- Sarah, the Mid-Level Manager: Sarah is a married working mother with two Singaporean children (born in 2021). She earns an annual salary of S$50,000. Under the old system (percentage-based relief), her WMCR would be a variable amount depending on her income.

However, under the new system (fixed amounts), she receives S$8,000 for her first child and S$10,000 for her second child, totaling S$18,000 of WMCR. This translates to a significant reduction in her taxable income, potentially pushing her into a lower tax bracket and resulting in even greater savings.

With the additional financial breathing room provided by WMCR, Sarah can explore better childcare options, invest in her children’s education, or manage unexpected expenses more comfortably.

- Jane, the Single Mompreneur: Jane is a self-employed single mother with a young daughter (born in 2024). While she doesn’t have a fixed monthly salary, her annual income falls within the tax bracket. Thanks to the WMCR, Jane can claim S$8,000 in tax relief for her daughter. This helps her manage childcare costs and reduces her overall tax burden, allowing her to reinvest in her business or save for her daughter’s future.

Calculating Your WMCR Benefits under the New System

Calculating your WMCR benefits under the new system is straightforward. Simply refer to the fixed amounts based on your child’s birth date (pre- or post-January 1, 2024) and birth order:

- 1st Child: S$8,000

- 2nd Child: S$10,000

- 3rd Child & Subsequent: S$12,000

Maximizing Your Benefits: Combining WMCR with Other Schemes

The WMCR isn’t the only government program available to working mothers. Singapore offers a suite of other benefits that can be combined with WMCR to maximize tax savings. Here are a few examples:

- Qualifying Child Relief (QCR): This scheme provides tax relief for all children in a family, regardless of the mother’s working status.

- Handicapped Child Relief (HCR): This offers higher tax relief for children with disabilities.

- Parenthood Tax Rebate (PTR): This is a one-time tax rebate for parents, with varying amounts depending on the birth order of the child.

- Reduce Your Tax Bill: While the WMCR focuses on child-related relief, it’s important to be aware of other tax deductions and reliefs you may be eligible for. There are multiple ways you can reduce your income tax in Singapore. My guide can help you uncover additional tax-saving opportunities.

In addition to government programs, consider exploring financial resources that can help you manage rising costs. This article provides useful tips on coping with inflation in Singapore: Coping with Inflation in Singapore.

Understanding Tax Implications and Seeking Professional Help

While the move to fixed relief amounts simplifies calculations, understanding the new WMCR structure is still crucial for accurate tax filing. Here are some ways to navigate the new system and maximize your benefits:

- Utilize IRAS Resources: The Inland Revenue Authority of Singapore (IRAS) website offers a wealth of information on WMCR and other tax reliefs. They have guides, FAQs, and online calculators to help you estimate your potential tax savings (https://www.iras.gov.sg/).

- Consult a Tax Professional: For personalized advice and navigating the complexities of your specific situation, consider consulting a qualified tax professional. They can help you understand how the WMCR interacts with your other income sources, deductions, and potential tax liabilities. This could be particularly helpful if you are self-employed, have a complex income structure, or have any uncertainties about your eligibility or calculations.

Beyond WMCR: Additional Support for Working Mothers

The Singaporean government recognizes the vital role working mothers play in the nation’s economy and well-being. Here are some additional forms of support available:

- Early Childhood Development Assistance Scheme (ECDAS): This government initiative provides subsidies for childcare expenses at approved childcare centers. This can significantly reduce the financial burden of childcare, especially for working mothers with young children.

- Flexi-Work Arrangements: Many companies in Singapore offer flexible work arrangements like part-time hours, staggered working hours, or work-from-home options. These arrangements can help working mothers achieve a better work-life balance and manage childcare responsibilities more effectively.

- Maternity Leave: Singapore offers statutory maternity leave for employed mothers, providing them with paid time off work to recover from childbirth and bond with their newborn.

The Future of WMCR: Adapting to Evolving Needs

The government is likely to continue reviewing and refining the WMCR to adapt to evolving needs. We might see adjustments to relief amounts, eligibility criteria, or even the introduction of new support programs in the future. The government’s efforts to strike a balance between supporting lower-income mothers and maintaining incentives for higher earners are understandable. Transparency and clear communication are crucial in addressing these concerns. Staying informed about these changes ensures you can continue to benefit from this valuable tax relief program.

Conclusion: Working Mom, You’re Not Alone

The journey of working motherhood requires resilience and resourcefulness. The WMCR is a valuable tool in your arsenal, offering financial support as you navigate childcare, career demands, and the joys and challenges of raising a family. By understanding the program, maximizing its benefits, and utilizing other available government resources, you can alleviate some of the financial stress and create a more manageable, fulfilling work-life balance.

Leave a Reply