Not too long ago, the HSBC Revolution Credit Card was the underdog of the credit card world. Offering a mere 2 miles per dollar and losing points for essentials like insurance and bills, it was far from a crowd-pleaser. But, hold on to your seats because, in August 2020, this card did a complete 180. Imagine the annual fee vanished into thin air and the earn rate skyrocketed to an impressive 4 miles per dollar on your everyday expenses – dining, groceries, you name it.

It was like witnessing a superhero transformation – the card went from zero to hero overnight, making it a must-have in everyone’s wallet. Let’s dive into the remarkable journey of the HSBC Revolution Credit Card, the card that went from “meh” to “heck yeah!”

Note: Starting from 1 January 2024, there’ll be changes in the qualifying transactions or eligible purchases. The Merchant Category Codes (MCC) 4722 and 7011 will be removed from the list of eligible transactions and no longer be rewarded with 10× Reward points. Please refer to HSBC’s credit card FAQ page for the changes in detail.

Key Takeaways

- Diverse Rewards: The HSBC Revolution Credit Card stands out for its versatile rewards program, allowing you to earn not just miles but also cashback and vouchers. This diversity ensures you get the most value from your spending.

- No Annual Fees: One of the key attractions is the absence of annual fees, providing a cost-effective way to access a range of benefits. You can enjoy the perks without worrying about additional charges.

- Miles Galore: For those with a penchant for travel, the HSBC Revolution Credit Card’s 4 miles per dollar (mpd) on online and contactless transactions is a game-changer. Imagine accumulating miles effortlessly as you shop, dine, or make travel bookings.

- Capitalize on Categories: The card focuses on specific categories like dining, shopping, groceries, transport for the coveted 4 mpd. Tailor your spending to these categories to maximize your rewards.

- Flexibility and Freedom: Whether you’re a seasoned credit card user or a newcomer, the HSBC Revolution Credit Card offers flexibility and freedom in choosing how you want to be rewarded. It’s a card that adapts to your lifestyle.

- Effortless Everyday Earnings: Transform routine purchases into valuable rewards effortlessly. From your morning coffee to weekend groceries, every transaction contributes to your rewards, making every swipe count.

- Entertainer App Perks: Explore additional benefits with the Entertainer app, unlocking 1-for-1 offers and discounts at various dining establishments. This sweetens the deal, providing extra value beyond regular rewards.

Table of Contents

HSBC Revolution Credit Card Rewards 2024

Before we get into the nitty-gritty, let’s talk rewards. Picture this: You get to choose between a swanky Samsonite ZELTUS 69cm Spinner worth SGD680 or straight-up SGD150 cashback when you spend at least SGD1,000. If you’re already rocking an HSBC card, you still get a sweet SGD50 cashback. More details here.

HSBC Revolution Credit Card Feature & Benefits

The HSBC Revolution stands out in the crowded credit card market with its no-fee structure and a remarkable earn rate of 4 miles per dollar on travel, shopping, groceries, dining, and transport.

| HSBC Revolution Credit Card Features | Benefits |

| Annual Fee | No annual fee, ever |

| Income Requirement | S$30,000 p.a. for citizens and PRs, S$40,000 p.a. for foreigners |

| Key Features | – Annual fee: No annual fee, ever |

| – 4 mpd on various transactions: Earn 4 miles per dollar on travel, shopping, groceries, dining, and transport (online or contactless) | |

| – The Entertainer: Receive a complimentary copy of The Entertainer for exclusive 1-for-1 offers on dining, entertainment, and travel | |

| – Bonus Conditions: Bonuses apply to contactless or online transactions only |

Now, what sets the HSBC Revolution apart from the credit card crowd? Well, two words: no fees. Yep, you heard it right. As of August 1, 2020, the annual fee vanished into thin air. It’s like getting VIP access to the credit card world without paying a cover charge. As a savvy consumer, this caught my attention – a credit card that not only costs nothing to own but also generously rewards daily expenditures.

The inclusion of a complimentary copy of The Entertainer, offering more than 1,000 1-for-1 offers, adds another layer of value, making it a practical choice for those who enjoy dining out or exploring entertainment options.

Oh, and here’s the cool part – even if you’re not rolling in the big bucks, you can still snag this card. Just lock in a SGD10,000 fixed deposit, and voila! You get a credit card with a limit up to 100% of your deposit. Perfect for the hustlin’ students or freelancers out there!

Pro tip: This can be especially beneficial for students initiating their miles journey. By applying for this credit card, you can conveniently cover the bill during large group dining outings with friends, maximizing your miles earnings.

HSBC Revolution’s Rewards Program

Now, let’s talk rewards. The HSBC Revolution Rewards Program is all about points, baby! You rack up 0.4 miles per dollar on regular Singapore Dollar (SGD) and foreign currency (FCY) spends. But here’s where it gets exciting – 4 miles per dollar for specific online and contactless transactions. Yep, you read it right – 4 miles! 🌟

However, there is a monthly cap of S$1,000 on this bonus, and any spending beyond this limit earns at a rate of 0.4 mpd.

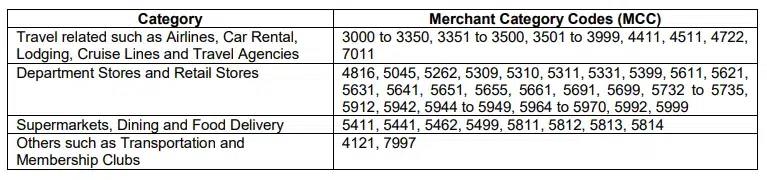

The bonus points are applicable to various daily spending categories, encompassing airlines, department stores, supermarkets, dining, and transportation. Eligible Merchant Category Codes (MCCs) dictate which transactions qualify for bonus points. Examples of these eligible MCCs include department stores and retail stores (e.g., Amazon, Lazada), supermarkets and dining outlets (e.g., Cold Storage, GrabFood), as well as transportation services and membership clubs (e.g., Comfort, Grab).

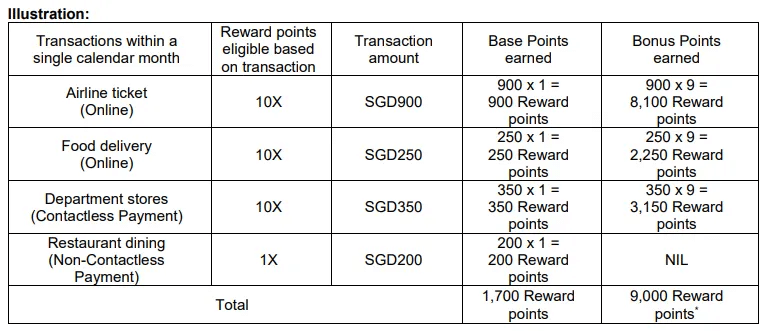

To illustrate the earning potential, let’s delve into a practical scenario:

Consider a cardholder spending $1,000 on contactless purchases:

- Base: 1,000 HSBC Reward Points (equivalent to 400 miles)

- Bonus: 9,000 HSBC Reward Points (equivalent to 3,600 miles)

This structure, with a monthly cap, means that spending $2,000 on contactless purchases would yield:

- Base: 2,000 HSBC Reward Points (equivalent to 800 miles)

- Bonus: 9,000 HSBC Reward Points (equivalent to 3,600 miles)

It’s noteworthy that 10,000 HSBC Reward Points translate to 4,000 air miles based on the redemption ratio of 5:2. Therefore, a consistent monthly expenditure of $1,000 with the HSBC Revolution Credit Card could accumulate 4,000 air miles each month, resulting in an impressive total of 48,000 air miles within a year.

Typically, I would recommend charging $1,000 to this card and the balance to another air miles card like Citi Rewards. You can find out how I pair Citi Rewards with Amaze to consistently earn 4mpd.

Contactless & Online Transactions For 10x Points

The HSBC Revolution Credit Card employs a whitelist system to determine the eligibility of bonus points for contactless or online payments. These payments are categorized based on specific Merchant Category Codes (MCCs), and transactions at these designated merchants qualify for 10x Reward points. If the MCC code matches the specified criteria, bonus points are awarded.

But here’s the catch: Starting January 1, 2024, some places won’t be on the bonus list anymore. It’s like they’re not cool enough for the party. So, spots like Agoda, Klook (4722), and Booking.com (7011) are missing out. The inclusion of Travel as a bonus category for the HSBC Revolution card is what differentiates it from competitors like UOB PPV and Citi Rewards. However, seems like it would not be the case anymore.

Now, I get it – HSBC Revolution is a bit picky about where you can earn those extra points. It’s not like a free-for-all where you earn bonuses everywhere. But here’s the good part – the places they do cover include your regular spots. Think shopping, eating out, and catching a ride – those are still bonus-worthy.

Quick tip: If you want those 4 miles per dollar, whether you’re shopping online or in a store, use contactless payment methods. That means things like Apple Pay, Google Pay, and tapping your physical card with Visa Paywave. Just a heads-up, though – no love for Garmin Pay, Fitbit Pay, or Samsung Pay right now.

HSBC Revolution Points Crediting & Transfer

Crediting Process

Base HSBC Points (1X) are credited when the transaction posts, usually within 1-3 working days. Bonus 9X HSBC Points are credited by the end of the following calendar month from the transaction date, reflecting in the cardholder’s statement no later than the last day of the second calendar month.

Points Expiry

All HSBC Points have a 37-month expiry period, starting from the month following the one in which the points were earned. For instance, points earned in September 2021 expire on October 31, 2024.

On a personal note, I don’t delve into the intricate details. When you get approval for your HSBC Revolution Credit Card, you should set a reminder to review your HSBC points status around the 30-month mark. This will allow you the time and bandwidth to plan and determine the points redemption process.

You can monitor the expiry status of points either through the monthly statement or the HSBC mobile app.

Transfer Process

HSBC Points can be transferred to frequent flyer programs at a 5:2 ratio, with a minimum transfer block of 25,000 HSBC Points. The transfer process incurs a S$43.20 transfer fee for unlimited conversions within a 12-month period. This fee covers transfers to both KrisFlyer and Asia Miles.

Alternatively, cardholders can choose to pay 9,000 rewards points for a program fee waiver (which is not recommended).

Other Perks of the HSBC Revolution Credit Card

Entertainer App with HSBC

The Entertainer app serves as a delightful additional perk for HSBC Revolution Credit Card holders. This versatile mobile application offers a plethora of 1-for-1 deals and dining bill discounts across various lifestyle categories.

Despite its selection not being exhaustive, I find it to be a useful companion when dining out. The app features enticing options such as Hoshino Coffee (25% off), Shin Minori (1-for-1), and Paul Bakery (1-for-1). With a user-friendly interface and regular updates, the Entertainer app enhances the overall experience for cardholders by providing exclusive savings on meals and entertainment.

1% bonus cashback with HSBC EGA

HSBC Revolution Cardholders have the opportunity to earn an extra 1% cashback on all transactions when linked with the HSBC Everyday Global Account (EGA).

To unlock the additional 1% cashback on your credit card spending through the HSBC Everyday+ Rewards Programme, simply follow these steps:

- Deposit Requirements:

- HSBC Personal Banking: S$2,000/month

- HSBC Premier and Jade: S$5,000/month

- Transaction Criteria:

- Conduct a minimum of five eligible transactions each month (excluding those listed in the exclusions section).

- Cashback Details:

- Enjoy 1% cashback upon meeting the specified criteria.

- Cashback Caps:

- HSBC Personal Banking: Maximum of S$300 per month

- HSBC Premier and Jade: Maximum of S$500 per month

Make the most of your credit card spending by taking advantage of this rewarding program. Start saving and transacting to enhance your cashback benefits!

Is HSBC Revolution the Right Card for You?

The HSBC Revolution Card’s rewards program caters to those who embrace a dynamic lifestyle. If you frequently engage in online and contactless transactions, this card can be one of the most lucrative options in Singapore. However, it may not be the ideal choice if your spending habits are predominantly in categories not covered by bonus points.

Pros of HSBC Revolution Card:

- Attractive rewards for online and contactless spending.

- Bonus points for various everyday categories, including dining and transportation.

- Broad selection of eligible merchants.

- No annual fee, providing cost savings.

- Regular promotions and partnerships for added benefits.

Cons of HSBC Revolution Card:

- Bonus points capped for specific spending categories.

- Limited bonus point eligibility based on Merchant Category Codes (MCCs).

- Some may find the redemption process less straightforward.

- Non-bonus spending earns lower points per dollar.

While the HSBC Revolution Card presents compelling advantages, it’s essential to weigh these against the drawbacks, considering your individual spending patterns. As a cardholder, I’ve navigated through the perks and challenges. What’s your perspective on these aspects?

How To Maximise Miles With HSBC Revolution

If you’ve opted for the HSBC Revolution card, here’s a quick guide on maximizing your 4 mpd earnings:

- Payment Method: Stick to online or contactless payments, whether it’s through Visa payWave or mobile payment options.

- Selected Categories: Focus on specific categories such as dining, shopping, groceries, transport, and travel to earn the 4 mpd rate.

- Spending Limit: Be mindful that the 4 mpd rate applies only to the first S$1,000 of spending per calendar month.

Pro Tip: If your monthly expenses exceed S$1,000, consider charging the excess to another credit card like Citi Rewards, especially if you’re keen on maximizing rewards with its impressive features.

HSBC Revolution vs Citi Rewards

When it comes to choosing a rewards credit card, the HSBC Revolution and Citi Rewards cards present compelling options. For simple comparison, HSBC Revolution has an 4 mpd earn rate with contactless payment on many different categories (including groceries and dining) whereas Citi Rewards has a 4 mpd earn rate on shopping & online spending.

The HSBC Revolution card emerges as a superior choice for everyday expenses, especially with its extensive 4 mpd earning capabilities. However, if you pair Citi Rewards together with the Amaze Card, it will become equally as versatile as the HSBC Revolution card as it converts all offline spending to online spending. If your monthly spending exceeds $1,000, I would advise that you can get both of the cards. In such cases, you can optimize the Citi Rewards card for exclusive use in online spending and retail shopping, reserving the HSBC Revolution for other expenses like dining and groceries.

Verdict: HSBC Revolution Review 2024

You should definitely get the HSBC Rewards Credit Card. This credit card is probably what I would recommend as the first card if you are just starting to collect air miles due to its versatility.

Earning miles with the HSBC Revolution Credit Card is remarkably straightforward, involving regular expenses like transportation and food. Unlike the UOB One Credit Card, which I’ve reviewed, there are no intricate hoops to navigate.

In summary, the HSBC Rewards Credit Card stands out as a valuable and rewarding choice, particularly for those starting their air miles journey.

Leave a Reply