Update on CPF Shielding Strategy: Changes Ahead 19 Feb 2024

For those nearing the age of 55, the CPF Shielding Hack has been a favored strategy to optimize CPF returns and maintain flexibility in retirement planning. By employing this method, individuals could maximize interest earnings while preserving the ability to utilize CPF funds as needed in later years.

However, significant alterations loom on the horizon, slated to take effect starting in 2025. As revealed in the latest Singapore Budget for 2024, there will be a fundamental shift in CPF dynamics. Alongside the mandatory opening of a new Retirement Account at 55, another notable change entails the closure of the Special Account.

This impending adjustment marks a significant departure from the current CPF Shielding approach, essentially rendering it obsolete. As such, individuals relying on this strategy must prepare for the forthcoming modifications and adapt their retirement plans accordingly. Stay tuned for further updates and insights as we navigate these evolving CPF landscape changes together.

In Singapore, financial planning for retirement is intricately tied to the effective management of your Central Provident Fund (CPF). From your first paycheck, contributions to your CPF Ordinary Account (OA), Special Account (SA), and MediSave Account (MA) lay the groundwork for your financial security in later years. Among the various strategies to optimize these savings, CPF Shielding stands out as a particularly savvy approach, often referred to as a ‘retirement cheat code’ for its ability to significantly boost your retirement funds risk-free.

CPF Shielding is a powerful tactic used as you approach a critical financial milestone: your 55th birthday. This strategy involves judiciously managing your CPF accounts to maximize interest earnings. The SA and RA both give 4% interest, so there is no gain from moving money from SA to RA in terms of interest rates. What people aim to shield is their SA from being moved into the RA, preferring instead that the CPF take their money from their OA. This is where the concept of shielding comes into play, to ‘protect’ the SA from being transferred to the RA.

The essence of CPF Shielding lies in its simplicity and effectiveness. It does not require extensive financial knowledge or complex maneuvers. By understanding the nuances of CPF SA Shielding and how it can be implemented with straightforward tools like Singapore Treasury Bills, you can take control of your financial future, ensuring that your golden years are not just secure, but also more prosperous.

This article aims to demystify the concept of CPF Shielding, offering a comprehensive guide on how it works, its benefits, and practical steps to implement it effectively. Whether you’re a pre-retiree planning for a comfortable retirement or a young adult helping your parents manage their finances, understanding CPF Shielding is a crucial step towards achieving financial stability and independence in Singapore.

Table of Contents

Basics of CPF: Overview of the Central Provident Fund (CPF) System

The Central Provident Fund (CPF) in Singapore is more than just a retirement savings plan; it’s a comprehensive social security system that assists Singaporeans and permanent residents in managing their healthcare, housing, family protection, and retirement needs. Every employed Singaporean and permanent resident contributes a portion of their monthly income to various CPF accounts, namely the Ordinary Account (OA), Special Account (SA), and MediSave Account (MA). These contributions, matched by employers, grow over time through interest.

Understanding the CPF’s structure is crucial. The OA is typically used for housing, insurance, investment, and education. The SA is earmarked for old age and retirement-related financial products. The MediSave Account, meanwhile, is reserved for medical expenses and health insurance. Learn more about CPF.

CPF Shielding Concept: Unveiling the CPF Shielding Strategy

CPF Shielding is a strategic approach used by savvy CPF members to maximize their retirement savings. This concept revolves around minimizing the amount in the Special Account (SA) that gets transferred to the Retirement Account (RA) when one reaches the age of 55.

Just before turning 55, a member might transfer a significant amount from the OA to the SA. This is done to maximize the SA balance, which earns higher interest. When the RA is formed, the CPF system will first use funds from the OA (which now has a lower balance due to the earlier transfer to the SA) to meet the FRS in the RA. The higher-interest-earning SA funds are thus ‘shielded’ or preserved.

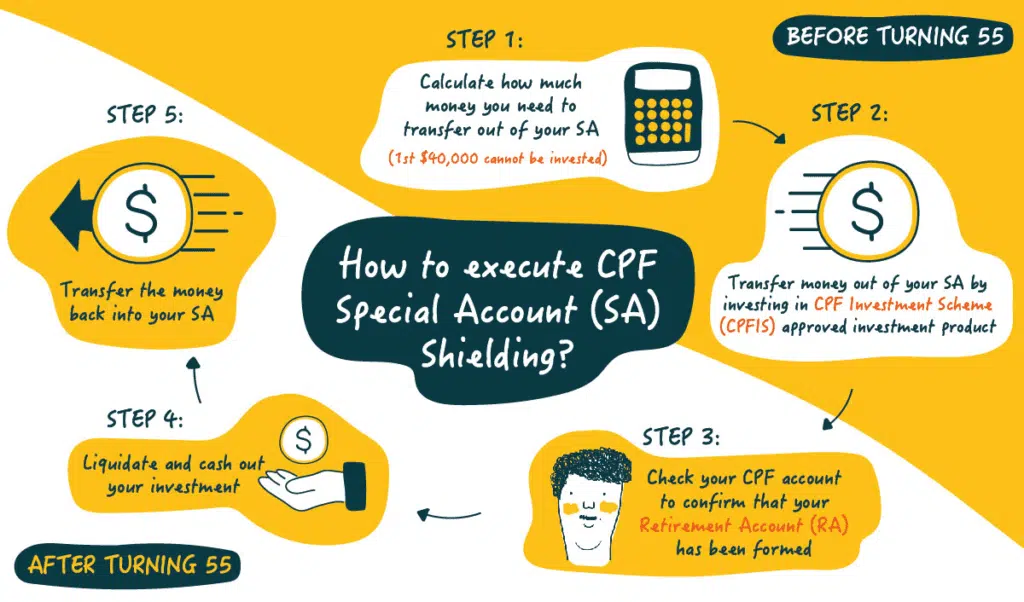

How CPF Shielding Works: Step-by-Step Guide to CPF Shielding

To effectively utilize your Special Account (SA) funds for CPF Shielding, here’s a streamlined process to follow:

Step 1: Opt for SA Fund Investments Firstly, consider investing your CPF SA funds. It’s important to maintain a minimum balance of S$40,000 in your SA. With the remaining balance, explore investment opportunities under the CPF Investment Scheme (CPFIS). This scheme enables CPF members to invest their CPF funds in various assets, including:

- Investment-linked Insurance Products (ILPs) – excluding those categorized as high-risk

- Unit Trusts – focusing on options that are not high-risk

- Singapore Government Bonds

- Annuities

- Treasury Bills

- Endowment Policies

These investment options offer a diversified approach, aligning with different risk profiles and financial goals.

Step 2: Maintain SA Investments Post-55 After selecting your investment vehicles, keep your funds invested until you turn 55. During this time, the CPF board will initiate your Retirement Account (RA), using the S$40,000 in your SA and any additional required funds from your Ordinary Account (OA).

Step 3: Revert Funds to SA for Interest Accumulation Following the establishment of your RA, you have the option to liquidate your investments. Upon doing so, transfer the proceeds back into your SA. This action enables you to benefit from the 4% interest rate offered in the SA, thus enhancing your retirement savings.

By following these steps, you can strategically manage your CPF funds to maximize their growth potential while preparing for a financially secure retirement.

This strategy effectively ‘shields’ a portion of your OA funds, allowing them to continue accruing higher interest in the SA.

Benefits of CPF Shielding: Maximizing Retirement Savings

CPF Shielding offers three primary benefits:

- Maximizing Retirement Savings: The SA and RA have a higher interest rate than the OA, so shielding your SA funds maximises the interest you earn from your CPF funds.

- Enhanced Retirement Savings: By maximizing interest earnings, CPF Shielding can significantly enhance the total retirement savings. This increased amount can lead to a more comfortable and financially secure retirement.

- Potential for Higher Returns: If the investments chosen during the shielding process perform well, there is a potential for higher returns compared to the standard CPF interest rates. However, this comes with the associated risks of investment.

Eligibility for CPF Shielding: Who Can Utilize CPF Shielding

CPF Shielding is available to all CPF members who are approaching the age of 55 and have balances in their OA and SA. It’s particularly beneficial for those who have accumulated substantial savings in their OA through employment, investments, or housing refunds.

Implementing CPF Shielding: Practical Steps for CPF Shielding and Timing for Optimal Benefits

Implementing CPF Shielding requires careful timing and an understanding of your financial situation:

- Assess Your Financial Position: Review your OA and SA balances and consider your retirement needs and goals.

- Timing: The optimal time to transfer funds from OA to SA is shortly before turning 55. This timing ensures that the transferred amount is maximized for interest accrual in the SA before being counted towards the FRS in the RA.

CPF Shielding and Retirement: Enhancing Retirement Funds and Long-term Impact

CPF Shielding can significantly enhance your retirement funds. By optimizing the interest earned on your CPF savings, you’re not just saving more; you’re also ensuring that these savings work harder for you, bolstering your financial security in retirement. The long-term impact of CPF Shielding can be substantial, providing a more comfortable and secure retirement.

Legal and Ethical Considerations: Navigating Legal Frameworks and Ethical Implications

CPF Shielding is a legal strategy, fully compliant with CPF rules and regulations. However, it’s crucial to approach it ethically, understanding that the primary goal of CPF savings is to ensure financial security during retirement. CPF Shielding should be part of a broader, balanced retirement planning strategy.

Common Misconceptions: Debunking Myths Around CPF Shielding

There are several misconceptions surrounding CPF Shielding, such as it being overly complex or only beneficial for high-income earners. In reality, CPF Shielding is a straightforward strategy that can benefit a wide range of CPF members, regardless of their income level.

Case Studies and Success Stories: Real-life Examples of Effective CPF Shielding

Case Study 1: Mr. Tan’s Strategic Planning

Background: Mr. Tan, a 54-year-old engineer, had accumulated substantial savings in his OA through diligent contributions and wise investments.

Strategy: As he approached his 55th birthday, Mr. Tan executed a CPF Shielding strategy. He transferred a significant portion of his OA funds to his SA, thus ‘shielding’ these funds from being moved to his RA.

Outcome: Over the next decade, the funds in his SA, which earned a higher interest rate than the OA, grew significantly. By the time Mr. Tan turned 65 and started receiving CPF LIFE payouts, his retirement fund was considerably larger than it would have been without CPF Shielding.

Case Study 2: Ms. Lee’s Early Retirement Plan

Background: Ms. Lee, a 53-year-old educator, had always planned for early retirement. She was well-versed in CPF policies and understood the benefits of CPF Shielding.

Strategy: Two years before turning 55, Ms. Lee started transferring her OA savings to her SA, maximizing the interest accrual in her SA.

Outcome: This strategy not only increased her retirement savings but also allowed her to retire two years earlier than planned, comfortably relying on her enhanced CPF savings.

Hypothetical Scenario: A Young Couple’s Forward Planning

Background: John and Mary, both in their early 30s, were planning for their future retirement.

Strategy: Understanding the benefits of CPF Shielding, they decided to start early. They planned to regularly transfer funds from their OAs to their SAs, ensuring a higher interest accrual over the years.

Outcome: By the time they reached 55, the couple had significantly increased their retirement savings. This foresight allowed them to enjoy a more comfortable and financially secure retirement.

Success Story: Mrs. Kumar’s Tax-Saving Approach

Background: Mrs. Kumar, a 50-year-old business owner, sought ways to reduce her taxable income and enhance her retirement savings.

Strategy: She utilized CPF Shielding as a dual strategy – transferring funds from her OA to SA not only for higher interest rates but also for tax benefits, as contributions to the SA are tax-deductible.

Outcome: This approach led to substantial tax savings over the years and an increase in her retirement funds, demonstrating the multifaceted benefits of CPF Shielding.

CPF Shielding Alternatives: Other Financial Strategies for Retirement Savings

While CPF Shielding offers a unique way to maximize your CPF funds for retirement, it’s important to consider other strategies that can complement or serve as alternatives to CPF Shielding. These alternatives not only provide diversified approaches to growing your retirement nest egg but also cater to different financial situations and goals.

- Voluntary CPF Top-Ups: One effective alternative is making voluntary top-ups to your Special Account (SA) or Retirement Account (RA). This strategy not only increases your retirement savings but also offers tax relief, which can be significant. For a more in-depth understanding of the benefits of topping up your CPF SA, you can refer to my article toping up CPF SA for retirement savings. This resource provides valuable insights into how voluntary top-ups can enhance your long-term financial security.

- Investing Through the CPF Investment Scheme (CPFIS): The CPFIS allows you to invest your OA and SA savings in a variety of instruments such as shares, bonds, and unit trusts. This can be a good way to potentially earn higher returns than the standard CPF interest rates. However, it’s crucial to understand the risks involved in investment and choose instruments that align with your risk appetite and financial goals.

- Prudent Financial Planning and Investment Outside of CPF: Diversifying your retirement savings by investing outside the CPF system can also be a wise strategy. This could include investments in stocks, bonds, mutual funds, or real estate. Effective financial planning and smart investment choices can help you build a robust retirement fund. For strategies on reducing your taxable income, which is an essential aspect of financial planning, consider reading my article on how you can reduce income tax in Singapore.

- Balancing CPF Strategies with Other Retirement Plans: It’s important to balance CPF strategies with other retirement plans, such as employer-provided pension plans, annuities, or individual retirement accounts. A well-rounded retirement plan takes into account various sources of income and investment, ensuring a stable and comfortable retirement phase.

By exploring these alternatives, you can develop a comprehensive retirement savings plan that goes beyond CPF Shielding. Each of these strategies has its own set of advantages and considerations, and they can be effectively combined to create a robust retirement financial plan.

Expert Opinions: Financial Experts on CPF Shielding

Financial experts recognize CPF Shielding as a legitimate strategy that utilizes existing CPF schemes to optimize retirement savings. This strategy, while slightly deviating from the default approach, aligns with the policy intent of ensuring sufficient retirement income through CPF LIFE. However, experts caution against potential misuse and emphasize understanding the risks involved.

For instance, CPF Shielding typically involves investing your Special Account (SA) savings, which could expose you to risks of mis-selling. You might be recommended expensive or higher-risk investment instruments without fully comprehending the associated risks or costs. Such investments could lead to losses that outweigh the benefits of SA Shielding. Experts often recommend investing in low-risk and low-cost options like short-term Singapore treasury bills or government bonds, focusing on safety over returns.

The intent of CPF Shielding is to optimize CPF savings to earn higher returns, but it should not compromise the primary goal of CPF, which is to provide a steady stream of income during retirement. Therefore, it’s crucial to ensure that your Retirement Account (RA) has enough funds for CPF LIFE payouts. Financial advisors are encouraged to explain the risks of CPF Shielding to their clients comprehensively, as the CPF Board has heightened its alert on this practice.

FAQs on CPF Shielding: Addressing Common Queries About CPF Shielding

What Are the Risks of SA Shielding?

SA Shielding, while beneficial in maximizing CPF returns, carries inherent risks. If you choose to invest your SA funds in unit trusts or other investment vehicles, you may incur capital losses due to market conditions, management fees, and transaction fees. It’s important to select low-risk funds to minimize the likelihood of incurring such losses. Additionally, regardless of the investment choice for SA Shielding, you will forfeit the CPF interest for the period your funds are invested, which can be significant.

What Investment Options are Available for SA Shielding?

Upon turning 55 and implementing CPF Shielding, you can invest your SA funds in various products like unit trusts, investment-linked insurance products (ILPs), annuities, endowment policies, Singapore Government Bonds (SGBs), Treasury Bills (T-bills), Exchange-Traded Funds (ETFs), fixed deposits, stocks, Real Estate Investment Trusts (REITs), and bonds. Each product varies in risk and the maximum investible savings.

What Are the Downsides of CPF Shielding?

The main downsides of CPF Shielding include potential high transaction fees associated with investment products used for shielding and the risks involved in these investments. Shielding involves the buying and selling of funds after the CPF Board creates your RA, which may not seem risky, but depending on the investment choice, there could be high-risk factors leading to losses. Additionally, the CPF Board has indicated that it might alter its rules to address the misuse of this strategy.

What Are the Best Practices Recommended by the CPF Board?

The CPF Board recommends careful consideration before executing CPF Shielding. Account holders should seek advice before making large-sum withdrawals. Filling up the SA to earn a higher interest rate of 4% is advisable, as topping it up maximizes the interest earned, increasing retirement savings and monthly payouts. Early top-ups to the SA are also recommended to leverage the power of compounding interest.

Conclusion: Unlocking the Power of CPF Shielding for a Secure Retirement

In summary, CPF Shielding is a cornerstone strategy in the realm of retirement planning in Singapore. This approach unlocks the potential of your CPF savings, transforming your retirement journey into one of financial comfort and security. By strategically managing your CPF accounts, particularly through CPF Shielding, you can significantly boost the interest earnings of your retirement funds, ensuring a more prosperous and worry-free retirement phase.

Understanding and utilizing CPF Shielding is more than just a financial maneuver; it’s a smart investment into your future. This technique, effectively harnessing the benefits of the CPF system, underscores the importance of proactive financial planning for Singaporeans. With CPF Shielding, you’re not just saving for retirement; you’re optimizing your CPF OA and SA for maximum growth, leveraging high-interest rates, and paving the way for a retirement lifestyle that you aspire to.

For Singaporeans nearing retirement age, CPF Shielding stands out as an essential tool to maximize their CPF savings. This strategy is particularly beneficial for those looking to enhance their retirement income, reduce taxable income, and make the most of their CPF contributions. As you navigate the complexities of retirement planning, remember that CPF Shielding is a powerful ally, offering a straightforward yet effective way to increase your financial resilience.

Comments (5)

Patricksays:

January 27, 2024 at 5:58 amHi Eugene,

Its a good suggestion to move OA money into SA as early as possible to start earning the higher interest. But as the transfer is irreversible, its very important that each individual must ensure that this money is money that he / she does not need for home loan payment or other needs.

Your article however missed the whole essence of “shielding”.

When the RA is created for individuals turning 55, CPF will move money from their SA into the RA. If there was insufficient money in the SA, money from their OA will be taken to make up the shortfall to make the full retirement sum (FRS).

SA gives 4%, RA gives 4% so there is no gain from moving money from SA to RA. What people want to shield is their SA from being moved into the RA. People would rather the CPF take their money from their OA than their SA. So they do shielding! Shielding is thus to “protect” their SA from being taken and put into their RA.

The cash rich ones have also shielded their OA on top of shielding their SA.

When people mention shielding, they are referring to shielding their SA savings.

Also when people transfer their OA funds to their SA, they do not enjoy tax relief. Tax relief applies only to cash top ups to the SA, MA (for those below 55) and for MA and RA for those 55 and above.

Hope the above clarifies.

Eugene Chaisays:

January 28, 2024 at 7:07 amHi Patrick,

Thanks for sharing across all these information. You are absolutely right, I made a lot of mistakes when writing this blog and thus have reworked the entire blog.

Eugene Tansays:

January 28, 2024 at 1:18 amTransferring oa to sa don’t give u tax saving, topping up your sa give u tax saving. The shielding is to protect your sa interest not your oa interest, the whole idea is somewhat confusing

CXsays:

January 28, 2024 at 4:19 amHi Eugene, while the concept of transferring OA to SA to earn higher interest is spot on, your concept on forming of RA and cpf shielding seems to be off. Firstly It doesn’t matter if OA or SA is of higher balance, RA will always be formed with SA first and any shortfall from OA, regardless of balance in either account. Secondly incorrect cpf shielding is commonly referring to shielding of SA, not OA. How u shield? Just before your 55 birthday, use your SA to buy funds or equivalent. After 55 birthday and RA formed, sell your funds and mone returns to your SA. In this way, u maximised the quantum of money earning 4% interest in both SA and RA.

Eugene Chaisays:

January 28, 2024 at 7:08 amHey CX,

Thanks for your comment. You are absolutely right, thanks for correcting me. I made a lot mistakes when working on this blog and I’ve done more research and reworked the content. Appreciate the candidness!