So, you’ve decided to take the plunge into the exciting world of investing, and you’ve got your eyes set on opening a Central Depository Account (CDP). Congratulations on this pivotal decision! If you’re here, it’s likely because you’re keen on not just trading stocks, Singapore Savings Bonds (SSBs), and Treasury Bills (T-Bills) but also holding them securely in your own financial space, steering clear of the broker-dominated custodian account route. And if you’re pondering between a CDP account and a custodian account, check out my blog post on CDP vs Custodian for a deep dive first before committing to a CDP account.

In this guide, we’re about to embark on a journey that goes beyond the conventional. You’re not just entering the stock market; you’re claiming ownership, seeking control, and opting for a personalized approach to managing your investments. Opening a CDP account isn’t just a step in your financial journey; it’s a statement of autonomy and a strategic move towards a more hands-on investment experience.

So, buckle up and get ready to discover the ins and outs of creating your very own CDP account. This guide is tailor-made for individuals like you, enthusiasts who are ready to break free from the norm and take charge of their financial destiny. Let’s dive into the empowering world of CDP accounts, where your stocks, SSBs, and T-Bills find a home under your direct ownership. Your financial journey is about to take a thrilling turn – let’s make it one to remember!

Table of Contents

What is a CDP account?

Before we jump into the nitty-gritty, let’s understand what CDP accounts are. Managed by the Singapore Exchange (SGX), a CDP account is your gateway to directly owning stocks listed on the SGX. It’s not just for stocks – you can also house T-bills, SSBs, and corporate bonds listed on the SGX in this financial haven.

Having your stocks in a CDP account has perks – you’ll get invitations to Annual General Meetings (AGMs) and stay in the loop about corporate actions, like exciting rights issues. It’s like having a backstage pass to the stock market concert.

In a CDP account, the shares are held directly in your name. This means that even if the broker you’re using faces financial difficulties or bankruptcy, your shares remain safeguarded within the CDP.

This offers an additional layer of security, assuring you that your investments won’t be impacted by such circumstances.

What you need before opening a CDP account?

Now, let’s talk prerequisites. To open a CDP account, you need to be 18 or above and not an undischarged bankrupt. Gather your essentials:

- Singapore Bank Account: Your financial home base.

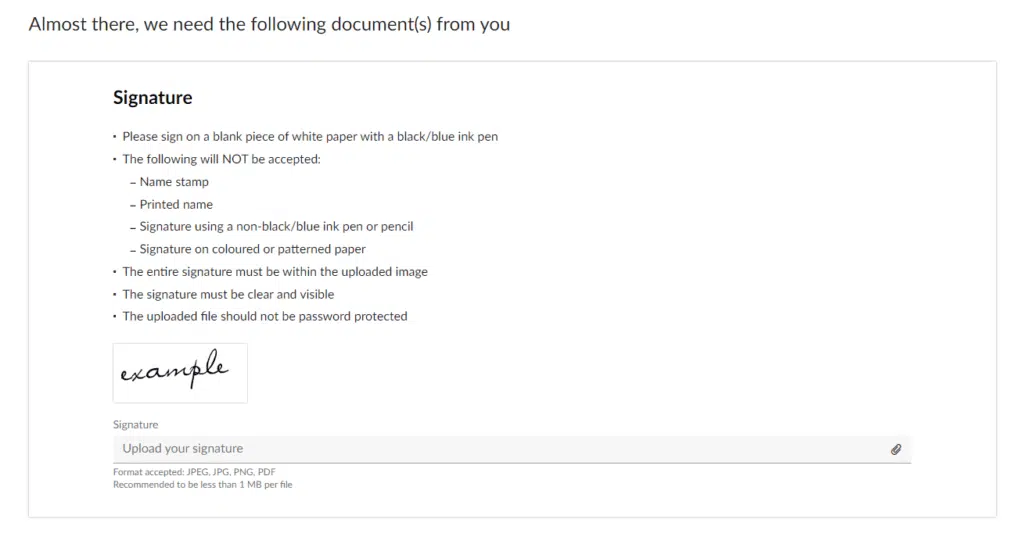

- Photographed/Scanned Copy of Signature: It’s like your financial autograph.

- Tax Identification Number (TIN): Uncle Sam wants to know you too.

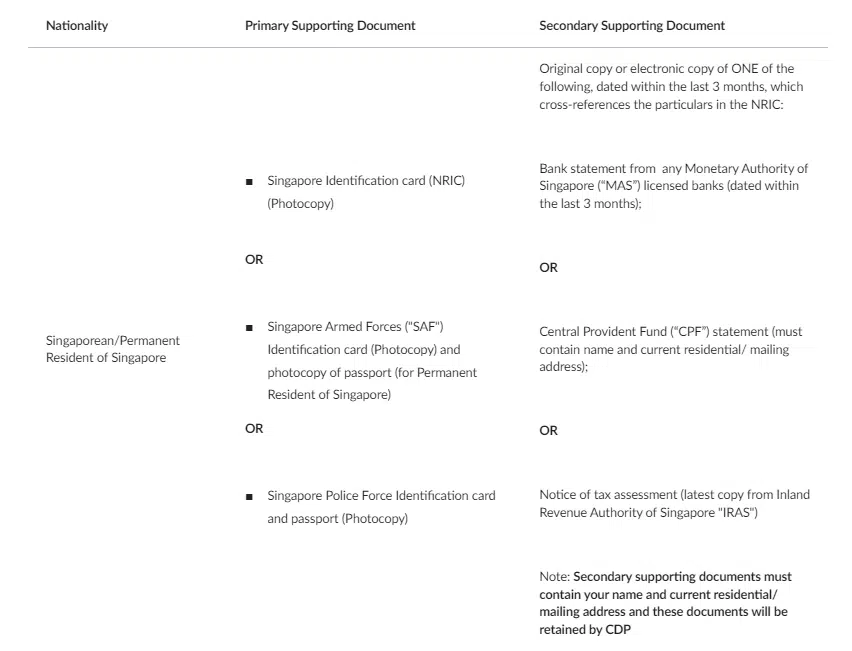

If you’re not a Singapore citizen or PR, you’ll need a bit more details:

- Passport or Malaysian IC

- Work Pass

- Recent Secondary Support Documents: Pick one from a local bank statement, CPF statement, or IRAS statement, all dated within the past 3 months.

Apply for CDP account using Singpass Myinfo

Step 1: Select Sign-up method

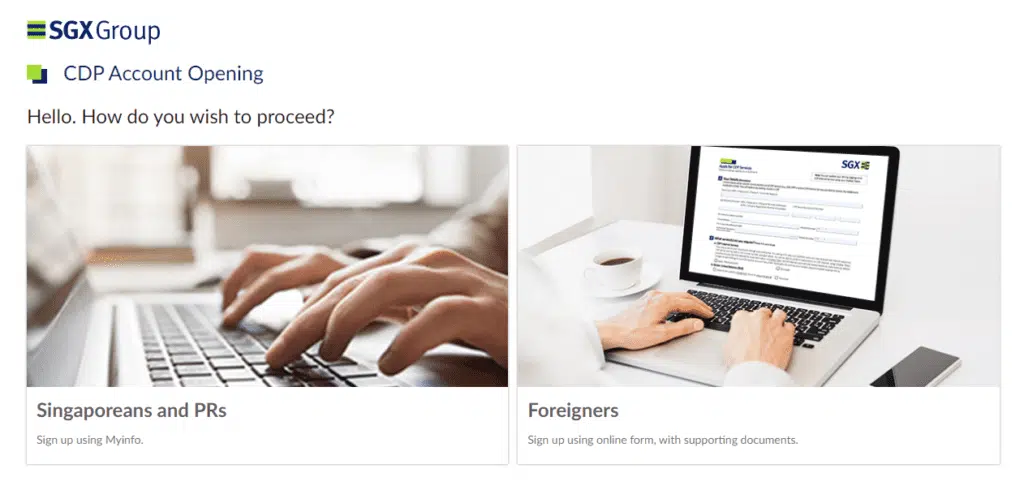

You may create the CDP account online through SGX.

There are two methods – Singaporeans & PRs, Foreigners. For Singaporeans and PRs, it is a lot more straightforward as Myinfo helps to retrieve information from Singpass to populate the information quickly, whereas the latter will require more supporting documents.

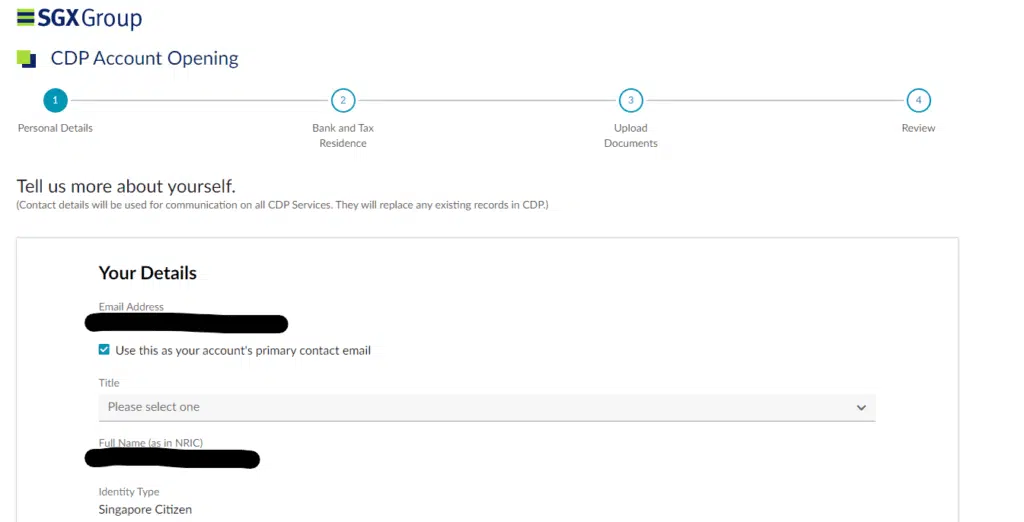

Step 2: Fill in Personal Details

Once you have selected, Singpass Myinfo, the CDP system should have populated all the required fields such as Full Name, NRIC, Mobile Number etc.

At this stage, do check through and verify that all the information are correct. If you realised any discrepancies or choose to change any personal details, please do it on the Myinfo application rather than on the CDP system. This will make sure that there are no further complications.

If you’re a foreigner, you simply have to fill in the form manually, the steps are exactly the same.

Pretty neat huh?

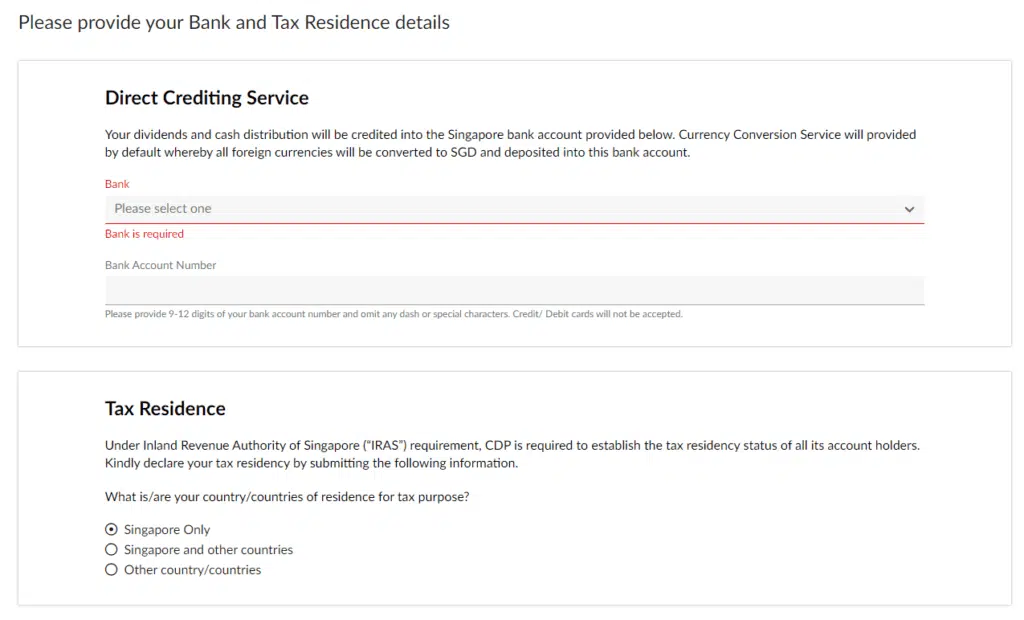

Step 3: Fill in Bank & Tax Residence details

Next, select a local bank account. The eligible bank accounts you can use to set up your CDP account are as follows:

- Citibank NA (Citibank)

- DBS Bank Ltd (DBS/POSB)

- Malayan Banking Berhad (Maybank)

- Oversea-Chinese Banking Corporation Limited (OCBC)

- Standard Chartered Bank (SCB)

- The Hongkong and Shanghai Banking Corporation Limited (HSBC)

- United Overseas Bank Limited (UOB)

Do note that credit and debit cards are not accepted.

Under Inland Revenue Authority of Singapore (“IRAS”) requirement, CDP is required to establish the tax residency status of all its account holders. If your tax residency is Singapore only, it is pretty straightforward. However, if you have a tax residency status outside Singapore, you have to provide the following information:

- Country of Tax Residency

- Tax Identification Number (TIN)

- and any other documents required by CDP.

Step 4: Upload Documents

Following this step, it’s time to gather and submit the essential documents that will complete your Central Depository Account (CDP) application.

If you’re a Singapore citizen and not a US tax resident, the process is streamlined – a simple upload of your signature is all that’s needed to validate your application.

However, for those with different tax residency or US tax residents, a bit more documentation is required. This includes uploading both primary and secondary supporting documents. The primary documents establish your identity, like your passport or Malaysian IC, while secondary documents, dated within the past three months, can be a bank statement from a local bank, a statement from the Central Provident Fund (CPF), or a statement from the Inland Revenue Authority of Singapore (IRAS).

This step ensures that your application is thorough and complies with the necessary regulations, giving you the green light to move forward in the exciting process of establishing your CDP account. So, get those documents ready and let’s bring your CDP account one step closer to reality!

Step 5: Review application

Take a moment to meticulously review all the details you’ve entered and ensure that every document uploaded is spot on. This is your last chance to double-check, ensuring that your application reflects the accurate information needed to set up your Central Depository Account (CDP).

Once you’ve given the green light to all the details, it’s time to make it official. Check those declaration boxes – your virtual signature to seal the deal.

Once your application is approved, you’ll receive a confirmation, along with the golden ticket – further instructions on accessing and utilizing your newly minted CDP account. For more insights on getting started with investments, check out my personal journey – From Savings to Investments: How I Got Started on My Investment Journey in Singapore.

Frequently Asked Questions (FAQ)

Is opening a CDP account free?

Yes, opening a CDP account is absolutely free. There are no charges for the account’s creation or maintenance. However, it’s essential to note that while the CDP account itself is cost-free, there may be trading and settlement fees imposed by SGX when buying or selling securities.

Do I need a CDP account to buy Singapore Savings Bonds or T-bills?

Yes, if you intend to purchase Singapore Savings Bonds (SSBs) or Treasury Bills (T-Bills), you will need an individual CDP Securities account. Other types of CDP accounts, such as joint accounts, are not eligible to hold these specific securities.

What do I need before I can start trading?

To commence trading, you’ll need a trading account with a broker as well as a CDP Securities Account. Ensure you link your trading account with CDP by completing the account linkage form and submitting it to your broker. You have the flexibility to link more than one broker to your CDP account, providing options for different trading platforms.

What happens to my CDP account after death?

In the unfortunate event of the account holder’s demise, the CDP account will be subject to estate distribution procedures. The process involves legal and administrative steps to transfer ownership or liquidate the assets in the CDP account according to the deceased individual’s will or the applicable laws of succession. It’s advisable to consult with legal professionals and the CDP for guidance in handling such situations.

Final Words: Should you open CDP account?

By opening a CDP account, you’re not just entering the stock market; you’re seizing control of your financial destiny. Enjoy the benefits of direct ownership, streamlined portfolio management, and exclusive shareholder entitlements. From trading stocks to securing Singapore Savings Bonds (SSBs) and Treasury Bills (T-Bills), a CDP account empowers you to shape your investment journey with confidence.

Gain autonomy over your financial portfolio, eliminate intermediaries, and enjoy cost-effective transactions. Your CDP account isn’t just a financial tool; it’s your key to a world of smart investments and strategic financial decisions. Say goodbye to limitations and hello to a future where your financial success is in your hands.

Make the wise choice today – open a CDP account and embark on a journey towards financial freedom, flexibility, and personalized wealth creation. Your financial adventure begins now!

Leave a Reply