At the crossroads of financial planning and life’s unpredictable journey stands your whole life insurance policy. More than just a safety net, it represents a complex blend of long-term security and investment strategy. But what happens when life throws a curveball, leading you to consider the significant step of surrendering your policy? This crucial decision is not just about numbers; it’s about understanding the implications, exploring alternatives, and aligning choices with your evolving life story.

This article aims to dissect the factors involved in this critical choice, providing a detailed understanding for policyholders.

Table of Contents

Introduction to Whole Life Insurance

Whole life insurance policies are designed for lifelong coverage, offering stability with fixed premiums and a savings component. This unique combination of insurance and investment makes it an integral part of long-term financial planning. Drawing on insights from financial experts, it’s evident that these policies are particularly beneficial for individuals seeking predictable costs and guaranteed benefits over a long period.

But when circumstances change, policyholders are faced with a pivotal decision: should they surrender their policy?

Understanding Cash Value in Life Insurance

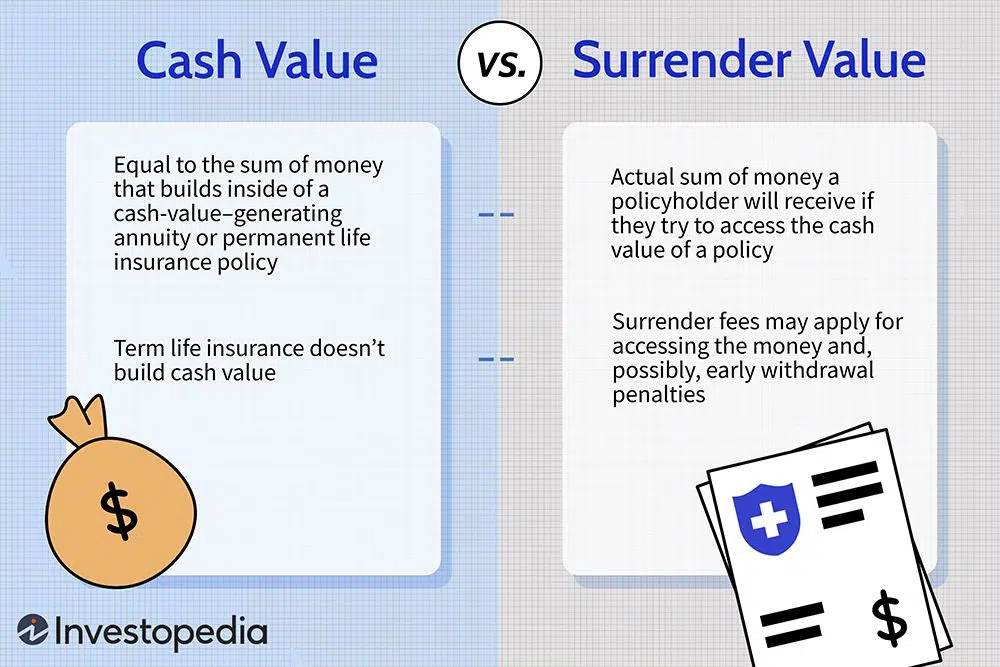

When delving into the realm of life insurance, the concept of ‘cash value’ is pivotal, especially for permanent life insurance policies. According to industry experts, this feature not only provides financial flexibility but also contributes to the policy’s overall value, making it an appealing choice for long-term financial security.

For a deeper understanding of cash value and its role in life insurance policies, consider reading this comprehensive guide from Investopedia

But what exactly is cash value, and how does it differ between various types of life insurance policies?

Cash Value in Layman

The cash value in a life insurance policy is essentially a savings component. It’s a portion of your premiums that is set aside within the policy and grows over time. Predominantly found in permanent life insurance policies like whole life or universal life, cash value is a distinguishing feature that sets these policies apart from term life insurance.

Accumulation of Cash Value

So how does this cash surrender value grow?

Cash value accumulation occurs as a part of your premium payments are allocated to this component. Over time, this cash value grows, generally at a rate determined by the insurance company.

It might be a guaranteed rate, or in some cases, a non-guaranteed rate that depends on various factors including company performance. Additionally, some policies may offer dividends that can be added to the cash value, though these are not always guaranteed.

Implications for Policyholders

Citing financial advisors, it’s crucial for policyholders to understand these implications thoroughly before accessing their policy’s cash value. For those holding these policies, the cash value component offers several financial advantages:

- Flexibility: Unlike term life insurance, the cash value in a permanent life insurance policy provides a level of flexibility. You can borrow against it, use it to pay premiums, or in certain circumstances, surrender the policy and receive the cash value.

- Financial Asset: The cash value can be a significant asset in your financial planning. It grows tax-deferred and can be accessed under certain conditions.

- Impact on Death Benefit and Policy: It’s important to note that accessing the cash value, whether through loans or withdrawals, can affect the death benefit. For example, loans against your policy’s cash value typically reduce the death benefit unless paid back. Additionally, withdrawals or surrendering the policy for its cash value can significantly alter the policy’s performance and benefits.

Pros and Cons of Whole Life Insurance

These policies offer a guaranteed death benefit and a cash value component that grows over time. However, they come with higher premiums compared to term life insurance and may not always offer the best investment returns. Experts suggest that these policies are best suited for individuals with specific long-term financial goals and the ability to commit to the premium payments over time.

Understanding the pros and cons of whole life insurance is essential to determine if it’s the right choice for your financial strategy.

Pros of Whole Life Insurance:

- Lifetime Coverage: Whole life insurance provides coverage for your entire life, as long as premiums are paid.

- Cash Value Component: A portion of your premiums builds a cash value over time, which can grow at a guaranteed rate.

- Policy Loans: Policyholders can borrow against the cash value, potentially useful in financial emergencies.

- Fixed Premiums: Premiums are generally fixed and do not increase with age or health changes.

- Death Benefit: Beneficiaries receive a death benefit, which can be important for estate planning or leaving an inheritance.

Cons of Whole Life Insurance:

- Cost: Whole life insurance typically has higher premiums compared to term life insurance, making it less affordable for some people.

- Complexity: These policies can be more complex than term life insurance, with various factors affecting the cash value and overall benefits.

- Investment Returns: The return on the cash value component is generally lower compared to other investment options.

- Inflexibility: Once set, the death benefit and premiums generally cannot be altered, which may be a disadvantage if your financial situation changes.

- Opportunity Cost: The higher premiums could potentially be invested elsewhere for potentially higher returns.

It’s important to weigh these factors against your financial goals, current financial situation, and long-term planning needs. Whole life insurance can be a beneficial part of a comprehensive financial plan, especially for those with long-term dependents or significant estate planning considerations. However, for those seeking a more affordable and straightforward option, term life insurance might be more appropriate. Consulting with a financial advisor can provide personalized guidance based on your specific circumstances.

Reasons to Surrender Whole Life Insurance

Deciding to surrender your whole life insurance policy is often a heart-wrenching choice, steeped in deep personal and financial considerations. It’s a path walked by those facing profound changes in life, where the harmony between financial planning and personal circumstances becomes discordant.

Understanding why others have walked this path can shed light on your own journey, helping you decide if this is the step you need to take.

Here are some of the most common reasons:

Desire for Liquidity

Some policyholders may desire more liquidity in their financial portfolio. Especially for those approaching retirement or in need of immediate funds, surrendering a whole life insurance policy can provide a significant lump sum.

This can be redirected into other investments such as investing in ETFs or used for urgent expenses, offering a flexible solution during financial changes.

Financial Hardship

Financial hardship is one of the most compelling reasons for surrendering a whole life insurance policy. This scenario is not uncommon in today’s economic climate. When faced with economic challenges, such as job loss, significant debt, or unexpected expenses, maintaining life insurance premiums can become burdensome.

For instance, consider the case of Michael, a small business owner whose enterprise has suffered due to market downturns. Struggling to keep his business afloat and manage personal expenses, he views the cash value of his life insurance as a necessary financial buffer. Surrendering the policy, albeit emotionally difficult, becomes a crucial step in stabilizing his immediate financial situation, providing a sense of security during turbulent times.

Life Changes Prompting Policy Reevaluation

Significant life changes often necessitate a reevaluation of one’s financial plans, including life insurance.

Emily, for example, purchased a whole life policy when her children were young. Years later, with her children now financially independent and her mortgage paid off, her insurance needs have drastically changed. She decides to surrender her policy, not only because it’s no longer as critical for her family’s financial security but also to free up funds for her retirement plans and travel dreams.

Evolving Financial Strategies and Insurance

As individuals become more financially savvy, they often reconsider the role of life insurance in their investment portfolio.

Consider the story of Alex, an engineer with a keen interest in stock market investments. Initially, Alex viewed his whole life policy as a secure, long-term investment. However, over time, he realizes that the policy’s returns are modest compared to the potential gains from direct stock market investments. Surrendering his policy, therefore, becomes a strategic move to reallocate his funds into more aggressive investment avenues such as investing in the VWRA ETF, aligning better with his financial goals and risk appetite.

For those considering diversifying their investment portfolio beyond whole life insurance, understanding all available options is crucial. Discover more in my article on The Best Investment Options for Beginners in Singapore, which provides valuable insights for those just starting out in investment.

Pursuing Better Investment Opportunities

The quest for higher returns can lead policyholders to surrender their whole life policies.

Take Laura, an entrepreneur who discovers an opportunity to invest in a high-growth tech startup. Given the potential for substantial returns, she decides to surrender her whole life policy, which has been yielding modest growth. This decision allows her to reinvest the cash value into the startup, aligning her financial resources with an opportunity that she believes has greater growth potential.

Concerns Over Policy Performance

In some cases, policyholders may be dissatisfied with their policy’s performance.

John, a retired teacher, finds that the dividends from his whole life policy are lower than anticipated, affecting the overall growth of the policy’s cash value. After thorough consideration, he decides to surrender the policy and invest the cash value in a more diverse and potentially more lucrative portfolio, seeking better returns to supplement his retirement income.

The Weight of Premium Payments

Continuing with premium payments can become a financial burden, especially in changing economic circumstances.

Helen, a recent widow, finds herself in a tight financial spot, having to manage her living expenses on a reduced income. The ongoing premium payments for her whole life insurance policy, once manageable, now pose a significant strain on her budget. After careful consideration, she decides to surrender the policy, easing her financial burden and allowing her to focus her limited resources on immediate needs.

Shifting Estate Planning Needs

Changes in estate planning can also lead to the surrender of a whole life policy.

Mark and his wife, after reassessing their estate plan, realize their assets are more than sufficient to provide for their heirs. The whole life insurance policy, initially a crucial part of their estate planning, is now redundant. Surrendering the policy simplifies their estate, reduces administrative burdens, and frees up financial resources for other uses.

Financial Implications of Surrendering

When considering the financial implications of surrendering a whole life insurance policy, it’s important to delve into the details to understand the full impact of this decision. It’s advisable to consult authoritative financial sources or professionals to understand the specific terms of your policy and the potential financial impact of surrendering.

Understanding the full spectrum of life insurance and its role in financial security is essential. Learn more about this in my detailed guide on The Importance of Life Insurance in Singapore, which offers a broader perspective on providing financial security for your loved ones.

These are the few financial implications of surrendering:

Cash Value Accumulation

The surrender value of a policy largely hinges on its accumulated cash value. This is the portion of your premiums that has been set aside and has grown over time. However, it’s important to note that in newer policies, this cash value might not be as substantial as in older policies, due to the time needed for accumulation. In the early years of a policy, a significant portion of premiums goes towards insurance costs and fees, leaving less to contribute to the cash value. Thus, if you surrender a policy early in its term, the return might be lower than expected.

Surrender Charges

Another critical factor to consider is surrender charges. These are fees levied by the insurance company if a policy is surrendered before a certain period, usually within the first few years of the policy. Surrender charges are designed to recoup some of the insurer’s initial expenses and can significantly reduce the cash value you receive upon surrendering. These charges typically decrease over time, so the longer you hold the policy, the lower the surrender charges will be.

Lost Future Benefits

Surrendering a whole life insurance policy also means giving up on its future benefits, most notably the death benefit. This is a significant consideration, especially if the policy was initially purchased to provide financial security for beneficiaries. Upon surrender, not only is the death benefit forfeited, but also the potential for the policy’s cash value to continue growing. For those who have held policies for a considerable time, this could mean losing out on a substantial financial asset that could have been passed on to beneficiaries or used later in life.

Surrendering vs Keeping Your Whole Life Insurance Policy

When contemplating whether to surrender or keep your whole life insurance policy, weighing the pros and cons is vital. While surrendering the policy might offer immediate financial relief, such as unlocking the cash value for urgent needs, it’s important to consider the long-term implications.

Keeping the policy ensures ongoing life coverage and allows the cash value to potentially grow over time. If you can comfortably afford the premiums, maintaining the policy might offer more substantial benefits in the long run, especially considering the lifetime coverage and financial stability it provides.

This decision shouldn’t be based on a temporary financial crunch alone; it requires considering long-term financial goals and the implications of giving up a policy that has been part of your financial plan, potentially for many years.

For example, let’s consider the case of Emma, a 45-year-old professional. She’s been paying premiums on her whole life policy for 20 years. Recently, Emma encountered financial challenges due to unexpected healthcare costs. While surrendering her policy promises immediate cash, it also means losing out on the death benefit she planned to leave for her children and the cash value that has been accumulating.

In contrast, if she can find a way to continue paying her premiums, perhaps by cutting back on other expenses or using a temporary loan, she can maintain the policy’s benefits, which may be more valuable in the long run.

Alternatives to Surrendering

Policy Loans and Partial Surrenders

Before choosing to surrender, policyholders should explore alternatives like policy loans or partial surrenders. A policy loan allows you to borrow against the cash value of your policy. This can be a lifeline in times of financial need, providing quick access to funds without losing your insurance coverage. However, it’s important to understand that the loan amount plus interest will be deducted from the death benefit if not repaid.

Consider the case of John, who needed funds for his daughter’s college tuition. Instead of surrendering his policy, he chose a policy loan. This approach provided him with the necessary funds while maintaining the policy’s death benefit for future security.

Partial surrenders, another option, involve withdrawing a part of the cash value. This reduces the death benefit but allows you to keep some level of coverage. It’s a balancing act between immediate cash needs and long-term insurance benefits.

Expert Insights on Policy Surrender

Consulting with a financial advisor is crucial when considering surrendering a policy. These experts can provide insights tailored to your unique financial situation. For instance, they can help analyze how the surrender of a policy would impact your tax situation, retirement planning, and estate strategy.

Tax Consequences of Surrendering

Understanding the tax implications is vital. Surrendering a policy could lead to significant taxable income, especially if the cash surrender value exceeds the premiums paid. This tax impact could be a deciding factor in whether to surrender the policy. For instance, if the tax burden significantly reduces the net cash received, it might make more sense to keep the policy or explore other alternatives.

Grasp the finer details of tax implications related to surrendering your life insurance by exploring Forbes’ expert article.

Options Besides Surrendering

1035 Exchange: A Strategic Move

A 1035 exchange is a tax-free way to replace your current policy with a new one that better suits your needs. This option is particularly useful if your insurance needs have changed or if you find a policy with better features or lower premiums. For example, if a policyholder finds a new policy offering similar benefits at a lower cost, a 1035 exchange can be a smart financial move.

Making the Decision

When deciding whether to surrender your whole life insurance policy, consider all factors: your current financial needs, long-term financial goals, tax implications, and the benefits of keeping the policy. This decision should not be made in haste. Reflect on your unique situation, consult with financial experts, and explore all alternatives to ensure that your choice aligns with both your immediate and future financial objectives.

Each situation is unique, and what might be the right decision for one person could be different for another. It’s all about balancing the need for immediate financial relief with the potential long-term benefits of keeping a whole life insurance policy.

Conclusion

In conclusion, understanding the nuances of whole life insurance policies is pivotal for making informed financial decisions. Whether it’s appreciating the long-term security and cash value accumulation these policies offer, or evaluating the potential need for surrendering them in light of changing personal circumstances, it’s crucial to approach these decisions with a comprehensive perspective.

Whole life insurance, with its dual benefits of lifelong coverage and a growing cash value, stands as a robust pillar in the architecture of financial planning. It offers a unique blend of stability and flexibility, acting as a safeguard for your beneficiaries while also serving as a financial asset with potential growth. However, it’s important to balance these benefits against factors like cost, complexity, and the possible need for liquidity.

For those considering surrendering their policy, remember that alternatives like policy loans or partial surrenders might offer a middle ground, providing financial relief while retaining valuable insurance benefits. Consulting with financial experts and understanding the tax implications further solidify the foundation for a well-informed decision.

Every financial journey is unique, and whole life insurance policies are tools that, when used wisely, can significantly contribute to achieving long-term financial security and peace of mind. Whether you decide to maintain your policy, leverage its cash value, or consider surrendering, the key is to align your decision with your overall financial strategy and life goals.

Leave a Reply