March is rolling in, and with it, the less-than-exciting arrival of tax season. Let’s face it—seeing a chunk of your hard-earned money disappear into the abyss of taxes is nobody’s idea of a good time. And here’s the kicker—things seem to be getting pricier all around. With the rising cost of GST and inflation, it feels like every time you turn around, prices are creeping up. And if you’re like me, fresh out of NTU and just starting to dip your toes into the working world, that sting of income tax hits even harder.

I vividly remember the shock of my first paycheck after graduation. Sure, landing a job was a win, but when I saw how much was sliced off for taxes, it was a reality check. It’s not just about stretching the paycheck to cover bills and daily expenses; it’s about grappling with the fact that a significant chunk is earmarked for taxes.

As if the increased prices on everything from groceries to a cup of coffee weren’t enough, there it was—a noticeable dent in the take-home pay. With the cost of living on the rise, every dollar matters, and losing a substantial portion to income tax can feel like a gut punch.

But here’s the thing: understanding the tax game can turn the tables a bit. It’s not about magic tricks or complex financial maneuvers; it’s about being savvy and making the system work for you. In this guide, we’ll cut through the confusion and get real about tax season. But fear not—there are strategies, relief schemes, and smart moves that can help you keep more of your money where it belongs: in your pocket. Read on more to find out on the 7 ways to reduce your personal income tax in Singapore.

Table of Contents

Process for Filing and Paying Personal Income Taxes

Before we jump into the nitty-gritty of various tax relief schemes, let’s take a quick refresher on Personal Income Tax 101 for the 2024 tax season. Here’s the rundown of what to expect:

Timeline:

- Feb to Mar 2024: Filing Notification

- IRAS will shoot you a message—whether through SMS, email, or good old-fashioned mail—to inform you about the need to file income tax for the Year of Assessment (YA) 2024. Spoiler alert: If your 2023 income crossed the $22,000 mark, filing is on the agenda.

- 1 Mar 2024 – 18 Apr 2024: File Your Income Tax

- It’s action time. Head to myTaxPortal and e-file your income tax if you fall under the filing requirements.

- From end Apr 2024: Pay Your Income Tax

- Brace yourself for the Notice of Assessment, aka your tax bill, hitting your mailbox by the end of April 2024. You’ve got a month to settle the bill, and you can do it hassle-free through GIRO, AXS station, or Internet Banking.

Special Cases:

- No Notification? Check Anyway.

- If the IRAS notification seems to have missed your inbox, no worries. You can double-check your filing status using the IRAS Filing Checker or simply log in to myTaxPortal to confirm whether filing is required.

- No-Filing Service (NFS)?

- If you’re in the fortunate NFS category, meaning IRAS has pre-filled your income details, take a moment to revel in the shiok feeling. However, the ball is in your court to log in to myTaxPortal and ensure all the details are spot on. If there’s any discrepancy, don’t forget to e-file your tax return via the same portal.

So, whether you’re gearing up for a filing marathon or enjoying the NFS perks, understanding these key dates and processes will help you breeze through the 2024 tax season. Time to get tax-savvy!

What is under Taxable Income?

Before we dive into the 7 ways to reduce personal income tax, understanding what constitutes taxable income is fundamental to managing your tax liability. Here’s a breakdown of income types:

| Type of Income | Taxable Status | Details |

| Salary from Full-Time Employment, Part-Time Employment, and Freelance Work | Taxable | Earnings from employment, including regular salary and income from freelance projects, are subject to income tax. |

| Salary Bonuses | Taxable | Bonuses received as part of your compensation package, such as performance bonuses or year-end bonuses, are considered taxable income. |

| Rental Income | Taxable | Income earned from renting out property is considered taxable. Distinguish between income tax on rental earnings and property tax on ownership. |

| Compulsory CPF Contributions | Not Taxable | Mandatory contributions to the Central Provident Fund (CPF) are not considered taxable income. Voluntary contributions may have implications for certain tax reliefs. |

| Alimony and Child/Parent Maintenance Payments | Not Fully Taxable | Payments made for alimony or the maintenance of children or parents are generally not taxable for the recipient. Payers may not claim these as deductions. |

| Profits from Shares and Other Investments | Taxable (with exceptions) | Gains from the sale of shares or other investments are typically taxable. Exemptions or reliefs may apply based on the nature and duration of the investment. |

| Payouts from Insurance Policies | Not Fully Taxable (with exceptions) | Amounts received from insurance policies are usually not taxable. Exceptions may exist, especially if the payout is linked to investment components. |

| Lottery Winnings (4D, Toto, etc.) | Not Taxable | Winnings from lotteries, such as 4D and Toto, are generally not taxable. These winnings are considered windfalls rather than regular income. |

While these categories provide a general overview, it’s important to note that specific circumstances may impact your tax liability. For additional clarity on taxable and non-taxable income, refer to the IRAS page dedicated to what is and isn’t taxable in Singapore.

What is My Chargeable Income?

Once you’ve determined your taxable income, the journey doesn’t conclude there.

If you qualify for tax reliefs, these will be deducted from your taxable income, akin to a “discount” applied to the taxable sum. Following the deduction of tax relief amounts, the resulting (lesser) figure represents your chargeable income. This is the value that IRAS utilizes to compute the amount of tax you’re required to pay in the upcoming year.

Expressed in a formula: [Taxable income] – [Tax reliefs] = [Chargeable income]

Ways to Reduce Personal Income Tax

Singaporean tax residents have access to a total of 18 tax reliefs. You can easily determine which schemes you qualify for by utilizing the IRAS’ personal relief checker. It’s important to note that the income tax relief is capped at S$80,000, and certain reliefs are automatically calculated during the tax filing process.

Here are some of the key tax reliefs that you can leverage.

1. CPF-Related Top-Ups

CPF Cash Top-Up Relief

Making voluntary cash top-ups to your Central Provident Fund (CPF) is not just a savvy move for securing your retirement; it’s also a strategic tax planning tool. The CPF Cash Top-Up Relief enables you to claim deductions on the contributed amount, effectively reducing your taxable income. This dual advantage of bolstering your retirement savings while minimizing your tax liability makes it a compelling choice for individuals aiming for long-term financial security.

If you’re wondering why you should consider topping up your CPF, check out my guide on why voluntary CPF top-ups can be beneficial. However, it’s essential to weigh the pros and cons. Discover the reasons I chose not to top up my CPF Special Account. Making an informed decision ensures that your financial moves align with your overall goals.

Contribute to Your Supplementary Retirement Scheme (SRS) Account

Contributions to the Supplementary Retirement Scheme (SRS) offer a parallel avenue for tax relief. By channeling funds into your SRS account, you not only diversify your retirement portfolio but also enjoy immediate tax benefits. The contributions to SRS are deductible from your taxable income, providing a tangible reduction in your overall tax liability. This flexibility in retirement planning aligns with the diverse financial goals of individuals at different life stages.

2. Family-related Relief

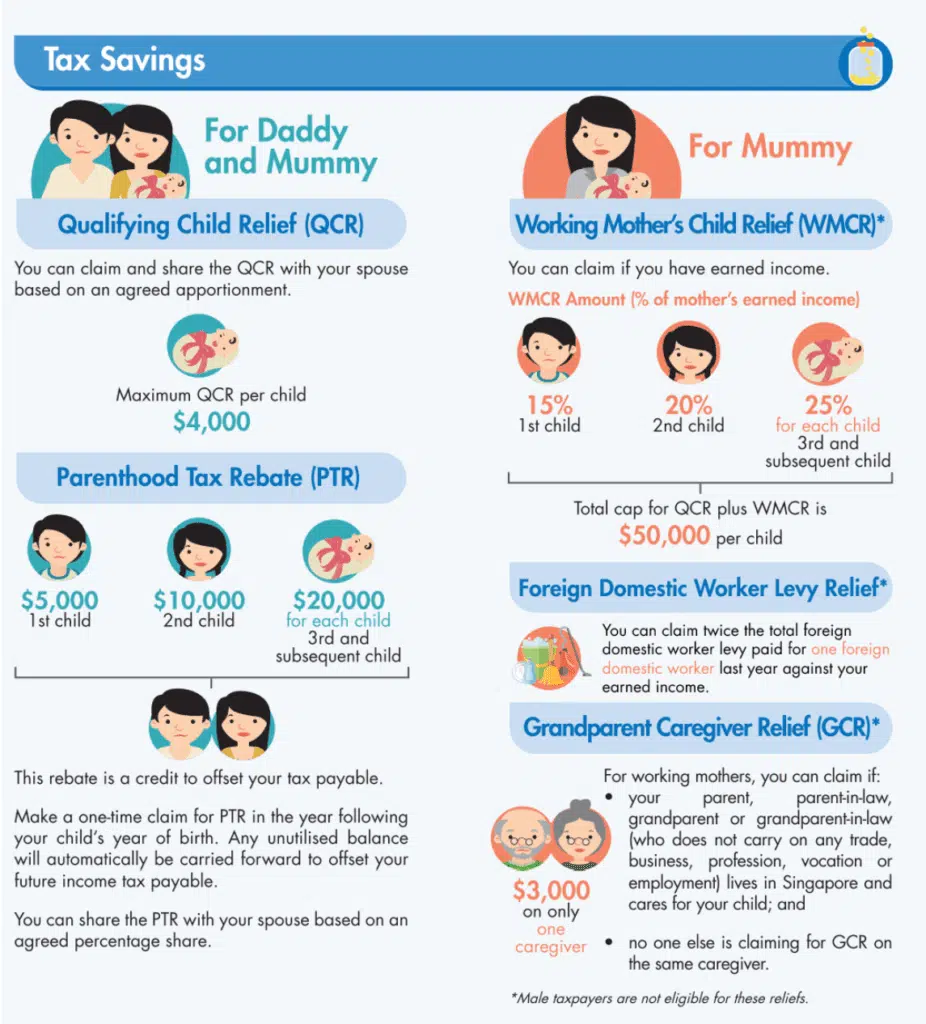

Working Mother’s Child Relief (WMCR)

For working mothers, the Working Mother’s Child Relief (WMCR) is a significant form of support. Designed to alleviate the financial burden associated with raising children, this relief recognizes the dual role of mothers who are not only contributing to the workforce but also nurturing the next generation. The relief extends to employed mothers, self-employed mothers, and those on no-pay leave, offering a comprehensive approach to supporting families.

From 2024 onwards, WMCR will be changed to a fixed sum from being percentage based. Mothers with children born or adopted after 1 January can claim S$8,000 for their first child, S$10,000 for their second child, and S$12,000 for their third and subsequent child. This will be reflected in the 2025 taxes they file.

Qualifying Child Relief (QCR) / Handicapped Child Relief (HCR)

Parents with qualifying children, including those with special needs, can benefit from Qualifying Child Relief (QCR) and Handicapped Child Relief (HCR). These reliefs acknowledge the additional costs and challenges associated with raising children, providing tangible support to families. The differentiation between QCR and HCR ensures that families with diverse needs receive tailored assistance, reflecting the inclusive nature of tax relief initiatives.

Grandparent Caregiver Relief (GCR)

Grandparents playing a pivotal role in caregiving can avail themselves of relief through the Grandparent Caregiver Relief (GCR). Recognizing the intergenerational support system, this relief acknowledges the financial contributions made by grandparents who actively participate in caring for their grandchildren. This not only eases the financial burden on families but also reinforces the importance of family ties in societal well-being.

Foreign Domestic Worker Levy (FDWL) Relief

When managing a household that includes the employment of foreign domestic workers, it comes with various responsibilities, one of which is the Foreign Domestic Worker Levy (FDWL). To navigate these financial commitments, families can explore the support offered through FDWL Relief. This relief mechanism acknowledges the financial responsibilities associated with maintaining domestic assistance, showcasing the government’s understanding of the diverse family structures and the corresponding financial obligations.

For families seeking reliable domestic assistance, services provided by agencies like Homekeeper Maid Agency can be instrumental. These agencies play a crucial role in connecting households with qualified and trustworthy domestic helpers. As families juggle the demands of daily life, having a reputable maid agency can simplify the process of finding suitable domestic help, ensuring a harmonious and well-managed household.

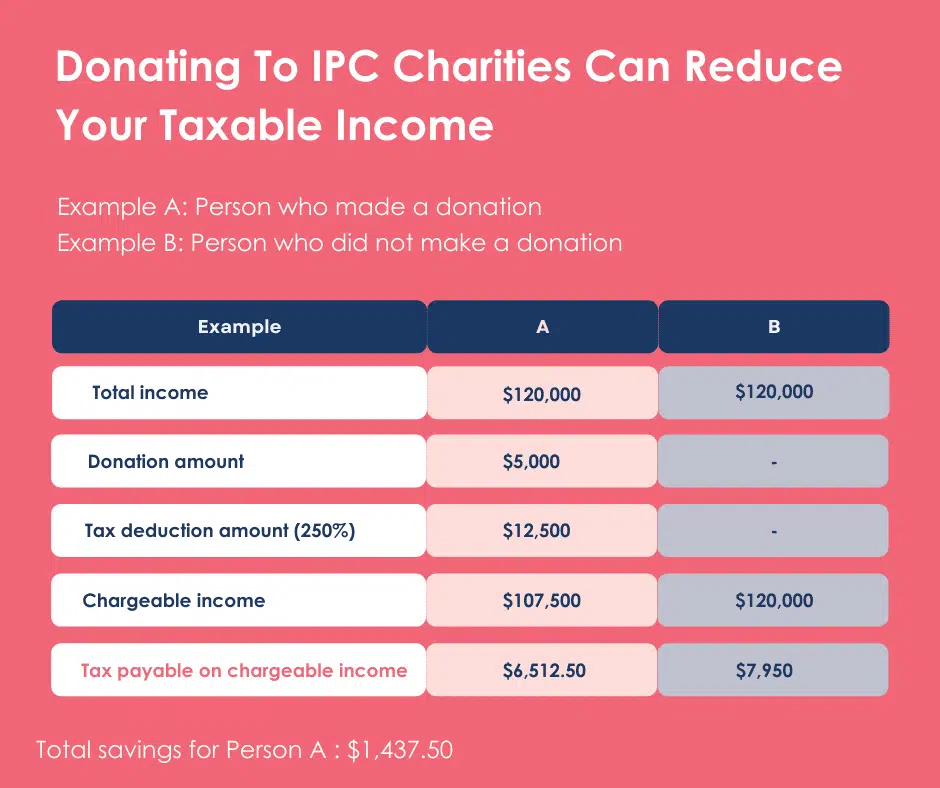

3. Donations

Contributing to registered tax-deductible charities like the Community Chest or approved Institutions of a Public Character offers the benefit of tax deductions—specifically, 2.5 times the qualifying donation amount. This applies not only to cash donations but also extends to other forms of contributions such as shares, computers, artefacts, land, and buildings. The IRAS provides a comprehensive list of applicable donations.

Charitable donations, whether in the form of money, shares, or other assets, wield the potential to create positive societal impact. Beyond the inherent satisfaction of supporting charitable causes, individuals can leverage these contributions to claim relief on their taxable income. This not only fosters a culture of giving but also underscores the shared responsibility of individuals in promoting the well-being of the community.

4. National Servicemen (NSmen) Relief

All operationally ready NSmen, including myself, are entitled to the NSman tax relief, a recognition of our contributions to National Service. This relief is granted based on the national service completed in the previous work year. If NSmen completed National Service in the preceding year, they are eligible for a relief ranging from S$3,000 to S$5,000. Otherwise, the relief varies from S$1,500 to S$3,500.

Acknowledging the crucial support provided by the families of those in National Service, spouses and parents are also granted tax reliefs. Both spouses and each parent can claim S$750 each. However, it’s important to note that a parent can only claim S$750, even if they have or had more than one child in National Service.

As an NSman myself, I am genuinely pleased with the government’s initiative in providing such a meaningful benefit. Balancing work commitments with reservist duties is no easy feat, but it is a duty we gladly undertake for the defense and security of our nation. The NSman Relief not only recognizes our personal sacrifices but also extends its support to our spouses and parents, demonstrating the government’s appreciation for the collective contributions made by National Servicemen and their families.

5. Life Insurance Relief

Encouraging responsible financial planning and risk management is a key aspect of promoting financial well-being. In this context, the Life Insurance Relief serves as a vital component by providing deductions for premiums paid. This relief acts as a strong incentive for individuals to prioritize financial protection not only for themselves but also for their dependents.

As highlighted in my article on the importance of life insurance in Singapore, life insurance plays a crucial role in ensuring the financial security of our loved ones. By recognizing the significance of life insurance in safeguarding the financial future of families, the Life Insurance Relief actively contributes to fostering a culture of proactive and prudent financial decision-making.

6. Course Fee Relief

Recognizing the strategic importance of investing in education beyond personal development, Course Fees Relief offers individuals a valuable opportunity to enhance their skills and qualifications while enjoying tax relief. This relief encompasses a wide range of educational pursuits, including academic degrees, professional certifications, and skill-specific courses, empowering individuals to invest in their continuous learning journey.

In addition to the relief provided on course fees, actively participating in skill development is acknowledged as a proactive strategy to enhance employability. Given the dynamic nature of the job market, continuous learning is crucial. Reinforcing the value of staying relevant and adaptable in one’s professional journey, the government supports this endeavor through tax relief.

For individuals seeking tech training courses for career transition, HeiCoders Academy stands out as a reliable source. Their offerings align perfectly with the government’s emphasis on skill development, providing individuals with the tools and knowledge needed to navigate the evolving tech landscape. As you explore options for enhancing your skills, consider institutions like HeiCoders Academy that actively contribute to your professional growth and align with the principles of Course Fees Relief.

7. Earned Income Relief

Claiming Expenses Incurred in the Course of Earning Your Income

Individuals actively involved in income-earning activities can leverage relief by claiming expenses directly related to their work. This acknowledges the costs incurred in the pursuit of professional endeavors, encouraging individuals to invest in tools, resources, and activities that contribute to their productivity.

Business Expenses Deductibles

Entrepreneurs and business owners navigating the complexities of running a business can benefit from relief on business-related expenses. This ensures that the costs associated with business operations are considered in the determination of taxable income. By providing relief in this domain, the government recognizes the significance of small and medium enterprises in driving economic growth.

Rental Expenses Deductions

Individuals engaged in rental activities can optimize their tax position by leveraging relief on associated expenses. This includes deductions for expenses incurred in maintaining and managing rental properties. The recognition of rental expenses reflects an understanding of the financial commitments involved in property ownership and management.

Income Tax Rates in Singapore 2024

Here are the current income tax rates for YA 2024 on your chargeable income:

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable ($) |

|---|---|---|

| First $20,000 Next $10,000 | 0 2 | 0 200 |

| First $30,000 Next $10,000 | – 3.50 | 200 350 |

| First $40,000 Next $40,000 | – 7 | 550 2,800 |

| First $80,000 Next $40,000 | – 11.5 | 3,350 4,600 |

| First $120,000 Next $40,000 | – 15 | 7,950 6,000 |

| First $160,000 Next $40,000 | – 18 | 13,950 7,200 |

| First $200,000 Next $40,000 | – 19 | 21,150 7,600 |

| First $240,000 Next $40,000 | – 19.5 | 28,750 7,800 |

| First $280,000 Next $40,000 | – 20 | 36,550 8,000 |

| First $320,000 Next $180,000 | – 22 | 44,550 39,600 |

| First $500,000 Next $500,000 | – 23 | 84,150 115,000 |

| First $1,000,000 In excess of $1,000,000 | – 24 | 199,150 |

Conclusion

In conclusion, mastering the art of income tax reduction is not only a financial strategy but a powerful key to unlocking substantial savings and securing your financial future. By strategically leveraging key tax reliefs, such as maximizing CPF contributions, capitalizing on family-related benefits, and embracing continuous learning initiatives, individuals can pave the way for significant monetary advantages.

Optimizing Central Provident Fund (CPF) contributions not only fosters a robust retirement nest egg but also positions you for valuable CPF Cash Top-Up Relief, translating to direct tax savings. Meanwhile, family-related reliefs not only recognize the importance of familial support but also offer tangible tax benefits, contributing to a healthier financial outlook for you and your loved ones.

Embracing continuous learning through courses and skills upgrades not only enhances your professional prowess but also unlocks Course Fees Relief, providing both personal and financial development. Furthermore, charitable giving, beyond its intrinsic rewards, becomes a strategic tax-saving tool, allowing you to contribute to meaningful causes while enjoying Donations Relief.

As we conclude our exploration of these 7 impactful ways to reduce income tax, the overarching theme is clear: empower yourself with knowledge, seize opportunities for financial optimization, and reap the benefits of a tax-savvy approach. In the dynamic landscape of personal finance, staying informed and proactive is the key to transforming tax complexities into opportunities for substantial savings and a secure, prosperous financial future.

Leave a Reply